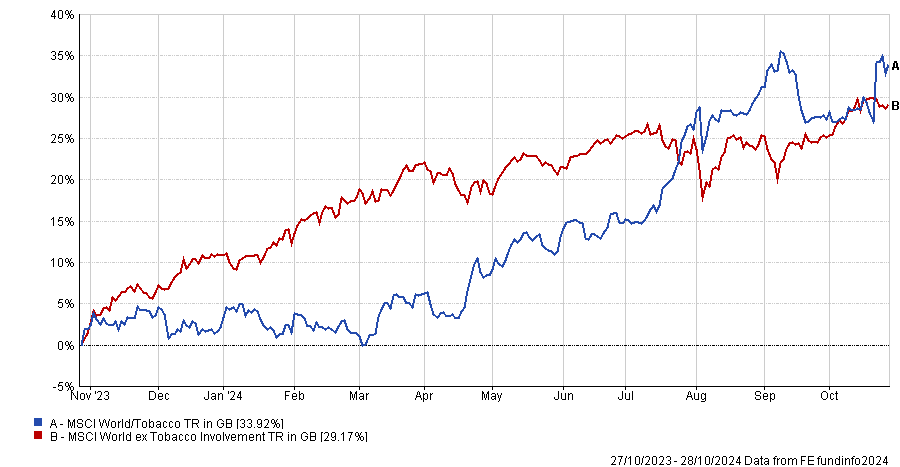

Tobacco is making a comeback. In the past six months, tobacco companies have risen above the rest of the global equity market, as the chart below shows.

They are also going through an evolution, offering less harmful products such as ‘heat not burn’ and vapes, and becoming more sustainable businesses, all of which might make them more palatable to investors, said Trojan Global Income manager James Harries. In the future, he thinks they will become known as “nicotine consumer products companies”.

Performance of indices over 1yr

Source: FE Analytics

“Although people are smoking less, you could argue that consumption of nicotine is increasing,” Harries said. At 5.1%, British American Tobacco is the third-largest holding in his portfolio.

Harries is not alone in backing the revival. Imperial Brands, formerly Imperial Tobacco, is the largest holding in Fidelity Special Values, taking up 4.2% of the portfolio.

But while FE fundinfo Alpha Manager Alex Wright, who manages the trust, considers tobacco to be a defensive play, cigarette manufacturers have made it into growth funds as well.

Stephen Yiu, who runs the £1.1bn Blue Whale Growth fund, has built up a “sizable” 4% position in Philip Morris this year.

“Everyone wants to talk about Microsoft, but the stock has gone up just about 15% this year, so it has been tracking the market,” the Alpha Manager said. “And yet interestingly, Philip Morris, this little boring consumer staples company, has gone up about 30% this year.”

Yiu was impressed by Philip Morris’ plans to return to the US (a market it exited in 2008) and expand the reach of its ‘I quit ordinary smoking’ (IQOS) machines, which use ‘heat not burn’ technology and have been approved for sale in the US.

“On top of that, two years ago the company acquired Swedish Match, meaning that over 50% of the business is now in non-traditional cigarettes,” Yiu noted.

BNY Mellon Multi Asset Income manager Paul Flood took profits from British American Tobacco’s corporate bonds in June and re-invested the proceeds in the company’s shares.

“The equity valuation was very low and the company was paying a 9% to 10% yield, so it seemed like a sensible thing to do from an income fund perspective. It has also helped us to bring the duration down a little bit as the year went on,” he explained.

To address potential concerns around environmental, social and governance (ESG) principles, Yiu said that Philip Morris is “trending towards being more environmentally-friendly than one could expect”, given the less harmful products it now focuses on.

Harries agreed that “these companies are able to offer products without tobacco, which would be attractive to some investors”.

The ethical version of the Troy fund, Trojan Ethical Global Income, excludes tobacco companies and other sectors. For this reason, it has a marginally lower yield, although its income is growing at slightly faster pace. The ethical version might therefore be suitable for younger investors with more of a total-return mindset, he explained. On the other hand, the non-ethical version is a more classic income fund that might appeal to an older cohort.