Private equity is no longer a niche industry, with businesses increasingly turning to private equity firms to raise capital rather than applying for a bank loan or approaching individual investors.

UK-based companies alone have attracted £1.3trn in private equity investment in the past 15 years and only 36% of the country’s 500 largest companies are currently publicly listed, according to US consultancy firm McKinsey & Company.

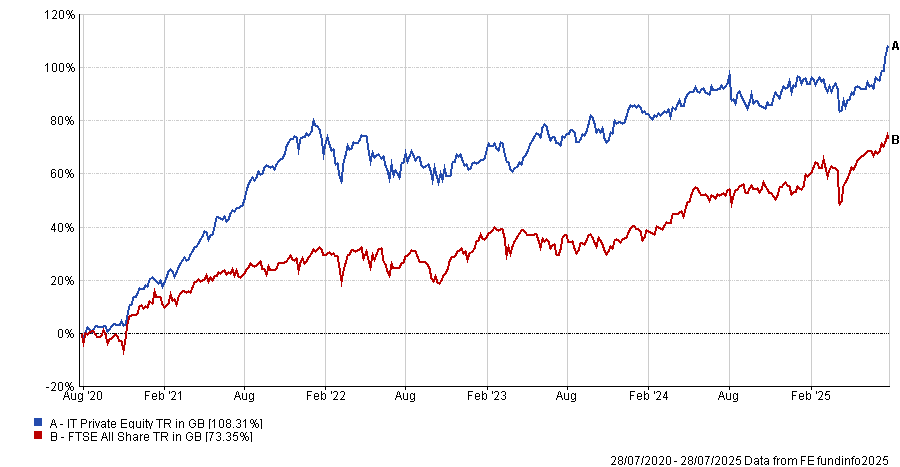

As such, investor interest in private equity has been steadily growing. It has been paying off, with the average trust in the IT Private Equity sector outperforming the FTSE All Share.

Total return of sector vs FTSE All Share index over 5yrs

Source: FE Analytics

Below, experts outline how investors can build a comprehensive allocation to private equity by pairing complementary funds.

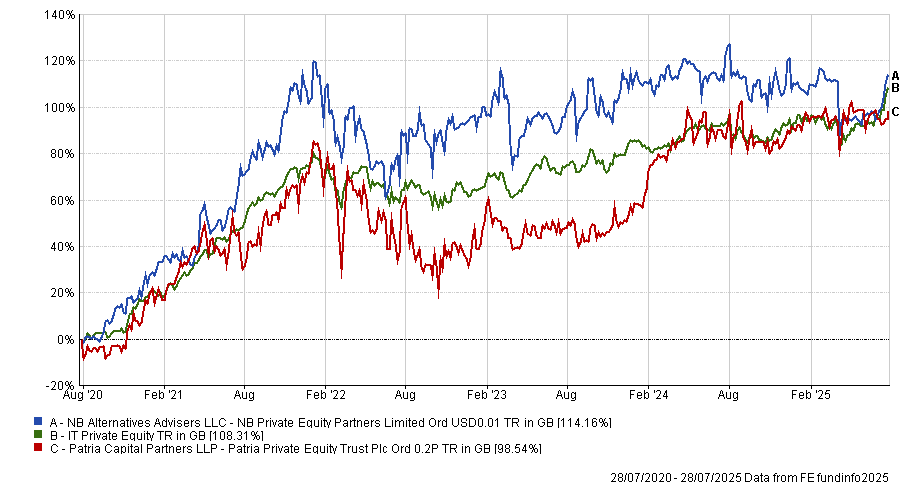

Patria Private Equity Trust and NB Private Equity Partners

Dzmitry Lipski, head of funds research at interactive investor, paired Patria Private Equity Trust with NB Private Equity Partners.

Launched in 2001, Patria Private Equity Trust’s £836m portfolio of private equity funds and co-investments has a strong emphasis on European markets and has outperformed the average returns of listed private equity peers over a decade.

Lipski’s other pick – NB Private Equity Partners – invests in companies with long-term secular growth prospects and lower expected cyclicality.

“The portfolio is well-balanced, aiming to capture future growth while maintaining vintage diversification,” Lipski said.

It has more than 70 holdings with over 70% of its exposure in the US.

“The trust has consistently outperformed both public equity markets and its private equity peers over the long term, underpinned by a strong track record and the resources of the Neuberger Berman platform,” said Lipski.

