Peter Walls has built a position in Chrysalis Investments in his Unicorn Mastertrust over the past three months, after adding RTW Biotech Opportunities last year.

He also has a bias towards trusts investing in private equity and small-caps – relatively illiquid asset classes where he feels the closed-ended structure works best – and believes that Japanese small-cap trusts offer outstanding value.

Below, Walls explains his investment thesis for 10 trusts in his portfolio and highlights the strong performers he is top-slicing, as well as the out-of-favour areas and trusts on wide discounts where he sees catalysts for improvement.

The newest addition: Chrysalis

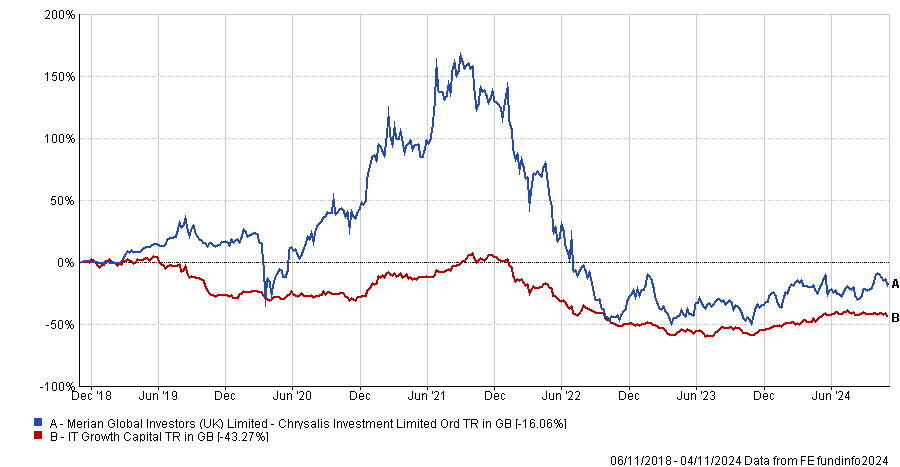

Chrysalis Investments is a rags to riches to rags story. It came to market in November 2018 at 100p a share, peaked at 271p a share on 3 September 2021 after stellar returns, then dropped to 53p a share on 24 March 2023 and again on 27 October 2023. Shareholders sold out after disappointing performance and over concerns about the managers’ high incentive fees.

Performance of Chrysalis vs sector since inception in total return terms

Source: FE Analytics

The trust’s managers, Nick Williamson and Richard Watts, left Jupiter Asset Management at the end of November 2022 to establish an independent investment firm, completely focussed on running the trust. Performance fees were reduced to 12.5% from 20% and an annual cap was imposed.

Chrysalis is currently trading at 85p a share and is on a 37% discount to its net asset value, Walls said. It recently committed to buying back £100m of its shares.

The trust specialises in high growth, private companies such as Starling Bank, its biggest holding, and Klarna, the buy-now-pay-later company which is expected to go public next year.

In July 2024, portfolio company Graphcore was acquired by Softbank at a 25% premium to its carrying value. The trust announced that it would return cash raised from this sale and from future realisations to shareholders via buybacks.

Walls first invested in Chrysalis on 23 July 2024.

RTW Biotech Opportunities

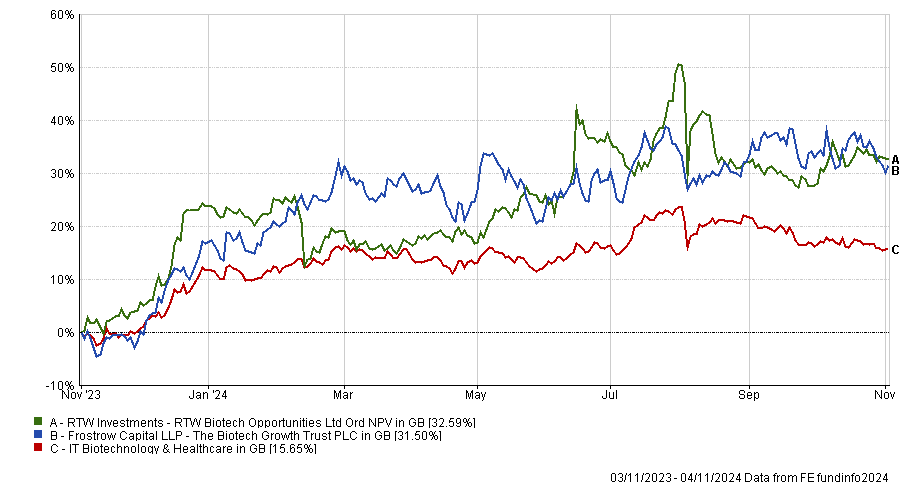

Another fairly recent addition to the Unicorn Mastertrust fund is RTW Biotech Opportunities. Walls started investing in the trust in May 2023 at a significant discount, just as the biotech sector was emerging from a multi-year bear market.

