Microsoft, Coca-Cola and Baker Hughes are among the US companies that can continue to thrive despite the changing of president, according to Hargreaves Lansdown analysts.

The US has just gone to the polls following months of campaigning in a closely fought election. During this time, analysts have been highlighting stocks that would benefit the most under a Kamala Harris or Donald Trump presidency, but there are some companies that would be largely unaffected by who is in the White House.

At the time of writing, Republican candidate and former president Trump had just passed the 270 electoral college votes need to win the election. However, not all stocks will be overly affected by who is in the White House.

Derren Nathan, head of equity research at Hargreaves Lansdown, said: “The US stock market comes with an impressive record of outperformance. And, while the new president’s policies could bring some volatility to markets, there will also be some opportunities for investors.

“There’s no guarantee that American companies can keep delivering positive returns, but we continue to see the region as appealing given the range of world-class companies with global reach.”

Below, Nathan offers three US stock picks that are not reliant on the election result.

Microsoft

First up is tech giant Microsoft, which has been a dominant force in software and computer services since the launch of its Windows operating system in the mid-1980s.

The company has evolved over the decades and the focus for its future growth has shifted towards its cloud platform Azure, which provides computing power, storage and databases to allow businesses to build, deploy and manage applications, and artificial intelligence (AI), through its holding in ChatGPT creator Open AI and the integration of AI into its own software.

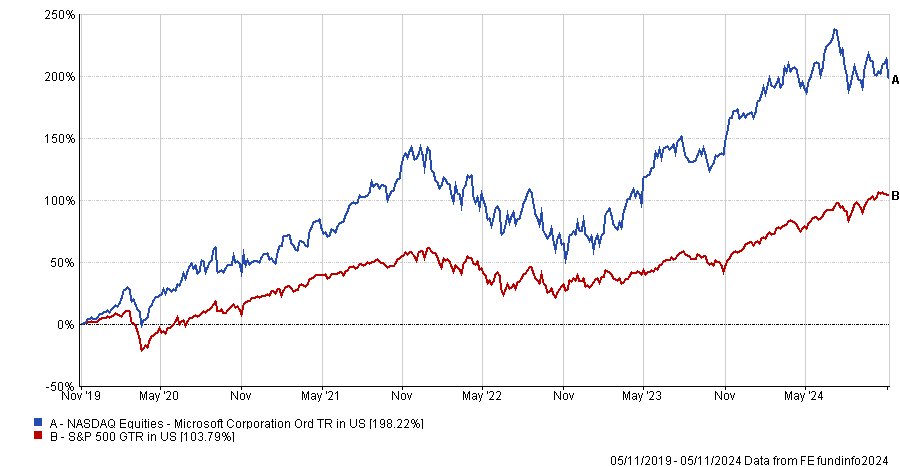

Performance of Microsoft vs S&P 500 over 5yrs

Source: FE Analytics

“Recent growth rates have continued to impress and the company is having to spend heavily on building-out the infrastructure to accommodate that demand,” Nathan said.

“There’s no guarantee that revenue will continue to grow at the same pace as costs and investment, so expect some bumps in the road as this megatrend plays out.”

He added that such bumps to watch out for include regulation, as policymakers are likely to start taking a look at increasingly intelligent machines, and its valuation, which is above the long-term average and leaves investors at the risk of losses if Microsoft’s growth disappoints.

Coca-Cola

Next up is soft-drinks powerhouse Coca-Cola, which Nathan said is one of the most profitable companies in its sector thanks to its “unparalleled” brand power and an efficient operating model.

“Coke is updating its strategy and brand portfolio to focus more on sharpening its proposition on a regional and local level, but it looks more like a refinement than a revolutionary change to us,” the head of equity research added.