Performance of funds vs sector over 5yrs

Source: FE Analytics

NB Private Equity Partners currently yields 4.7% on a historic basis, Lipski said, noting that this makes the trust a “compelling option for income-seeking investors and a potentially strong complement to the Patria Private Equity Trust”.

Both Patria Private Equity Trust and NB Private Equity Partners are trading on double-digit discounts to their net asset values (NAVs) of 28% and 22% respectively. As such, they could be a “potential attractive entry point for long-term investors”, said Lipski.

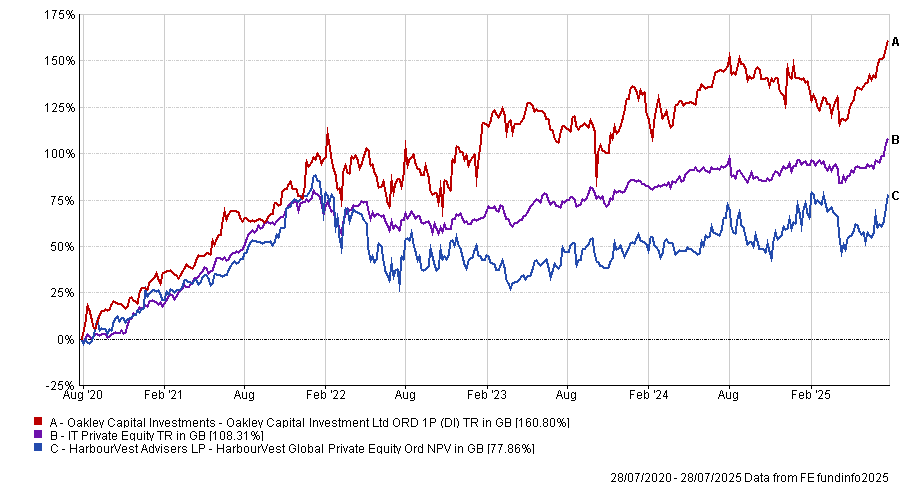

HarbourVest Global Private Equity and Oakley Capital Investment

Markuz Jaffe, analyst at Peel Hunt, said HarbourVest Global Private Equity offers a “well diversified” £2bn global portfolio of private equity through its fund-of-funds structure.

“The portfolio is also diversified across regions, industries, vintage year and investment stage,” he said, with underlying investments spread across buyout, venture, private credit, infrastructure and real assets.

“It actively uses share buybacks to enhance liquidity and address its discount,” Jaffe added.

Earlier this year, the board increased its allocation of gross realisation proceeds (profits from sales) to the distribution pool (the capital set aside for share buybacks) from 15% to 30%, Jaffe explained – a move which supports a “healthy level of buyback activity going forward”.

In contrast, the £926m Oakley Capital Investment has a more concentrated strategy centred predominantly around pan-European tech-enabled businesses.

“These businesses often benefit from recurring revenues in the consumer, technology, education and business services sectors,” said Jaffe.

As such, Oakley Capital currently benefits from a robust balance sheet and a recently increased commitment to share buybacks, he noted.

Performance of funds vs sector over 5yrs

Source: FE Analytics

Despite the compelling long-term return profiles of both funds, HarbourVest Global Private Equity and Oakley Capital continue to trade on wide discounts of around 33% and 28% respectively.

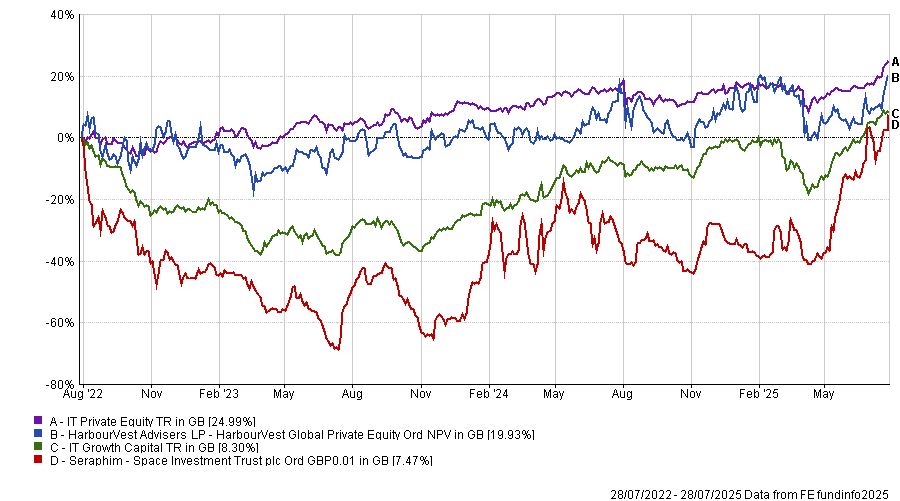

HarbourVest Global Private Equity and Seraphim Space

Shavar Halberstadt, analyst at Winterflood, also highlighted HarbourVest Global Private Equity, but chose to pair it with Seraphim Space Investment Trust.

