Investor confidence is making a strong comeback, according to Bank of America’s latest Global Fund Manager Survey, as sentiment becomes notably more positive after a period of caution.

The June edition of the closely watched survey reveals a clear increase in risk appetite, with fund managers moving away from defensive strategies as concerns about the global economy begin to ease.

Carried out shortly after a cooling in US-China trade tensions but before the recent escalation in the Middle East, the survey found that asset allocators are looking towards a soft landing and starting to take on more risk in portfolios.

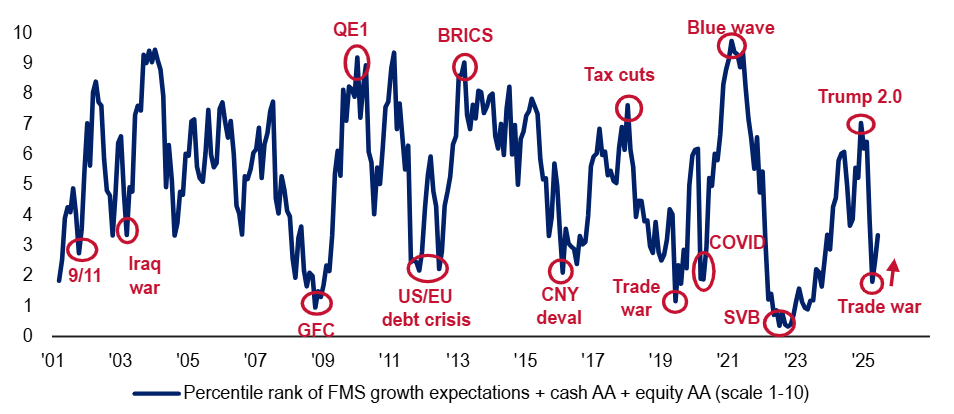

Percentile rank of fund managers’ growth expectations, cash level and equity allocation

Source: Bank of America Global Fund Manager Survey – Jun 2025

Investor sentiment has rebounded sharply in June, with Bank of America’s composite fund manager sentiment index climbing from 2.5 to 3.3, the largest monthly gain of 2025.

This upswing, driven by a combination of higher equity allocations, reduced cash holdings and improved growth expectations, lifted the Bull & Bear Indicator to a three-month high of 5.4.

The timing of the survey (it came after US-China trade progress but before fresh Middle East tensions) helped stabilise risk appetite. Although still well below euphoric levels, the bounce suggests that investors are cautiously rotating out of defensive postures amid signs of macro resilience.

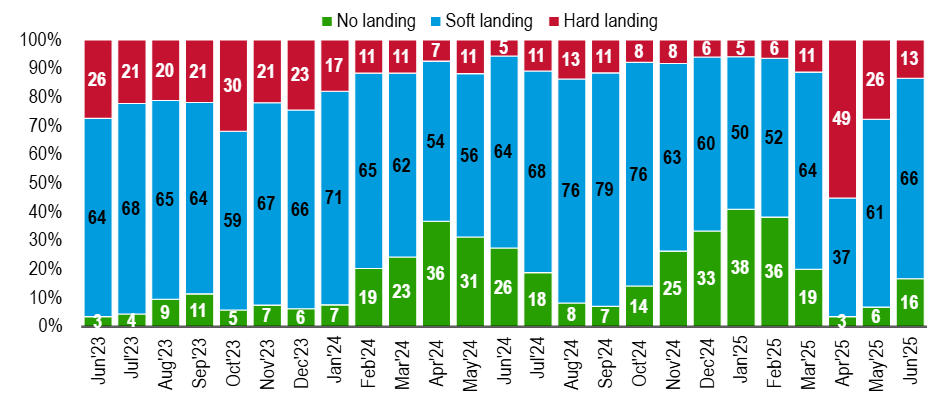

Fund managers’ expectations for the global economy in the next 12 months

Source: Bank of America Global Fund Manager Survey – Jun 2025

On this, recession expectations have eased significantly in the past two months. In April, a net 42% of fund managers expected a global recession in the coming 12 months; a net 36% now say this is unlikely.

