Investment trust discounts have started to narrow, leading experts to identify those that might be poised for further re-rating if their strong performance continues.

Data from the Association of Investment Companies (AIC) shows the average investment trust is on a 14% discount to its net asset value (NAV). However, according to Nick Britton, research director at the AIC, this is beginning to change.

“Since the start of the year, discounts have narrowed in 29 AIC sectors and widened in only seven,” he said. “The average discount has narrowed 1.5 percentage points – a small move, but a welcome one.”

With this in mind, Trustnet asked fund pickers for their favourite investment trusts benefitting from narrowing discounts.

Anthony Leatham, head of investment companies research at Peel Hunt, started with the “partial rotation” out of US equities following mixed economic data and other markets have surprised on the upside.

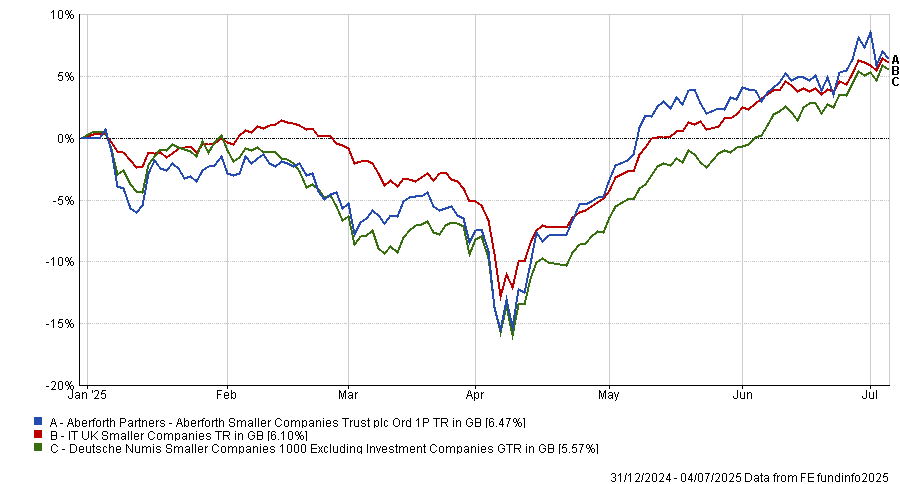

He highlighted Aberforth Smaller Companies as an example of a trust that is already benefiting from this trend.

Its value-focused investment style and emphasis on smaller companies puts the trust on a “triple discount”: the UK is discounted compared with global markets, smaller companies are discounted compared with larger peers and the trust itself is on an 11% discount.

Over the past 12 months, Aberforth Smaller Companies has underperformed the IT UK Smaller Companies sector (5.1%) and the Deutsche Numis Smaller Companies 1000 (23.3%).

However, the trust has been a key beneficiary of “recovery in UK equities and the pick-up in M&A activity” and is outperforming the sector and benchmark this year as a result.

Aberforth Smaller Companies performance vs sector and benchmark YTD

Source: FE Analytics

“As international and domestic buyers alike begin to engage with the attractive valuations and returns on offer at the small-cap end of the UK equity market, we anticipate the layers of discount that run through Aberforth Smaller Companies’ portfolio to narrow,” Leatham said.

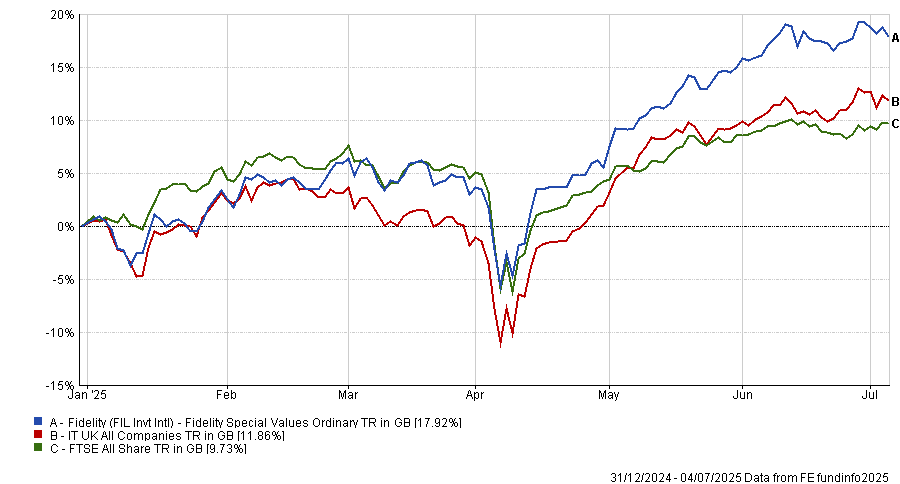

Meanwhile, Winterflood head of investment trust research Emma Bird favoured Fidelity Special Values.

At the end of June, its discount to NAV had narrowed down to around 2-3% from 8% at the start of the year, as investors have become more positive about UK equities, she explained. Net retail flows into the trust’s shares were consistently negative before ‘Liberation Day’ but have rallied since, according to research by Winterflood analysts.

FE fundinfo Alpha Manager Alex Wright has an “impressive stewardship” running the trust, outperforming the FTSE All Share over one, three, five and 10 years. Year-to-date performance has also been strong, with Fidelity Special Values up 17.9% and sitting in the top quartile of the IT UK All Companies sector.

