Square Mile Investment Consulting and Research has added nine strategies to its Academy of Funds, upgraded two more and suspended Keystone Positive Change Investment Trust’s rating.

BNY Mellon’s Multi-Asset Growth and Multi-Asset Income funds have gained A ratings, while the BNY Mellon Multi-Asset Moderate fund, which was established in August 2023, was given a Positive Prospect rating.

The latter has a much-shorter track record but it benefits from the same asset allocation process, investment team and lead manager, Paul Flood.

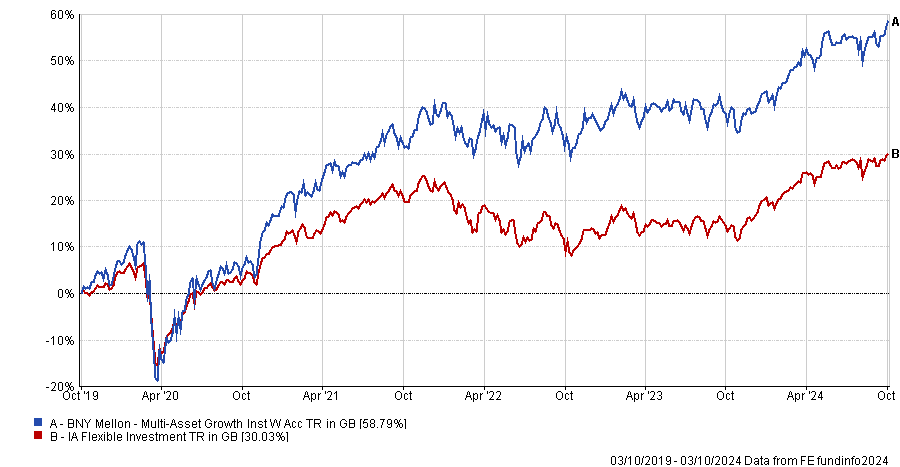

The growth fund is the third-best performing fund in its sector over 10 years and fifth-best over five years to 3 October 2024, according to FE Analytics.

Performance of fund vs sector over 5yrs

Source: FE Analytics

BNY Multi-Asset Income has “consistently delivered a regular and growing income in addition to a competitive total return”, Square Mile stated.

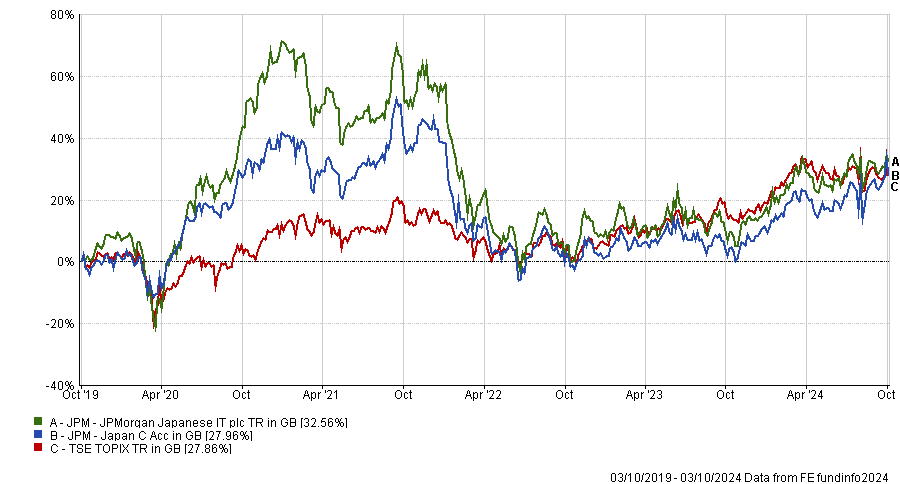

JPM Japan and its investment company sibling, JPMorgan Japanese, have achieved A ratings. They are managed by Nicholas Weindling, who is supported by Miyako Urabe, Shoichi Mizusawa and a team of sector analysts.

“The team seeks to identify quality-growth companies with sustainable business models that it believes are capable of compounding earnings over the long term,” Square Mile explained.

