Timing can be everything. Take the Crystal Amber trust, which was a holding in Neil Woodford’s LF Equity Income portfolio until it collapsed and he became a forced seller of assets.

As the fund has been wound down it has been sold off and was picked up by Alastair Laing, co-manager of the £991m Capital Gearing trust. This year, it was his best performer.

This is how Capital Gearing approaches equity investments, Laing explained – trying to profit from unloved, discounted companies bought at the right time. Speaking with Trustnet recently, he revealed three trusts that were added to the portfolio of late, and why he treats gold like an equity.

Below, he explains why he sees his fund as one for someone approaching or in retirement and describes the “surprising” trust that lost him money this year.

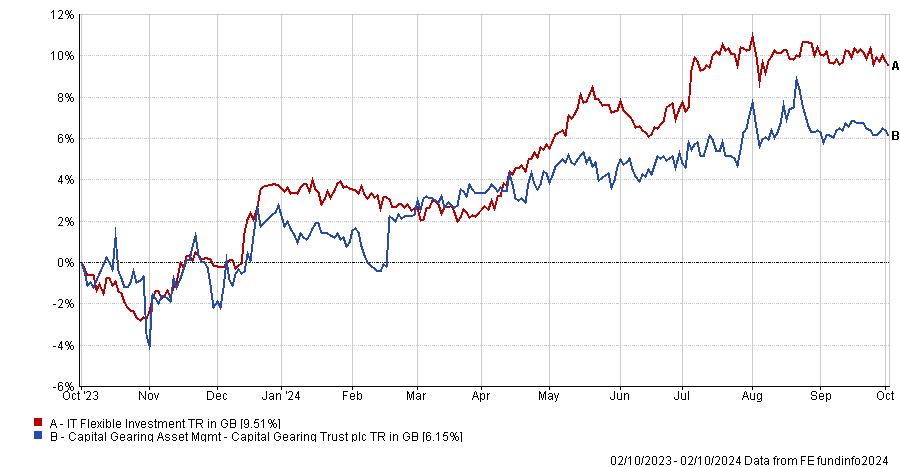

Performance of fund against sector and index over 1yr

Source: FE Analytics

Source: FE Analytics

Who is the trust designed for?

Our ideal investor is a sterling investor with a long-term time horizon and an aversion to making losses. They would also be indifferent between capital gains and income, they would be either approaching or in retirement and would want to have a decent return on their investment. It doesn't matter too much if it's going up 6% or 12%, the key thing is that they can rely on it.

How does the trust invest?

We have a diversified portfolio invested across equities, bonds and a little gold. Two-thirds are invested in very stable, high-quality assets that should deliver a return almost regardless of the environment – most of this is in inflation-protected assets such as bonds.

Then a third of the portfolio is in equities, in which we invest in a specialist way.

What’s your approach to equities?

We focus on investment trusts by analysing their discounts across the whole universe, seeking to generate the underlying return of the asset plus some additional return from the narrowing of the discount.

An investment trust is essentially a small-cap stock, so we can go in and analyse the shareholder base, have good contacts with the directors and engage with them. In particular, we're looking for vehicles trading on a discount with high-quality assets and managers.

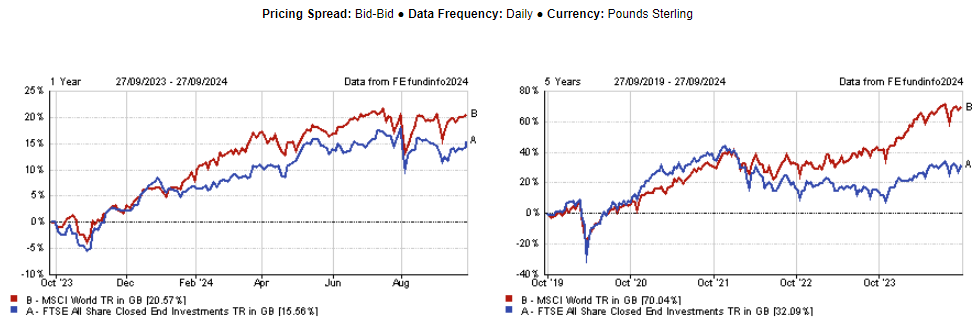

The investment trust index itself has returned very good returns, similar to the MSCI World, and we have consistently outperformed it.

