There has been a record rotation out of US stocks by fund managers, a closely watched positioning survey shows, after investor sentiment took a sharp hit.

Recent weeks have been challenging ones for markets, with the MSCI AC World index falling 3.1% (in sterling terms) since the start of the year. This has been driven by the US, the largest constituent of the global index; the S&P 500 is down 6.7% after investors were spooked by a weakening economy, trade war tensions and high valuations.

In contrast, other major equity markets are up. The Euro STOXX has gained 13.6% this year, followed by the FTSE All Share (up 5.7%), MSCI Emerging Markets (up 1.8%) and, barely, the Topix (up 0.02%).

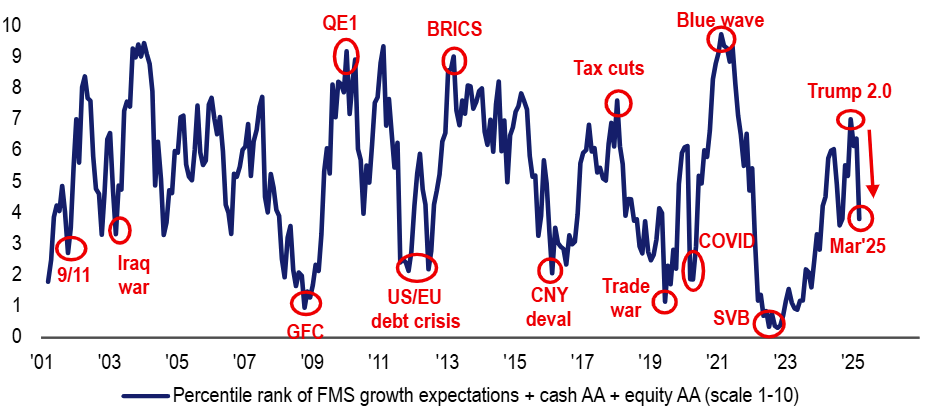

Percentile rank of fund manager sentiment

Source: Bank of America Global Fund Manager Survey – March 2025

The latest edition of the Bank of America Global Fund Manager Survey, which polled 171 asset allocators running a total of £426bn between 7 and 13 March, found investor sentiment has collapsed in recent weeks.

The survey’s broadest measure of fund manager sentiment, which is based on their equity allocations, cash levels and global growth expectations, fell to 3.8 in March from 6.4 in February. This marks a seven-month low.

Bank of America strategists said: “This month's decline is the largest since March 2020 and the seventh largest in the past 24 years, only surpassed by extreme bear sentiment observed around major market shocks (August 2007, May 2010, August 2011, March 2020).”

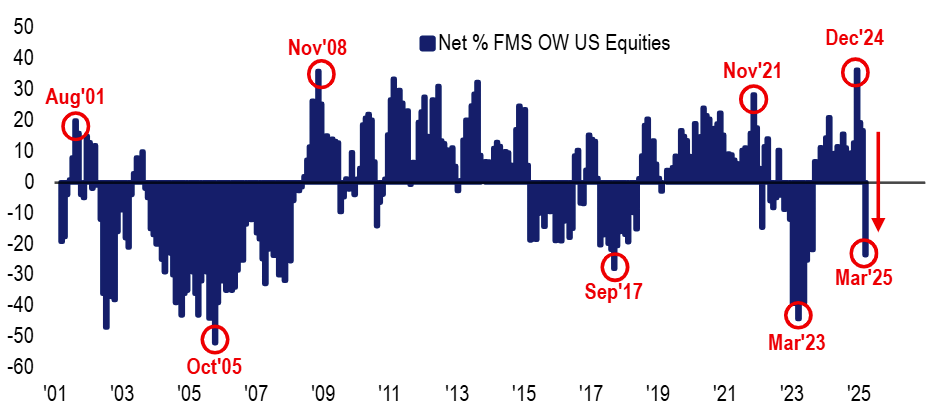

Net % of fund managers overweight US equities

Source: Bank of America Global Fund Manager Survey – March 2025

Notably, the poll found that the ‘US exceptionalism’ narrative – or the idea that the US is exemplary compared with other nations, which has driven the market’s outperformance for an extended period – is starting to crack. Some 69% of respondents think the US exceptionalism theme has peaked.

This view is reflected in the record rotation out of US stocks seen this month – the allocation dropped 40 percentage points to a net underweight of 23% (to the lowest allocation since June 2023).

This had a knock-on effect on the global equity allocation, which fell 29 percentage points month-on-month to a net overweight of just 6%, which is the lowest since November 2023 and the fifth largest decline on record.