Performance of fund and trust vs benchmark over 5yrs

Source: FE Analytics

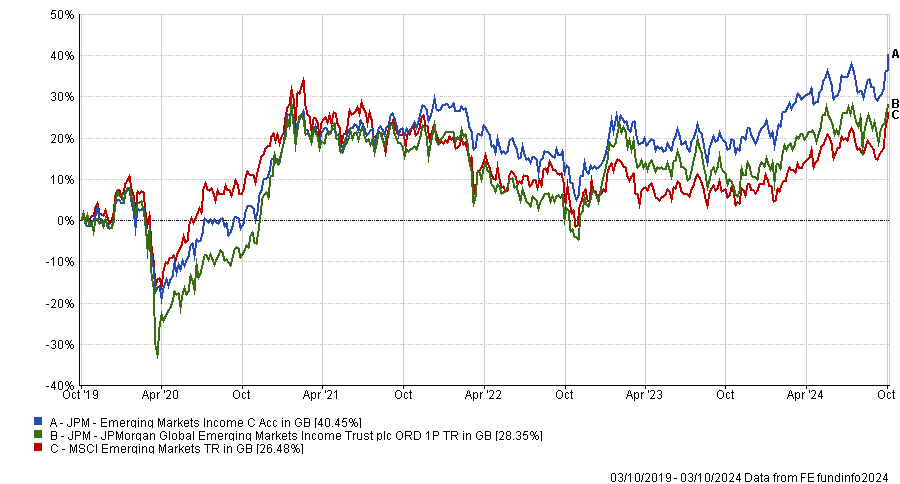

Additionally, the JPMorgan Global Emerging Markets Income trust and its open-ended sibling, JPM Emerging Markets Income, have been upgraded to AA.

“This reflects the analysts’ conviction in the lead manager, Omar Negyal, and the consistent application of his investment approach in what have been particularly challenging market conditions in recent years,” Square Mile’s analysts said.

Performance of fund and trust vs benchmark over 5yrs

Source: FE Analytics

Two global bond funds run by Man Group’s Jonathan Golan also secured A ratings. Man GLG Global Investment Grade Opportunities has a 20% maximum high-yield allocation, whereas Man GLG Dynamic Income has an unconstrained approach.

Golan, who also manages the better-known Man GLG Sterling Corporate Bond fund, won the FE Alpha Manager of the Year award in May for sterling fixed income. Square Mile’s analysts described him as “a talented fixed income manager who is passionate about credit selection”.

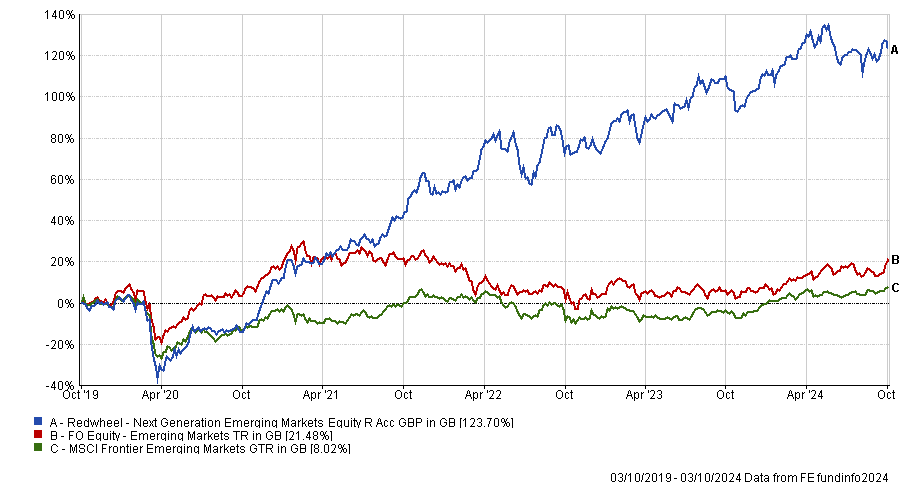

Rounding up the new entrants, Redwheel Next Generation Emerging Markets Equity achieved an A rating and AllianceBernstein Sustainable US Equity was awarded a Responsible A rating.

Redwheel’s fund provides exposure to smaller emerging and frontier markets and is managed by a “highly capable team”, the ratings agency said.

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics

AllianceBernstein Sustainable US Equity fund is managed by Daniel Roarty and Ben Ruegsegger, who focus on quality-growth companies whose products and services contribute to positive social and environmental outcomes. Companies’ revenues need to be aligned to the United Nations’ Sustainable Development Goals.

