The strong performance of US stocks looks set to continue into the new year, according to a panel of star managers polled by Trustnet, although one did warn investors to pay more attention to the risks that will come with 2025.

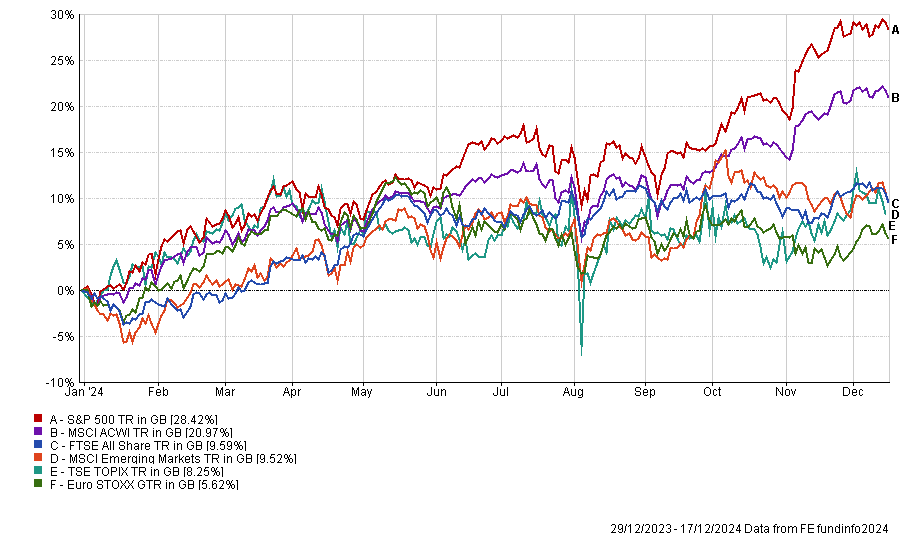

The past year has been another when the US stock market outperformed its peers, with the S&P 500 rising 28.4% over the year to 17 December. This compares with a 21% gain from the MSCI AC World, 9.6% from the FTSE All Share, 8.3% from the Topix and 5.6% from the Euro STOXX (all in sterling).

Performance of indices over 2024 to date

Source: FE Analytics

Paul Niven, manager of the F&C Investment Trust, is going into 2025 “relatively constructive” on equities, thanks to good fundamentals, robust corporate earnings, declining inflation and falling interest rates.

“Valuations are high, however, though this tends to be concentrated in the US and in the obvious names, such as the Magnificent Seven. While the premium levels of growth expected from this area look set to diminish, their earnings delivery should still comfortably outstrip that of the wider market,” he said.

Niven added that numerous other areas and markets are trading at lower levels of valuation, but their growth prospects still appear far more fragile or anaemic than the US.

James Thomson also expects his Rathbone Global Opportunities fund to continue to benefit from its overweight to the US, although he does expect some “scary setbacks” from US stocks given their strong outperformance in recent years.

He sees the first test for US equities coming in January, when companies publish their full year 2025 forecasts; investors may be disappointed when some firms put out muted forecasts to avoid overpromising.

In addition, the erratic nature of incoming US president Donald Trump’s “mercantilist, populist and protectionist” policy-setting could spook investors in affected sectors.

“Our US weighting has grown to a new all-time high (approximately 71%) as we benefit from US dominance, good stock selection and a watchlist bursting with more compelling US ideas,” Thomson said.

“Yes, the US is an expensive market, but expensive doesn’t always mean overvalued. Quality, resilience and a broad spread of future-proofed companies mean this market will grow through volatile economic cycles.”

Thomson added that many of Rathbone Global Opportunities’ holdings have rallied more than 20% during the past quarter despite jitters around the US election, the UK Budget and political uncertainty in France and Germany. Examples include Amazon, Amphenol, Formula 1, ServiceNow and Walmart, demonstrating the “broad church” of sectors with different demand drivers that can outperform against an uncertain backdrop.

Mike Fox, head of equities at Royal London Asset Management, said: “One of my favourite sayings is if you want to be a successful investor, be an optimist. This is not to say that investments can only go up, they clearly do not in some years, but it is to say that over the long term, societies improve, economies grow, innovation thrives and optimism wins.

“Whilst we expect 2025 to have unforeseen challenges, we also think it is a great time to be a long-term investor with more opportunities today than ever before.”

The root of Fox’s belief is the current high level of innovation being seen in the physical, digital and natural spheres of the global economy (or atoms, bytes and genes).

In the physical sphere, reshoring, decarbonisation and the need to build data centres to support artificial intelligence (AI) is creating a “once in a generation investment boom”; cloud computing combined with generative AI is boosting digital innovation; and new treatments are being created for diseases such as Alzheimer’s and obesity are bolstering the natural sphere.

“Any one of atoms, bytes and genes could be enough to drive economic growth but all three together are a powerful tailwind that could exist for many years to come. I think that equity investing is a great way to invest in all three of these areas,” the Royal London Sustainable World Trust manager finished.

“When we add base rate probabilities to a high level of innovation it seems the potential for 2025 to be another good year for equity investors is high.”

Ben Rogoff, co-manager of the Polar Capital Global Technology and Polar Capital Artificial Intelligence funds, was even more bullish on the opportunities created by AI and said “understanding the impact of generative AI may become the most significant differentiating factor in fund performance for the next decade”.

“Looking ahead to 2025, we expect strong demand for Nvidia’s Blackwell processors, coupled with high-profile generative AI model upgrades and product releases, will drive further investor interest in AI-exposed stocks,” he added.

“Pro-business policies from a Trump/Republican/Musk government should ensure the US remains one of the stronger global economies and at the forefront of generative AI development, while regulation does not hinder AI progress.”

Rogoff also thinks there will be a broadening out of AI as a wider range of companies both supplying the enabling technologies and benefitting from their application.

But this broadening out of AI does not mean that tech stocks will necessarily have a smooth ride next year. Indeed, he expects periods of volatility – as is typical during the early stages of any new technology cycle – when market leadership changes as new winners built on new architecture emerges. This suggests a tailwind of active management in tech next year.

Not every star manager is out-and-out optimistic about the coming year, however. Jacob de Tusch-Lec, manager of the Artemis Global Income fund, acknowledged the saying ‘bears sound smart, bulls get rich’ but cautioned that investors should probably focus on the heightened risks that could come with 2025.

“Valuations (in the US especially) are stretched – rarely more expensive than today. Momentum stocks have done particularly well in 2024. Stuff that is up, is up a LOT, often with some elevated PE-multiples to accompany. That in itself creates risks to market stability,” he warned.

“Interest rates don’t look – in our opinion – like coming down far or quickly which is a risk with elevated debt levels on government balance sheets and in the broader post-QE financial system. We have started to take some profits in momentum names and have positioned the portfolio for the real-politik world of today, rather than the world we were living in during the decade leading up to Covid, or the world we would like to be living in.”

This means that Artemis Global Income has more exposure to defence stocks, banks and capex stocks – which are beneficiaries of Trump’s Make America Great Again agenda. But at the same time, only one-third of the portfolio is in US equities – around half of the benchmark’s weighting.

“De-globalisation, trade wars, tariffs and general multipolar protectionism are likely to lead to a decoupling to some extent of economic regions of the world,” de Tusch-Lec finished.

“This can actually be helpful to investors. Instead of one global business cycle I think we’ll see more de-synchronized interest rate and growth cycles across the world.”