Brexit, a pandemic, a bear market, multiple Conservative prime ministers and, recently, a shift in political leadership to Labour.

As such, many investors have remained cautious on UK equities, instead favouring large US mega-caps and tech companies due to strong results, the artificial intelligence revolution and US exceptionalism narrative.

Guy Anderson, manager of the £1.8bn JP Morgan Mercantile Investment Trust, said: “It is difficult to answer what will cause people to move away from US equities into the UK. It is challenging to persuade someone invested in the US, even if the valuation difference is huge.”

However, Anderson argued that the tides are poised for a turnaround, and over time, UK businesses are demonstrating they can deliver strong results. Below, he highlighted several exciting UK opportunities set to experience this turnaround.

Cranswick

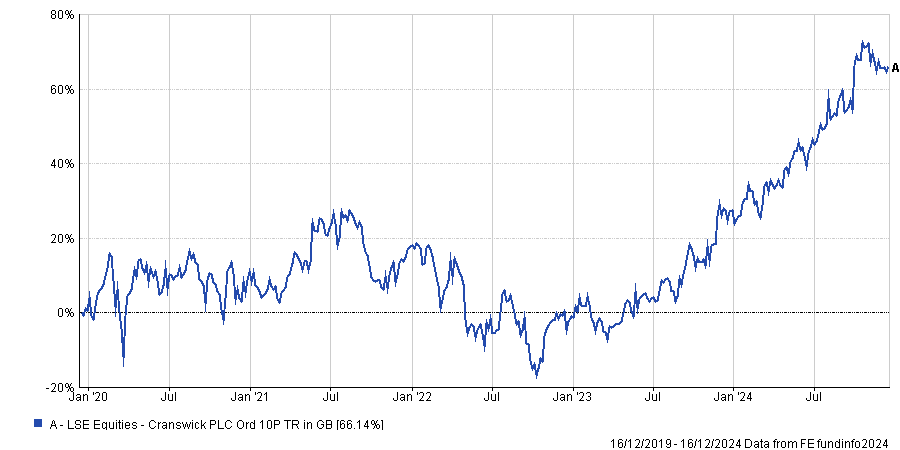

Firstly, Anderson identified poultry processing firm Cranswick as an example of an underappreciated winner this year. The business has delivered strong results over the past half a decade, with a total return of 66%.

Performance of Cranswick PLC over 5yrs

Source: FE Analytics

Anderson said: “I think Cranswick is a great example of an undervalued business because, on the face of it, poultry processing is absolutely a tough market.”

He explained that Cranswick's most exciting characteristic was “the amount of capital they are putting into the ground” to improve their capacity and automation.

He added: “Those two elements [capacity and automation] are hugely important because one will allow Cranswick to continue growing and the other will meaningfully impact profitability.”

Moreover, he said Cranswick is a business with a significant runway for further growth. Anderson explained that increased pressure on labour costs has negatively impacted Cranswick's competitors due to their higher leverage and made them less able to invest in growth and automation compared to Cranswick.

“From a competitive standpoint, I think it is in a good position," he concluded.

Softcat

IT infrastructure and reseller Softcat is another favourite of Anderson’s and is currently the seventh-highest conviction holding in the Mercantile Investment Trust.

“The most important element of our investment case is to look for high-quality businesses with a strong growth outlook, where we think the growth is not yet appreciated by the market,” he said.

