The US Federal Reserve cut interest rates by 50 basis points yesterday to a range of 4.75% to 5% and indicated that further cuts could follow, as it sought to meet its dual mandate of controlling inflation and maximising employment.

Chair Jerome Powell said that although the US economy is “growing at a solid pace”, the central bank opted for a bold 50bps cut because “we want to keep it there”.

The Fed is commencing monetary easing after the European Central Bank and Bank of England. Jack McIntyre, portfolio manager at Brandywine Global (part of Franklin Templeton), said the Fed was “in catch-up mode”.

“Powell knows they should have moved 25bps in July, so add in 25bps at this meeting and you get to the 50bps rate cut,” he explained.

Jeff Schulze, head of economic and market strategy at Clearbridge Investments, called the 50bps cut an “aggressive” move but believes it will be “positive for both the economy and risk assets as more accommodative monetary policy bolsters the odds that the Fed sticks the landing”.

Financial markets had a mixed reaction to the news, given that a cut had been telegraphed but investors were divided on whether there would be a 25bps or 50bps move.

Neil Wilson, chief market analyst at Finalto, said: “Stocks rallied then fell, the yen surged then dumped as the dollar index fell below 100 for the first time since July 2023 before rebounding, bond yields and gold whipsawed and ended flat.”

Fund managers are now looking beyond the Fed’s initial cut to the health of the US economy as they decide where to allocate money. The key question is whether cutting interest rates will provide sufficient stimulus to businesses, consumers and the economy to enable the US to avoid a recession.

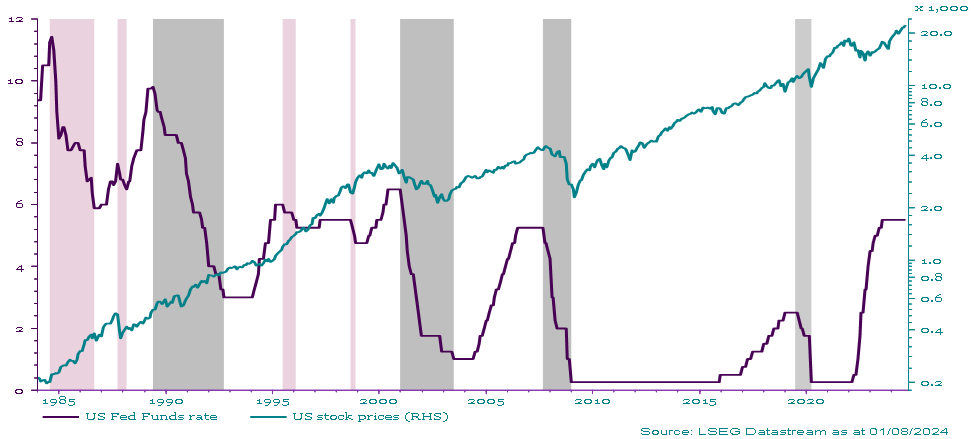

Historically, equities have rallied strongly during rate cutting cycles that coincided with soft landings but have struggled in recessions, said Trevor Greetham, head of multi-asset at Royal London Asset Management.

“Rate cuts amid disinflationary growth are bullish for stocks. If a US recession takes hold however, rate cuts don’t prevent a bear market and you could look to buy stocks on the Fed’s last rate cut, not the first,” he explained.

Federal funds target rate and US stock prices

Source: RLAM; Fed easing cycles shaded in grey around full blown US recessions and pink around soft landings.

When the economy has remained buoyant during quantitative easing, the S&P 500 has rallied by an average of 16.7% in the 12 months following the first rate cut, said Chris Galipeau, senior market strategist at the Franklin Templeton Institute. The average maximum drawdown for the S&P 500 has been 4.91%.

“Since 1990, when the Fed is cutting rates, large-cap growth and small-cap growth generate the strongest performance in the 12 months post the initial rate cut. As a result, we view any pullback as a buying opportunity,” he added.

Growth stocks even made positive returns when cuts coincided with recessions, said Wolf von Rotberg, an equity strategist at J. Safra Sarasin Sustainable Asset Management. Regardless of the economic backdrop, growth stocks typically add 9% during the 12 months following the first Fed rate cut, he said.

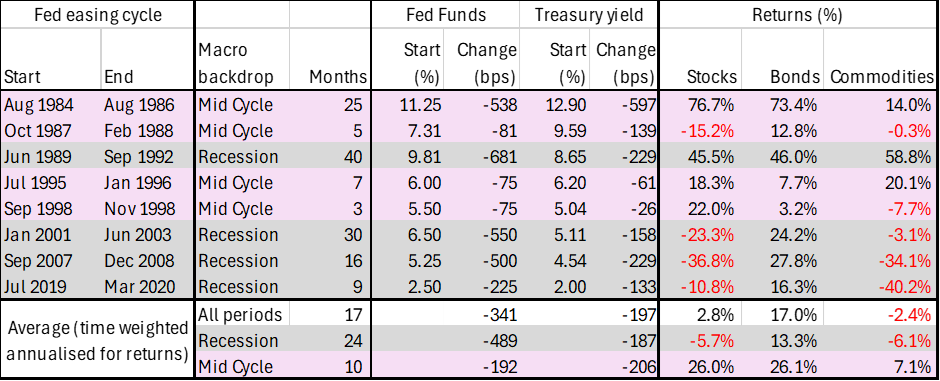

Government bonds also perform strongly during rate cutting cycles, whether a recession occurs or not.

Financial market behaviour during Federal Reserve easing cycles

Source: RLAM; changes between first and last Fed rate cuts. Total returns in US dollars using S&P Composite index for stocks, 10-year US Treasuries for bonds and the GSCI index for commodities

Greetham believes a recession next year is “possible but by no means a foregone conclusion” given that economic data has been mixed. Some manufacturing surveys are weak and US employment data has been soft but other US activity data remains strong, he said. Elsewhere, China is in the doldrums but the UK and Europe have “firmed up of late”.

“It may be that recent market volatility turns out to be seasonal or linked to the divisive and close-run US presidential election. If so, market jitters could present an opportunity to buy stocks for the traditional year-end rally, fuelled by Fed rate cuts, lower bond yields and, potentially, renewed leadership from the interest rate sensitive US technology sector,” he concluded.

Yet Jean Boivin, head of the BlackRock Investment Institute, struck a more cautious note. “Yesterday’s move was a surprise and could be positive for markets in the near term, but we think it raises the prospects of further volatility ahead, especially if growth and inflation don’t pan out in line with the soft landing in the Fed’s updated projections,” he said.