Soft landing expectations surged to 61% of fund managers in June, marking the strongest consensus since October 2024. This reflects a dramatic reversal from just two months ago, when nearly half of respondents anticipated a hard landing.

There was a collapse in hard landing forecasts to just 13% (down from 49% in April). Meanwhile, there was a steady rise in ‘no landing’ calls (now 16%, up from 3%).

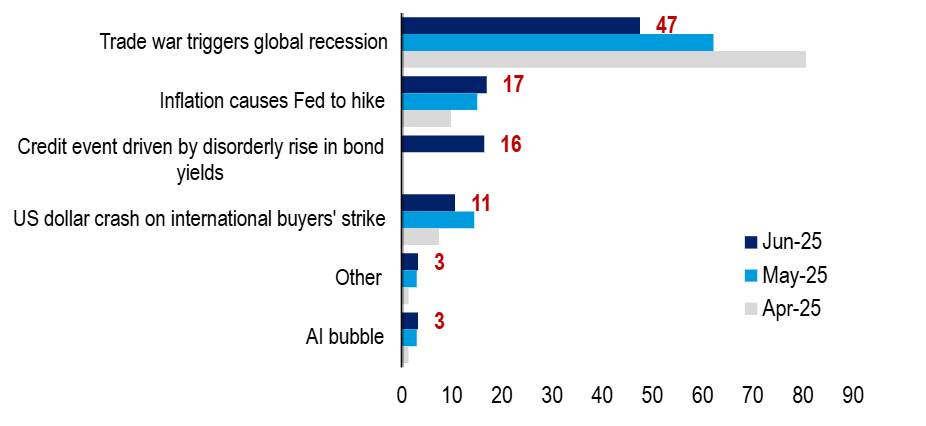

What fund managers consider to be the biggest tail risk

Source: Bank of America Global Fund Manager Survey – Jun 2025

Despite improving sentiment, 47% of fund managers still view a trade war-induced global recession as the top tail risk. This is down from 80% in April but still firmly the market's primary concern as the recent US-China tensions continue to cast a long shadow over otherwise stabilising macro expectations.

Rate hikes driven by sticky inflation remain the second-largest worry at 17%, closely followed by fears of a credit event from disorderly bond yield spikes (16%).

While recession odds are being marked down, investors remain aware that tightening financial conditions or geopolitical shocks could quickly reverse the current optimism.

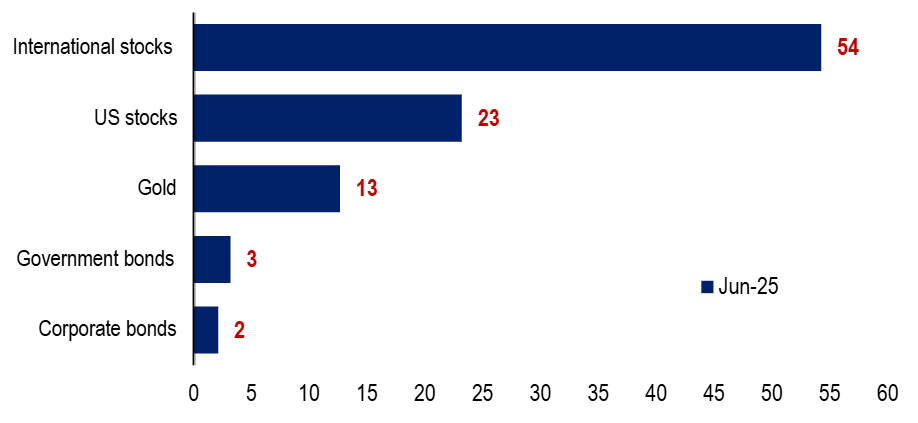

What managers see as the best-performing asset in the next five years

Source: Bank of America Global Fund Manager Survey – Jun 2025

The June survey’s reinforces recent signs of a break in the ‘US exceptionalism’ narrative, with 54% of fund managers tipping international equities to be the top-performing asset over the next five years – more than double the share favouring US stocks.

This highlights the notable shift in conviction away from the US market, reflecting growing concerns around the policies of US president Donald Trump, valuation stretch, fiscal headwinds and dollar strength.

