Even the best cannot always get it right. In an increasingly fast-moving and globalised market, getting the timing right on when to buy or sell has become a much greater challenge for even the most experienced investors.

Indeed, this is the case even for James Henderson, manager of the £375m Lowland Investment Company, who has over four decades of experience as an investor. “I think we are usually buying and selling too early," he said.

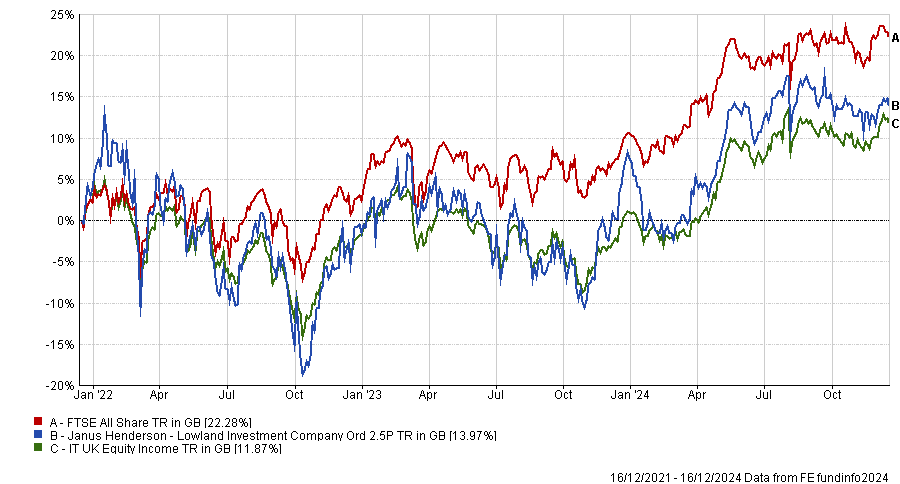

Performance of Lowland Investment Company vs the sector and benchmark over 3yrs

Source: FE Analytics

He explained that the way to counteract this was to buy and sell in small amounts and prolong the investment over a long period of time, ensuring investors can still experience some of the upside if a stock rises for longer than anticipated.

Nevertheless, it may be surprising to hear that Henderson has begun to sell out of his holding in Rolls Royce this year, despite it being the largest absolute contributor to Lowland’s performance year-to-date (YTD), with a total return of 94.8%.

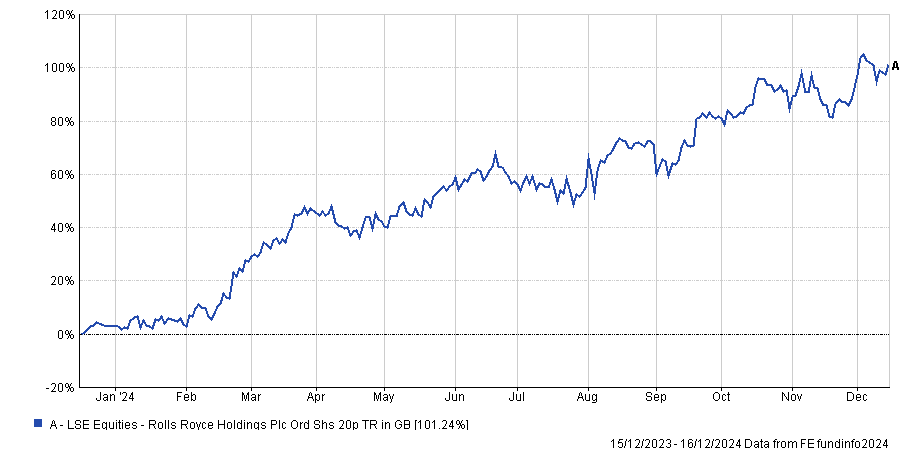

Total return of Rolls Royce YTD

Source: FE Analytics

He explained: “The important thing about Lowland is that it is an income fund. Growing the dividend is important to us and we try to grow the dividend by growing capital first."

This was where holdings such as Rolls Royce came in, because they added significant amounts to the pot of capital.