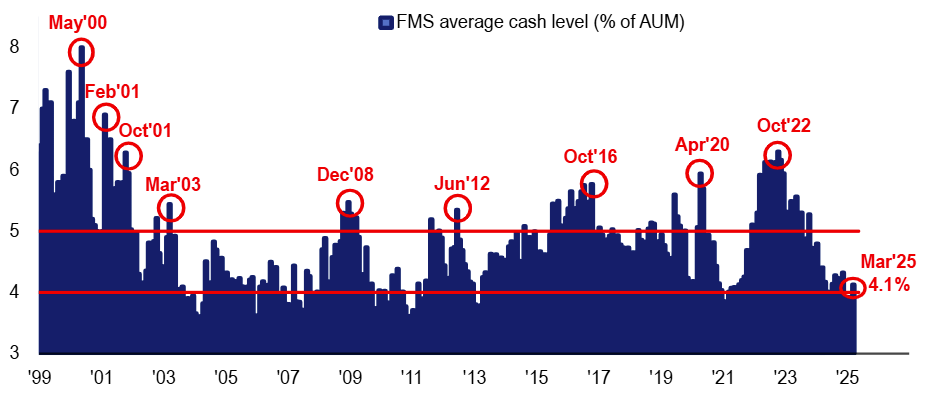

Fund managers’ average cash levels

Source: Bank of America Global Fund Manager Survey – March 2025

Bank of America strategists added: “Note the rotation from equities was to cash (allocations rose 17 percentage points month-on-month to a net 10% overweight), not bonds (allocations fell three percentage points to a net 13% underweight).”

Fund managers’ average cash levels, shown in the chart above, rose 62 basis points in March. This is the largest one-month increase since December 2021.

Expectations for the global economy – the final component of Bank of America’s sentiment indicator – also deteriorated this month. The latest Bank of America Global Fund Manager Survey recorded the second biggest monthly rise in macro pessimism on record as 63% of investors expect the global economy to weaken over the coming 12 months.

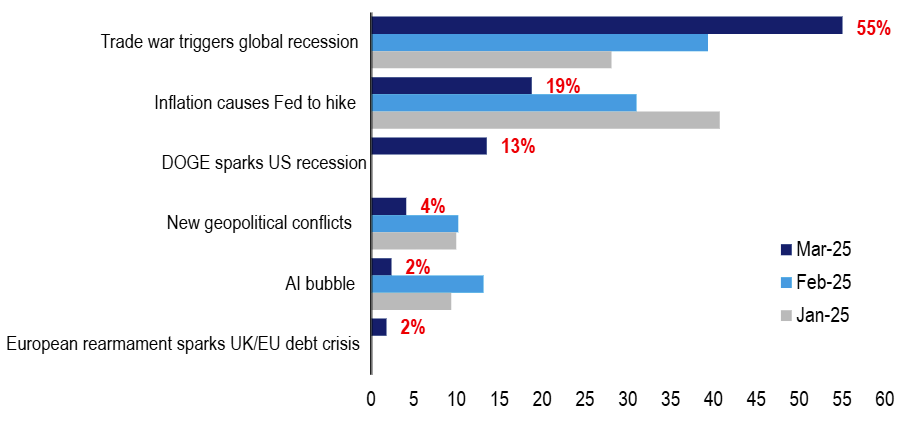

What fund managers consider to be the biggest tail risk

Source: Bank of America Global Fund Manager Survey – March 2025

A recessionary trade war remains the largest tail risk that fund managers are worried about, with 55% citing it in this month’s survey. US president Donald Trump spooked the markets by unveiling tariffs on Chinese, Canadian and Mexican goods (some of which were later postponed) then declining to rule out that the US was heading into recession.

Under a full-blown trade war scenario, 58% of investors expect gold to be the best performing asset. Some 16% pointed to 30-year treasuries, 9% opted for three-month T-bills and 6% said commodities.

Meanwhile, inflation causing the Federal Reserve to hike interest rates is the biggest risk for 19% of fund managers (down from 31% in February and 41% in January) while 13% are worried by the impact on the US economy of the Department of Government Efficiency (DOGE) and its cost-cutting drive.

Bank of America strategists offered up some contrarian trades for investors to consider.

Bulls who expect trade war and stagflation concerns to unwind should look at being long stocks and short cash or long tech stocks and short consumer staples. However, the bear case – in which US recession risk increases – would point to being long bonds while being short banks (currently managers’ favourite sector) and short Europe.