Fidelity Special Values performance vs sector and benchmark YTD

Source: FE Analytics

While the 2% discount “does not offer particular value relative to history”, the board is generally committed to maintaining a single-digit discount in normal conditions, Bird said.

“We believe that the fund’s contrarian value approach, with a focus on the potential for positive change, offers an attractive proposition,” she added.

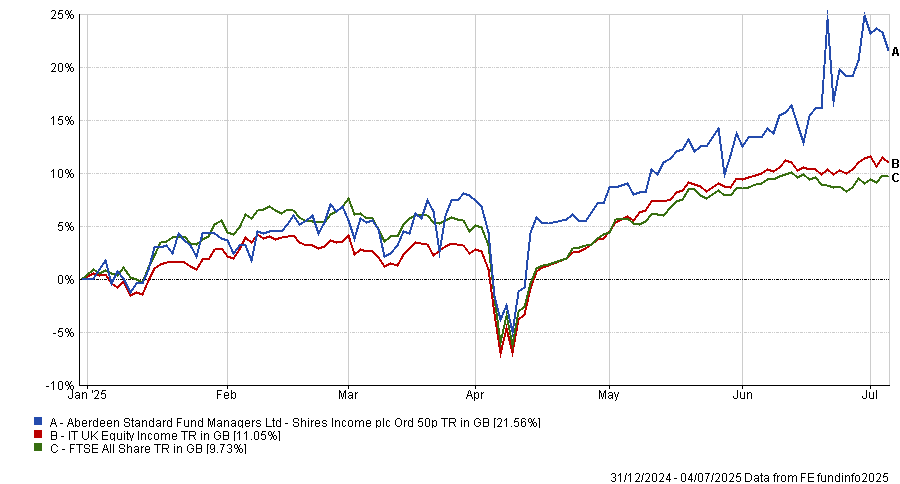

Shires Income has been “quietly building momentum this year”, according to Josef Licsauer, research analyst at Kepler Partners.

Managed by Iain Pyle, the trust favours undervalued high-yielding shares, with a slight preference for mid- and small-caps. As a result, it offers “meaningful diversification beyond traditional large-cap equity income strategies”.

For the first time in two years, Shires Income moved onto a premium towards the end of June (0.6%, as of 26 June, compared with a 13% discount at the end of the last financial year), Licsauer explained. While this has slipped in recent days, the trust still trades close to NAV.

This re-rating is particularly due to the attractive dividend yield of 5.1% which is “above average for the market” and provides a good balance of defensiveness and growth potential, the Kepler analyst said.

With UK fundamentals seemingly improving and the Bank of England entering a gradual rate-cutting cycle, which tends to benefit the more domestically exposed companies, these tailwinds are likely to continue, he explained.

“In a market where UK equities remain cheap and under-owned, we think the strategy's distinctive income-led approach appears to be resonating with investors.”

FE Analytics shows the trust’s 21.6% return is the best result in the IT UK Equity Income sector this year.

Shires Income performance vs the sector and benchmark YTD

Source: FE Analytics

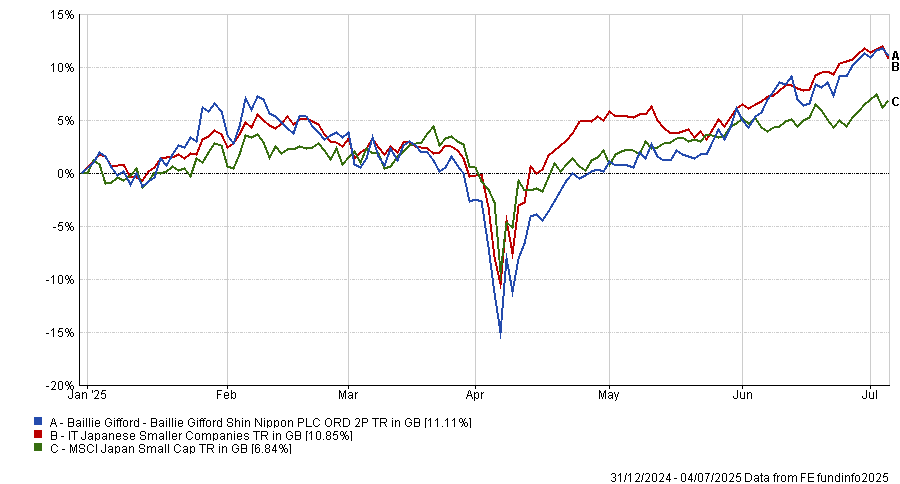

Finally, Mick Gilligan, head of managed portfolio services at Kilik, said Baillie Gifford Shin Nippon has “scope for further narrowing”.

It targets smaller Japanese companies that have disruptive business practices or appealing opportunities, such as overseas growth. This comes at a time when Japanese smaller companies are appealingly valued, with the MSCI Japan Small Cap index trading on a price-to-earnings ratio of 14.3x compared with around 30x for the S&P 500.

Shin Nippon currently has a discount of around 8% to NAV, but it generally traded on a premium between 2013 and 2021, Gilligan explained. With the trust delivering a strong performance so far this year, it is “entirely conceivable that it gets back to a premium rating” if this performance continues.

Baillie Gifford Shin Nippon performance vs the sector and benchmark YTD

Source: FE Analytics

However, Gilligan noted that the trust is a niche investment and if recent performance wanes, the discount is likely to widen. As such, it is only suitable for around a 2.5% allocation in most balanced portfolios, he concluded.