Chrysalis Investments, which invests in high growth businesses using technology to transform their sectors, is recovering after a difficult couple of years.

Its share price has gained ground in recent months, as an initial public offering (IPO) is on the horizon for one of its largest holdings, Klarna. The discount has narrowed too, from about 48% in January to 32% currently.

It has also been attracting new shareholders. AVI Global and Unicorn Mastertrust initiated positions in January and July 2024, respectively.

Below, Trustnet investigates whether this could be a good entry point into Chrysalis.

Peaks and troughs

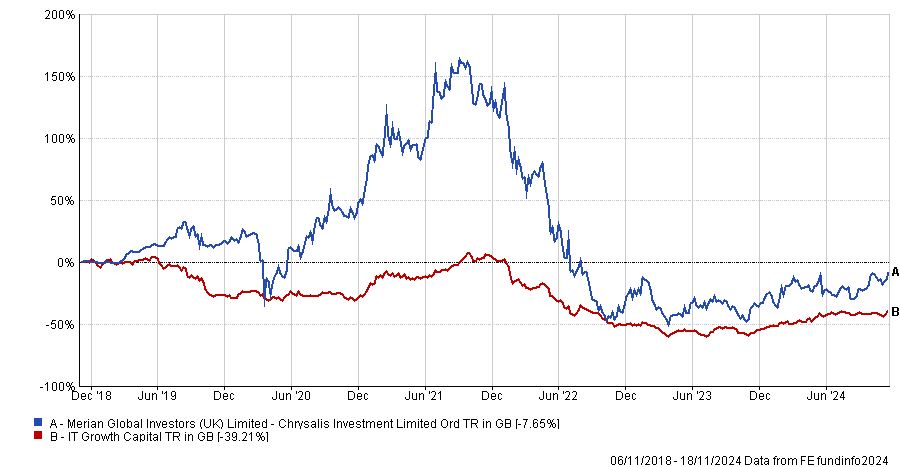

Chrysalis has been on a rollercoaster since coming to market in November 2018. Its share price peaked at 277p in September 2021, a 23% premium to its net asset value (NAV), but fell to 53p in 2023 after a period of poor performance.

James Carthew, head of investment companies QuotedData, said: “The discount widened markedly when interest rates started to rise and investors became more wary of backing unprofitable and cash-consumptive companies.”

Performance of trust vs sector since inception

Source: FE Analytics

Richard Parfect, a portfolio manager at Momentum Global Investment Management, has owned Chrysalis since inception. “The mixed outcome is reflective of when it was launched (arguably top of the market in private assets) and some of the mistakes have been avoidable in my view,” he said.

One of those mistakes was investing £45m into Revolution Beauty’s AIM listing in July 2021. Chrysalis sold its holding in late 2022 for just £5.7m.

Charges were another concern after Jupiter (the trust's investment adviser at the time) collected £112.1m in performance fees in 2021. Performance fees were reduced to 12.5% from 20% in November 2022.

Parfect does not think fees are an issue any longer. “The NAV needs to grow substantially from here for the fees to enter ‘performance fee territory’. The ongoing charges as disclosed in the full year 2023 results were 0.78% including the 50bp annual management charge,” he said.

The trust's managers, Nick Williamson and Richard Watts, took their performance payout in shares so suffered the fall along with their shareholders, noted Darius McDermott, managing director of Chelsea Financial Services.

The pair have cut ties with Jupiter and established an independent firm to focus solely on the trust. “They are hugely incentivised to get the asset value going,” McDermott said.

Things are looking up ahead of Klarna’s IPO

Chrysalis’ share price has recovered from its 2023 lows and price reached 96p on 21 November, surging after Klarna filed to IPO on 12 November.

Klarna is worth 14% of Chrysalis’ NAV. Deutsche Numis estimates Klarna's valuation to be $14.6bn but there has been speculation it could reach $15-20bn.

Joe Bauernfreund, who manages AVI Global, said: “At these figures, a full exit from Klarna would realise between 24% and 32% of Chrysalis’ current market cap.”

The current portfolio

Investors looking at Chrysalis need to take a view on Starling Bank because it is such a huge position, worth 30% of NAV, McDermott said. He thinks the UK challenger bank could IPO in the next couple of years.

Chrysalis’ top five largest holdings, which account for 69% of its NAV, are all mature and most of them are performing strongly, Bauernfreund said. The trust has 15% of its NAV in Smart Pension, a UK pension master trust, and 10% in The Brandtech Group, a US marketing technology company.

Other portfolio companies include money transfer platform Wise, cyber security company Deep Instinct, data platform InfoSum and travel agent Secret Escapes.

Buybacks and liquidations

In a move that could narrow its discount, Chrysalis has committed to buying back up to £100m of its own shares.

The buyback programme had been contingent on raising at least £50m in cash reserves through exits, which was achieved with the disposals of Graphcore and Featurespace. Graphcore, an artificial intelligence chip maker, was acquired by Softbank for £44m (a 25% premium to its carrying value) in July 2024. Then in September, Visa agreed to buy Featurespace, a fraud detection specialist, for £89m - a trebling of Chrysalis' original investment.

Now that Chrysalis’ investment managers are confident of being able to return £100m to shareholders, they are considering initiating a programme of new investments. “We believe a refreshing of the portfolio, which is likely to target late-stage private companies with long-term growth potential, is consistent with the ability of the company to grow its NAV in the long term,” Williamson and Watts wrote in the trust’s September factsheet.

Is Chrysalis a good buy now?

Carthew noted that despite this year’s recovery, the shares still trade on a hefty discount. “We still think the share price has a long way to go,” he added.

Bauernfreund agreed: “The prospect for further realisations of large holdings, such as Klarna or Starling, and the still wide discount to NAV makes for a compelling investment case.”

For Momentum, Chrysalis is a hold due to position size, but “the valuation itself implies a buy due to the line of sight for asset realisations in the near term”, Parfect said.

Momentum increased its position substantially when Chrysalis’ shares were de-rated two years ago. “We still consider the shares to be cheap but we have been taking some profits on those very cheap shares we bought,” he explained.

Chelsea Financial Services has also invested in Chrysalis since its IPO but sold a significant chunk of its stake near the peak. It has been rebuilding the position during the past 18 months.