Only 23% still back US equities for future outperformance and just 5% see bonds as likely winners, reinforcing the idea that global diversification is regaining favour.

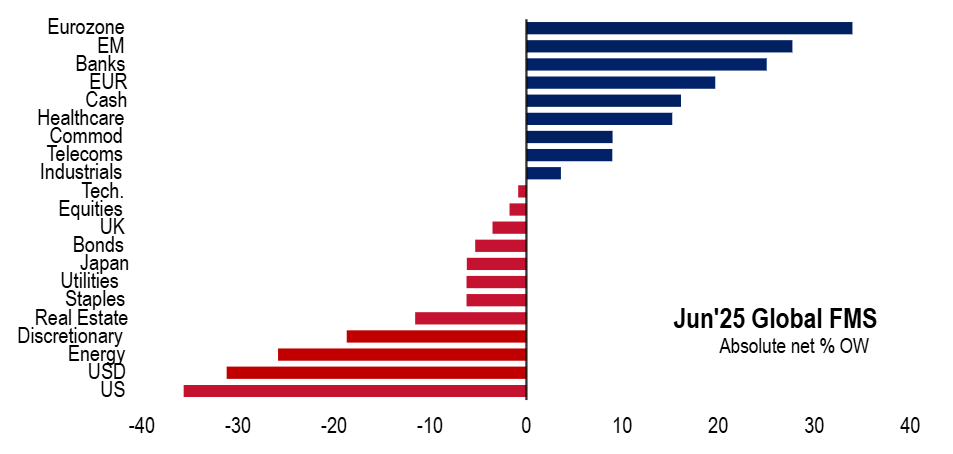

Fund managers’ absolute positioning (net % overweight)

Source: Bank of America Global Fund Manager Survey – Jun 2025

Investor positioning confirms the erosion of confidence in US market dominance, with fund managers now deeply underweight US equities, the dollar and energy. The June survey shows the US sitting at the bottom of the allocation spectrum, while eurozone and emerging markets equities, alongside banks, top the overweight ranks.

This rotation backs up the idea of a broader recalibration being underway, as investors respond to the US’s ‘America First’ agenda, fiscal fragility and more attractive relative value abroad. The tilt toward banks and emerging markets also implies a degree of optimism around global cyclical recovery.

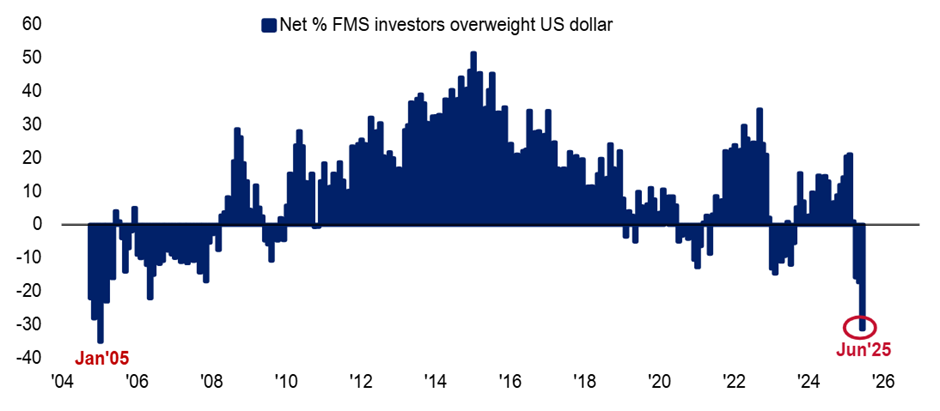

Net % of funds managers underweight the dollar

Source: Bank of America Global Fund Manager Survey – Jun 2025

Positioning towards the US dollar deserves a closer look. Fund managers are now the most underweight the US dollar in two decades, with net positioning at levels not seen since January 2005.

This shift underscores a decisive pivot toward non-dollar assets and likely reflects unease of the Trump administration’s policies and a structural rotation into international markets.

Bank of America’s analysts said the “biggest summer pain trade is long the buck”.

The June survey was carried out between 6 and 12 June, polling 190 fund managers running a collective £523bn.