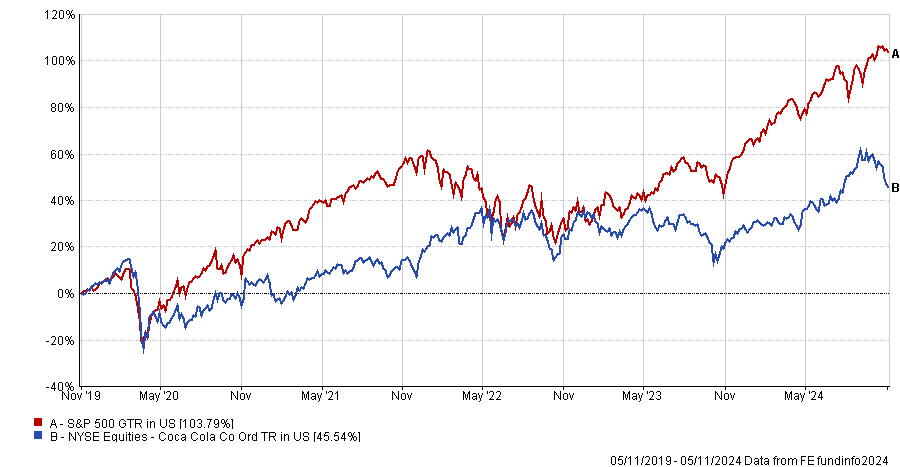

Performance of Coca-Cola vs S&P 500 over 5yrs

Source: FE Analytics

“Nonetheless, it's encouraging to see the group moving forward in a market where we still see room for further growth. Changes in consumer preferences are something we’re monitoring, but the group’s made big steps to integrate lower-calorie alternatives and has also been diversifying into the nutritional beverage market.”

Coca-Cola has increased its dividend in each of the last 62 years and is currently yielding 3.1%. Hargreaves Lansdown also highlighted the group’s strong balance sheet and cash flows as positives.

However, Nathan pointed out that the firm’s sales volumes have started to wobble after “a period of hefty price increases” when inflation was soaring. Although these cost increases are starting to moderate, Coca-Cola shares could come under pressure if these recent volume declines were to continue.

Baker Hughes

The third and final US stock pick that isn’t reliant on the election result is Baker Hughes, which is a major equipment and services provider to the energy industry.

Recently, domestic activity amongst its oil & gas customers has fallen from the high levels reached during the US shale boom, owing to lower commodity prices and cost pressures.

However, Hargreaves Lansdown noted that the US only accounts for around one-quarter of the firm’s revenue, while it is well-positioned to benefit from the resurgence in deep water exploration and development offshore and overseas thanks to its expertise in subsea systems.

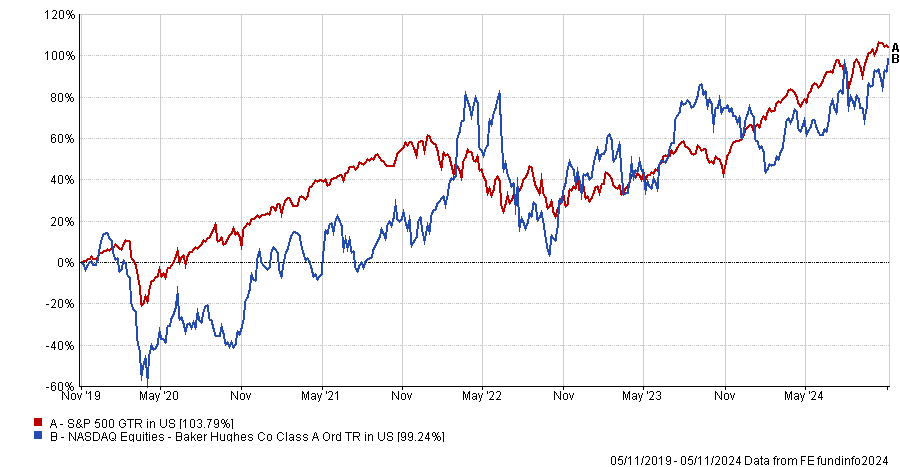

Performance of Baker Hughes vs S&P 500 over 5yrs

Source: FE Analytics

Nathan also suggested strong revenue momentum of Baker Hughes’ industrial & energy technology division, which is benefiting from the ongoing build-out of liquefied natural gas infrastructure, and the firm’s push to develop and sell more digital solutions across the client base as positives for the company.

“The order book is close to $33bn, meaning that it can deal with short-term lulls in commercial activity. This makes it less sensitive to energy price fluctuations than oil & gas producers, but it would still feel the impact if prices were weak for a prolonged period,” he finished.

“This is an exciting, emerging growth story, but that’s also reflected by a valuation towards the top of the peer group. It’s well deserved but means the shares are likely to be sensitive to any sustained weakness in order intake.”