Performance of funds vs sectors over 3yrs

Source: FE Analytics

With HarbourVest Global Private Equity providing investors with exposure to more than 1,000 underlying funds and 14,000 portfolio companies, it can be considered a “one-stop shop for broad-based private equity exposure”, Halberstadt said.

Meanwhile, Seraphim Space offers more niche exposure SpaceTech investments and is the “clearest beneficiary” of increased global defence spending in the investment trust universe, he said.

Seraphim Space’s shares currently sit at a discount of 45% to NAV, based on the “flawed perception that the portfolio contains ‘pie in the sky’ ventures that may or may not generate returns in the medium term”, he said.

However, Seraphim Space’s portfolio companies are more established than one might expect, Halberstadt claimed, noting that holdings have secured partnerships and joint venture agreements with large defence names and contracts with NATO partner governments, “representing sticky revenue”.

HgCapital Trust and T. Rowe Price Global Technology

Tony Mee, chief investment officer of Asset Intelligence, took a different and more thematic approach, choosing to pair private equity fund HgCapital Trust* with the public markets-focused T. Rowe Price Global Technology Equity fund.

“The blend of specialised European private equity and broad global technology equities can help construct a resilient, forward-looking portfolio capable of capitalising on both rapid innovation and the steady growth of established industry leaders,” Mee said.

HgCapital Trust is a dedicated vehicle for accessing private equity investments in Europe’s software and business services sector.

It is listed in the UK and managed by a team with “significant experience in identifying and nurturing technology businesses”, Mee said.

The portfolio comprises a select group of European software firms that are typically characterised by robust growth trajectories and strong profitability that “might rank among the largest in their field” if they were publicly traded.

“The trust’s approach centres on building value over the long term through direct engagement with its holdings,” he explained.

The fund’s degree of concentration can lead to periods of notable performance – both positive and negative. As such, Mee suggested the T. Rowe Price Global Technology Equity fund can offer an effective counterbalance.

“It casts a much wider net,” he said.

The fund’s holdings reflect a diverse mix of regions and include companies involved in software, hardware and digital services.

“One of its strengths is the ability to adapt to shifting tech landscapes by focusing on firms with sustainable competitive advantages and clear growth prospects,” said Mee.

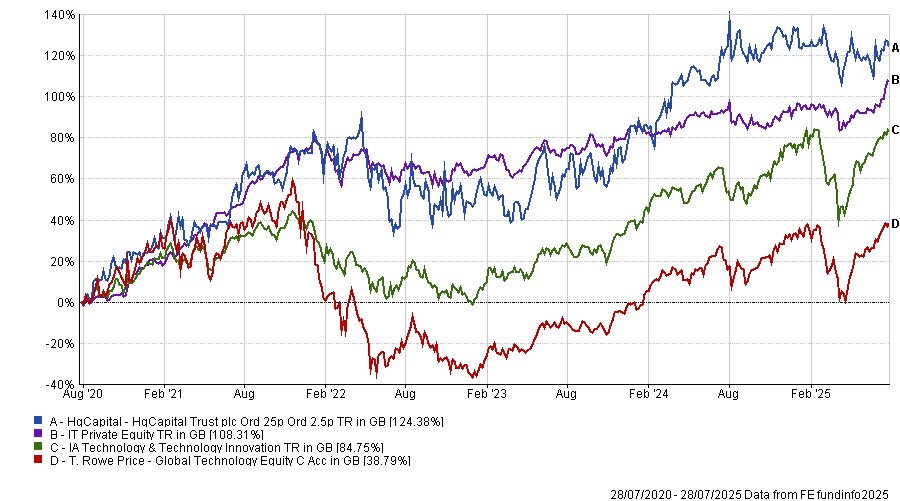

Performance of funds vs sectors over 5yrs

Source: FE Analytics

*HgCapital Trust is an investor in FE fundinfo.