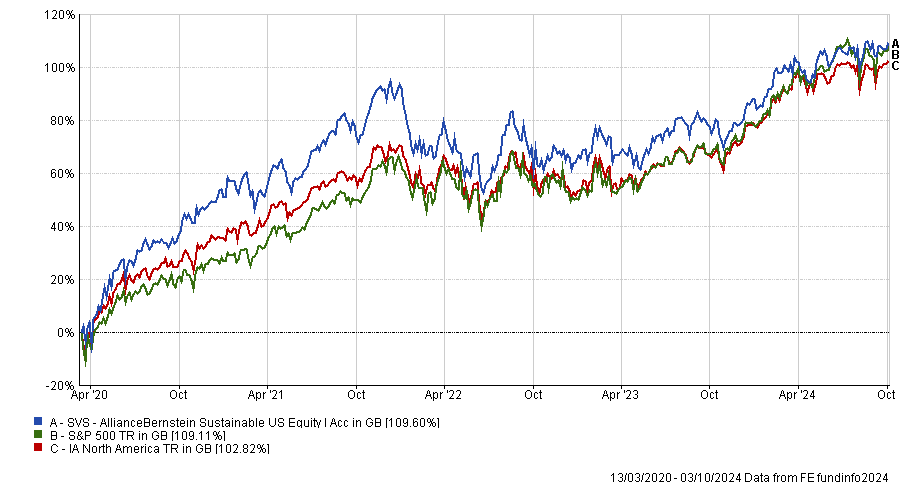

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics

Meanwhile, the WS Montanaro Better World fund has retained its Responsible A rating after a formal review, following the appointment of Adam Montanaro as co-portfolio manager alongside Mark Rogers.

Rogers has worked on the strategy since its inception in 2018 and became sole manager in September 2023 when founder Charles Montanaro stepped down from this fund. The reintroduction of a co-portfolio manager structure “ensures a level of continuity as part of any future succession planning”, Square Mile said. Adam Montanaro joined the family firm a year ago after a decade at abrdn.

However, Square Mile has suspended Keystone Positive Change’s Responsible A rating because its board is considering merging the trust into its more successful open-ended sibling, Baillie Gifford Positive Change.

“The board’s course of action raises doubts about the future viability and stability of the trust for long-term investors,” Square Mile said.

“It has faced ongoing underperformance relative to its benchmark and its net asset value (NAV) has sat at a persistent discount to its share price, which has continued even as global equity markets have recovered. This has been despite share buybacks and other corrective actions taken by the board to increase the trust’s market capitalisation and its appeal to investors,” the research firm observed.

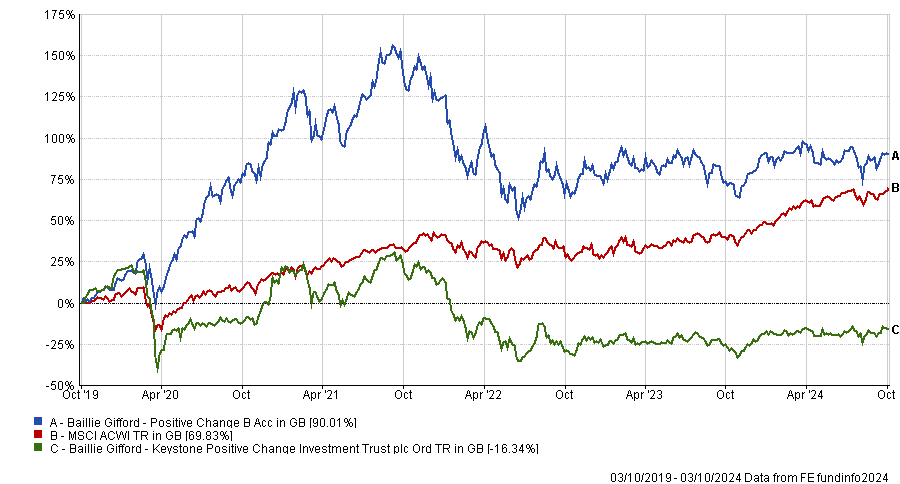

Performance of fund and trust vs benchmark over 5yrs

Source: FE Analytics

Although the Positive Change fund and trust are run by the same Baillie Gifford duo of Kate Fox and Liam Qian, their performance has diverged remarkably, as the chart above illustrates.

The open-ended fund has resoundingly beaten the MSCI All Country World Index to return 90% over five years – a top-quartile return – although it has dropped to the fourth quartile over one and three years. By comparison, the trust has lost money, with a total return of -16.3% over the past half-decade.