The issue, however, was that Rolls Royce had a 0 per cent dividend yield, meaning Henderson had to be much more certain that it was effectively growing Lowland’s capital. With perceptions around the company having improved and the businesses quality now better reflected in the share price, he concluded that there were plenty of other opportunities available which would likely contribute more.

Henderson explained: “We are likely in something such as Rolls Royce to sell too early, but that is always better than selling too late."

Moreover, he acknowledged that selling out too early of one of his top performers was a decision he has made in the past, such as with Croda International, which was formerly one of the trust’s largest contributors over a 25-year period.

He conceded: “I thought I was quite clever regarding Croda. I reduced it at £4, again at £6 and, by the time I sold the last lot, it was worth £103.”

While both Rolls Royce and Croda had further runway for growth, Henderson argued that trimming them was an appropriate move for the portfolio, despite their strong performance at the time.

He explained: "It is essentially contrarian investing. We reduced our winners to buy more unloved stocks.”

The case for selling out early

This conclusion that selling out too early is preferable to selling out too late, Henderson explained, reflected his belief that the UK has no “forever stocks”.

In his 40-year experience as a professional investor, Henderson has seen very few UK companies go from being small to sustainably large. Additionally, he explained that the UK market is intensely competitive, making it difficult for any company to gain a unique position and make above-average returns over a long period of time.

Certainly, businesses such as Croda have become global entities. However, he argued that Croda has experienced a recent downturn and lost some of its original growth momentum. “The things that made Croda successful are arguably now working against it.”

“Businesses can age,” he continued.

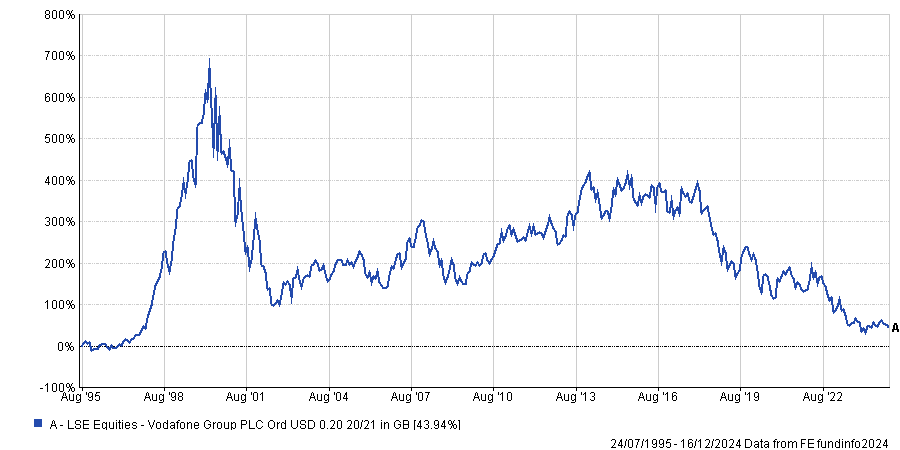

Another example of this is a company such as Vodafone. As Henderson explained, despite growing extremely rapidly, Vodafone's share price declined just as quickly. As the chart below shows, the firm’s shares surged and peaked in early 2000,but had shed the bulk of these gains just two and a half years later.

Price performance of Vodafone since 1995

Source: FE Analytics

“The life cycle of it [Vodafone] as a successful investment was really relatively short,” Henderson added.

As a result, he explained that there was value in flexibility and being willing to recognise when a holding is no longer a great fit for the portfolio, even if they are currently successful.

For this reason, he said that he does not have any particularly high conviction holdings in Lowland. Instead, a successful investor should have a long-diversified list of companies and should “weigh up the possibilities of what might happen, before buying and selling accordingly”.

While he acknowledged there are always temptations to rebuy a stock he sold out of early, such as Croda, which is currently priced at around £35, he concluded that being a successful investor required a willingness to accept mistakes and not carry too much baggage from the past.

“I am always wary that a good burglar should not return to the scene of his crime. Over a long period, you would be lucky to get it right twice.”