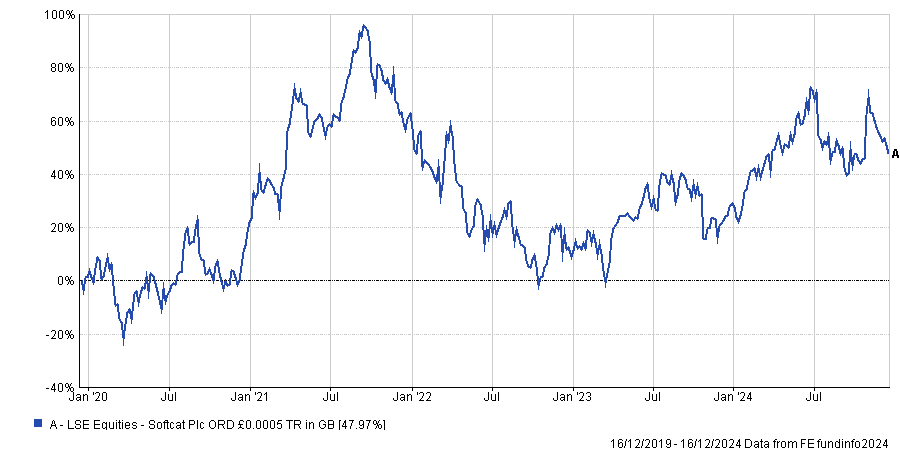

Anderson explained that Softcat is a great example of this. Anderson has owned Softcat since its IPO in 2015 and over this time it has had a “phenomenal track record”. Indeed, over the past five years, it has delivered a total return of 48%.

Performance of Softcat PLC over 5yrs

Source: FE Analytics

“As a general rule, I like to run my winners and so it has increased in size alongside its strong performance,” he added. “It is a company that has consistently outperformed ahead of the market expectations and the market is always looking for that growth to fade.”

For Anderson, however, Softcat is a long duration holding that he thinks will continue to deliver, despite the hesitation amongst UK corporations to invest in technology. He concluded that Softcat's performance had always surprised the market and he saw little evidence that this would change anytime soon.

Games Workshop:

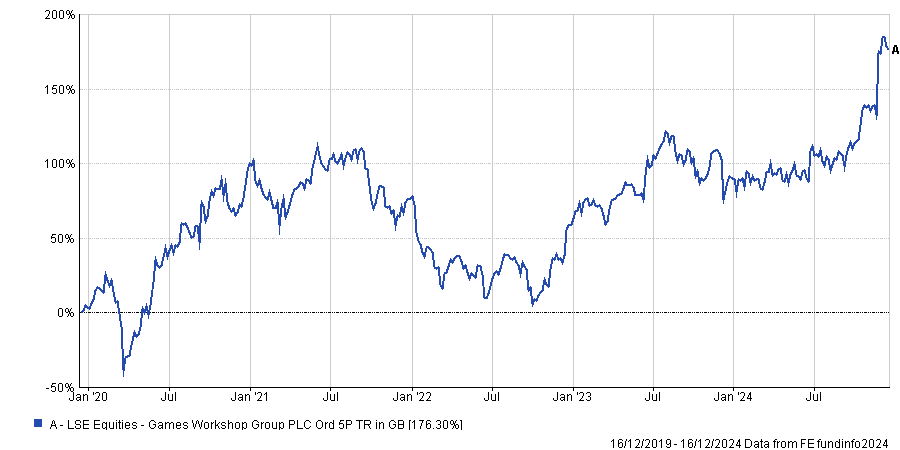

Finally, Anderson turned to highflier Games Workshop, producer of the popular Warhammer tabletop game series, which recently entered the FTSE 100 index. Over the past half a decade, it has posted a total return of roughly 176%.

Performance of Games Workshop Group over 5yrs

Source: FE Analytics

Despite its recent entry to the FTSE 100, Anderson concluded that it still “maintained a low profile in the City” and was underappreciated by many investors. However, Games Workshop has featured within Anderson's portfolio since 2017 and currently represents its fourth-highest conviction holding.

During this period, Anderson explained that the stock had delivered around 1,200% in total returns for the trust.

For Anderson, the appeal of Games Workshop came from its long-term focus and time horizon. As a leader in its relatively niche market, its efforts to constantly develop its Warhammer intellectual property enabled it to build a “global and growing base of fans, who are passionate supporters and loyal customers”.

Moreover, Anderson said the recent agreement with Amazon to develop a film and TV series based on the Warhammer brand illustrated the company’s long-term growth potential.