While receiving a regular, consistent income from your portfolio has always had its attractions, income strategies have become more popular amongst retired investors since chancellor Rachel Reeves decided to levy inheritance tax (IHT) on pensions from April 2027 onwards.

CJ Cowan, who co-manages the Quilter Investors Monthly Income portfolios, said he has seen more demand from financial advisers recently because their retired clients are now inclined to spend down their pensions instead of retaining wealth for the next generation. Monthly income funds can be a useful vehicle for facilitating this spending.

Furthermore, income funds can play a role in wealth transfer because gifts considered to be part of someone’s normal expenditure and made out of natural income – including dividends from funds – are exempt from IHT and the seven-year exemption rule does not apply.

Below, Cowan explains some tips for building portfolios with a monthly income and points out which pitfalls investors should look out for.

Beware style and performance biases

Income funds have inherent biases and will perform differently to – and sometimes worse than – funds that prioritise capital growth, Cowan said. Income portfolios tend to include more value stocks than growth, as well as higher UK and lower US exposure because the UK has more of a dividend-paying culture.

“The biases you end up with in an income fund aren’t what has performed as well over the past five years. It’s been a large-cap growth driven market and Nvidia doesn’t pay a dividend, for example. So it’s been a difficult backdrop for income investing,” he acknowledged.

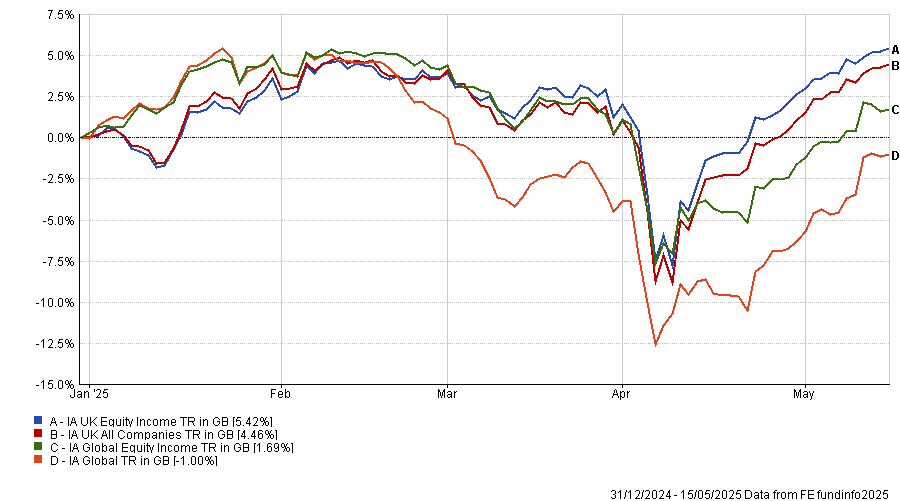

Conversely, income funds outperformed during the 2022 tech sell-off and year-to-date.

Performance of UK and global equity income funds YTD

Source: FE Analytics

The Quilter Investors Monthly Income portfolios have more duration and interest rate risk, and more bonds in general, than the Quilters Cirilium multi-asset range. The former should perform well when bonds rally and interest rates are being cut.

Quilter’s income portfolios have a permanent allocation to high-yield bonds, which “give you decent yield but without too much interest rate risk”, Cowan explained. For the Cirilium funds, which he also manages, high-yield bonds would be a tactical off-benchmark bet.

The two ranges use different alternative investments; the Cirilium strategies have more exposure to hedge funds while the monthly income portfolios invest in infrastructure and renewable energy via investment trusts, which provide inflation linkage and a reliable income.

Income investors’ secret weapon

For investors seeking a consistent and growing stream of income payouts, investment trusts are a vital weapon in their arsenal. They offer high yields, access to alternative assets with inflation-linked cashflows, a timely buying opportunity given pervasive discounts, as well as a much longer track record of steadily increasing their dividend payouts than open-ended funds.

Open-ended funds are obliged to pay out all the income they receive within each financial year but trusts are allowed to hold money in reserve for leaner years – leading to a smoother and more consistent stream of dividend payouts.

Cowan’s monthly income portfolios usually have a 7-10% allocation to investment trusts, some of which are throwing out double-digit yields. He holds Fair Oaks Income (which invests in floating rate, senior secured loans), CVC Income & Growth (whose core portfolio of performing loans is supplemented by opportunistic investments in distressed situations) and Biopharma Credit (which provides loans to life sciences companies). They are yielding circa 15%, 12% and 11%, respectively.

How to ensure a steady monthly stream of income

About 100 open-ended funds offer a monthly income stream, which narrows down the universe significantly from the thousands of funds available. Therefore, multi-asset and wealth managers mix and match funds with different income streams, then manage how income is paid to investors at the total portfolio level.

About 10% of the underlying funds within Quilter’s monthly income portfolios make 12 payments a year, including Allspring Emerging Markets Equity Income and Quilter Investors Dynamic Bond fund.

Allspring Emerging Markets Equity Income is a core/value strategy with a yield of 3.4%. Fund managers Alison Shimada and Elaine Tse focus on cashflow and reliable dividend payments, which Cowan said is helpful given his income mandate.

The Quilter Investors Dynamic Bond fund, managed by TwentyFour Asset Management, invests across high yield and investment grade credit, alongside collateralised loan obligations and government bonds.

“It’s a ‘go anywhere’ credit fund which performs a bit like lower-beta high yield, but it’s well diversified and has historically been able to cushion better on the downside in big credit drawdowns. It fits the bill for an income fund because the yield’s pretty decent,” Cowan said.

He also holds two US investment grade bond exchange-traded funds (ETFs), one from Vanguard which pays out monthly, alongside a quarterly payer from iShares. “We’re not getting diversification there from a returns perspective but we’re getting diversification from an income sequencing perspective and that’s another thing you need to build in when you’re picking holdings,” he explained.