Performance of indices over one and five years

Source: FE Analytics

Source: FE Analytics

Why is one of your largest holdings a FTSE 100 exchange-traded fund?

We do have a FTSE 100 index among our top holdings but it is not that big a position in the overall portfolio context. In aggregate, we have much more in investment trusts, which we are trading in and out of all the time.

What is your approach to bonds?

It's mostly index-linked government bonds because those are the lowest risk assets that any investor can hold.

They deliver a base level of return which is stable, reliable and protected from inflation, and typically have a negative correlation to equities in difficult markets. Even though they have the inflation protection side, they have delivered higher returns than nominal bonds.

What was your worst call in the past year?

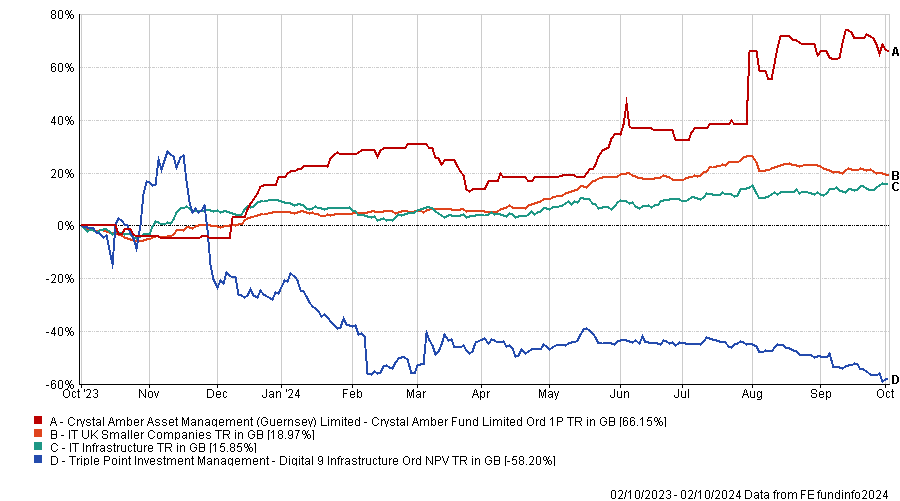

The worst call was Digital 9, an infrastructure trust that invests in data centres, fibre optic cables and broadcast towers. Our thesis when we made the investment – that we're in the middle of a data boom – was broadly correct, however, the underlying fund executed so poorly that despite being in the middle of a gold rush, we've lost quite a lot of money there.

It got into trouble because it made too many investments for which it needed to borrow money. We told [the management team] they were stretching their balance sheet too much, but they ignored us. We sold down our position a bit, but my mistake was to not exit.

The stock is down about 60%, which overall knocked off about 0.4% in total value of the portfolio – quite a significant loss for us. It was surprising because it should have been a quality company and we had a very bad outcome.

Performance of trusts against sectors over 1yr

Source: FE Analytics

And the best?

Our best call was from a much lower-quality position, a very obscure company called Crystal Amber. It’s an activist trust, so it buys shares in other companies and then engages with them.

We bought it off Neil Woodford when he was a forced seller. It had not been a good performer, but since the fund shut down, it has delivered fantastic returns, about 60% over the past year.

That’s because Crystal Amber itself went into a managed runoff and has been selling its assets, which had been very unloved for a long time but now have been revalued.

What do you do outside of fund management?

I chair the Edinburgh University endowment and am involved in a number of life-science research-led spin outs from universities. The intersection between finance, research and academia is a fascinating area and an opportunity for the United Kingdom.