“The biotech market had been on its knees and suddenly you found that quite a lot of the underlying businesses had net cash and were valued at less than cash in some cases,” he said.

RTW acquired Arix Bioscience late last year, which expanded its firepower but caused its discount to widen.

A notable success for RTW was Merck’s acquisition of Prometheus, a clinical-stage biotechnology company focused on immune-mediated diseases, in April 2023 for $10.8bn. RTW generated a more than 12x total multiple on invested capital in just over three years.

Walls also holds the Biotech Growth Trust and said he was intrigued by significant advances in the biotech sector, with cures being found for a host of diseases.

Performance of trusts vs sector over 1yr

Source: FE Analytics

Japan

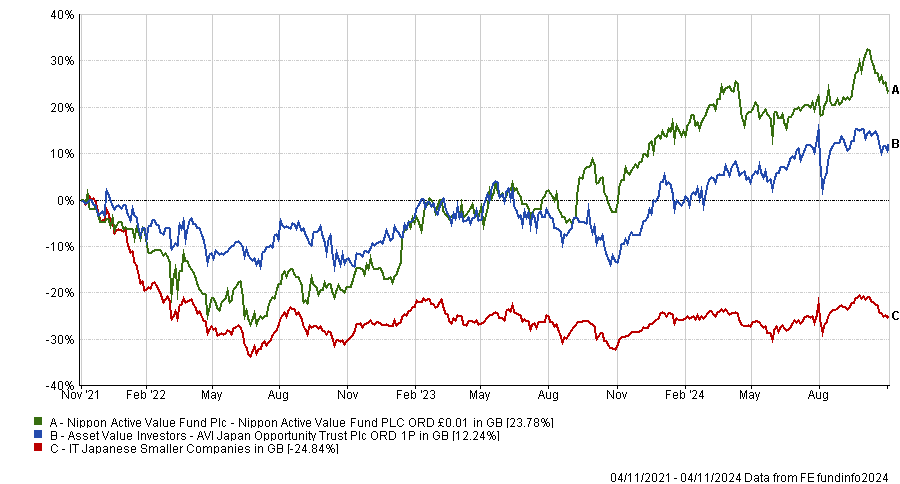

In some ways, Japan is similar to the biotech sector in that Japanese companies have a lot of cash on their books and are attractively valued, Walls said.

Unicorn Mastertrust holds Nippon Active Value and AVI Japan Opportunity, both of which focus on small-caps. Of the nine Japanese equity investment trusts, these are the two best performers over one and three years.

Performance of trusts vs sector over 3yrs

Source: FE Analytics

UK small-caps trusts

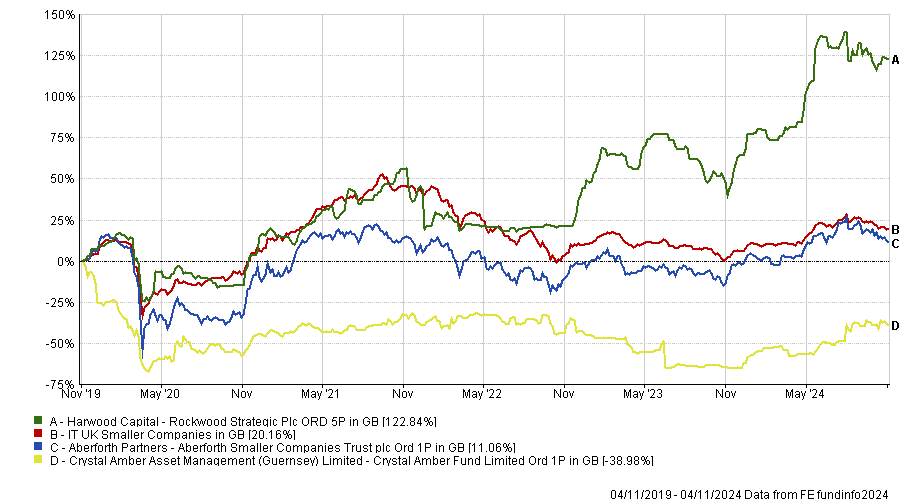

Rockwood Strategic is Walls’ best-performing holding. It is top of the IT UK Smaller Companies sector over three and five years and second over one and 10 years to 4 November 2024.

Unicorn Mastertrust also owns Aberforth Smaller Companies. It has delivered strong returns in aggregate since inception in 1990, he said, although the manager’s value style has at times fallen dramatically out of favour, leading to a rollercoaster ride for investors.

It was a top performer during the 1990s but went from hero to zero in the technology, media and telecoms (TMT) bubble. By the turn of the millennium it was languishing at the bottom of the performance tables, he recalled. Then it recovered and performed well until the financial crisis, after which low rates and monetary stimulus meant “everyone went crazy for growth, which really slowed them down”.

Walls went back into Aberforth Smaller Companies in 2019.

Performance of trusts vs sector over 5yrs

Source: FE Analytics

Crystal Amber, an AIM-listed activist fund specialising in small and mid-cap equities, is in managed wind-down. It owns 81% of GI Dynamics, a medical device business specialising in type 2 diabetes and obesity, which Walls thinks could be an exciting prospect.

Walls noted that Crystal Amber, which is managed by Richard Bernstein, has encountered some difficulties, including its 16.5% stake in De La Rue. The bank note printer’s shares have risen this year off multi-year lows and it has just sold its authentication division to Crane NXT.

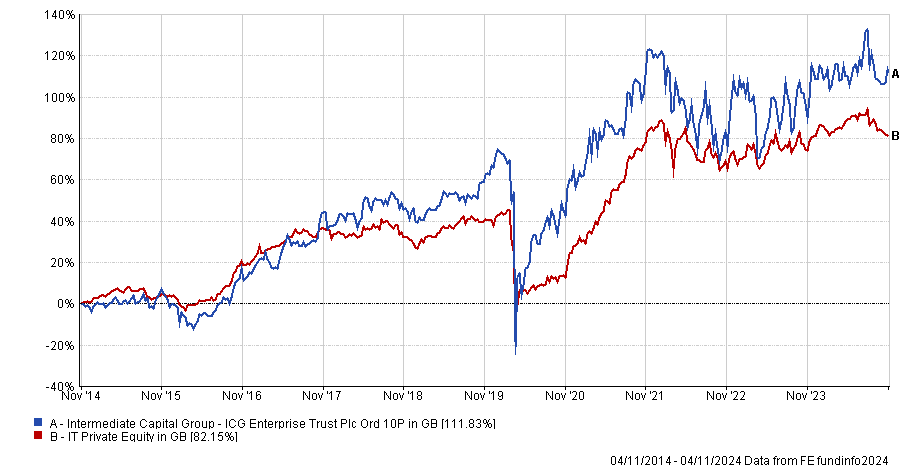

Private equity: ICG Enterprise Trust

Several private equity trusts are trading on significant discounts to their NAVs after a perfect storm in recent years.

Not only did interest rate hikes impact the discount rate used to value many investments, causing investors to shy away from growth stocks, private equity and venture capital, but investors became sceptical about private equity managers’ valuation methodologies.

Walls holds ICG Enterprise Trust and said its valuation methodology has always been consistent.

Investors also deserted private equity trusts because cost disclosure rules – which have recently been changed – made them look very expensive. Walls believes investors were wrong to move away from the asset class because of high fees. “It’s the tail wagging the dog, it’s beyond belief,” he said.

ICG is on a 37% discount which Walls described as “entirely the wrong price”.

Performance of trust vs sector over 10yrs

Source: FE Analytics

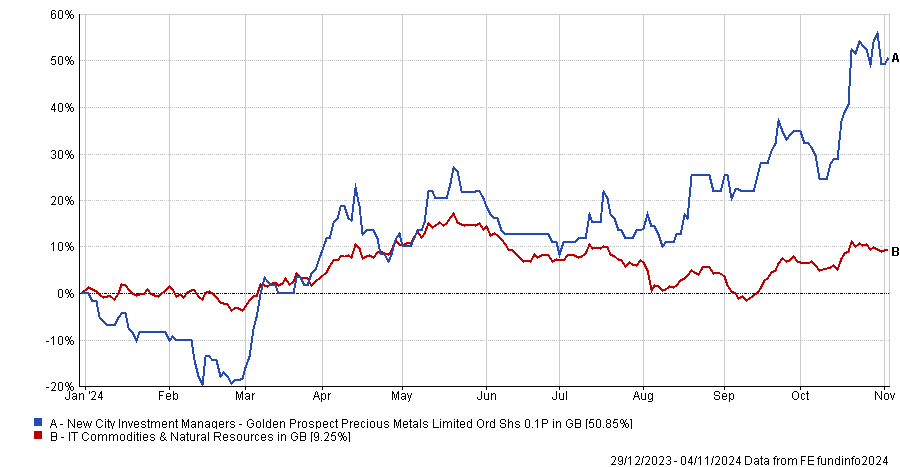

Precious metals

Walls has a small allocation to Golden Prospect Precious Metals, which invests in gold, silver and other precious metals, uranium and miners. It was on a massive discount for a long time, he said, but its share price has shot up 50% year-to-date.

Performance of trust vs sector year-to-date

Source: FE Analytics

Walls said he runs a very diversified portfolio and “the winner each year always surprises me”.