Investors searching for hidden gem multi-asset funds have been spoiled for choice over the past three years, according to recent Trustnet research.

Multi-asset funds are a popular option for investors looking for asset-allocation ‘one-stop shops’. However, with almost 652 funds across the four Investment Association (IA) multi-asset sectors, determining where to start can be a struggle.

While larger funds may be a safe option, investors can find a range of funds which have delivered top performance with less than £250m in assets under management (AUM).

Below, we examine the funds that matched these criteria in the IA Mixed Investment 40-85% shares, IA Mixed Investment 20-60% shares, IA Mixed Investment 0-35% Shares and IA Flexible Investment sectors.

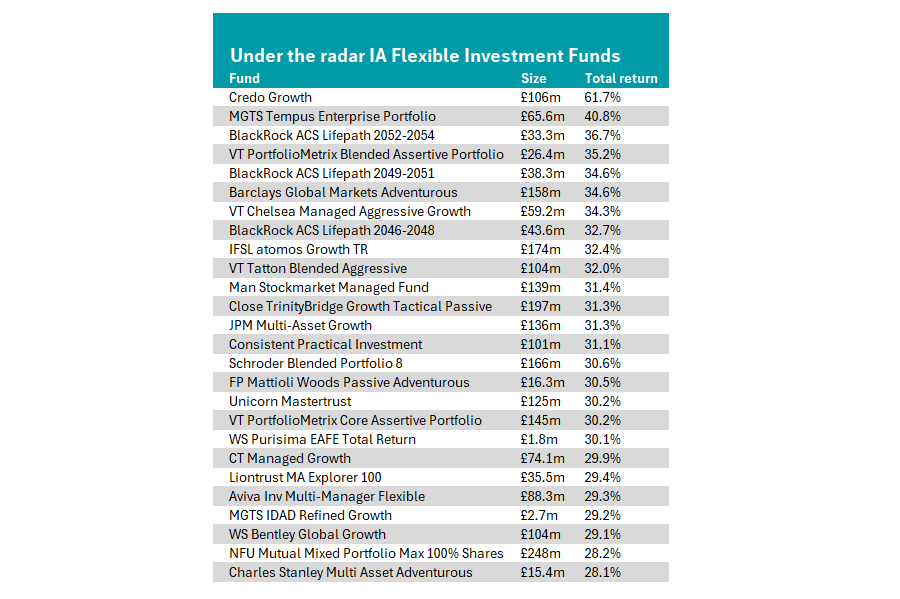

IA Flexible Investment

First, we turn to the strategies in the IA Flexible sector, where managers have the freedom to invest as much as they like into different asset classes.

The Credo Growth fund stands out due to outperforming its nearest competitor by 21 percentage points over the past three years.

Source: FE Analytics. Data as of 31 July. Total return over three years

Led by Roy Ettlinger, the fund has achieved this with an extremely stock-heavy portfolio, with nearly 94% of the total assets invested in equities, contrasting a 5.1% allocation to fixed income.

Ettlinger explained these allocations are a consequence of a “more challenging fixed income environment”, as high interest rates last year had placed pressure on bond prices. By contrast, equity markets had been experiencing “substantial gains” driven by technological advancements, particularly in the field of artificial intelligence, increased investor confidence and strong earnings.

Its top-10 positions include many leading tech companies, including Amazon, Nvidia and Palantir Technologies, which have all been strong performers.

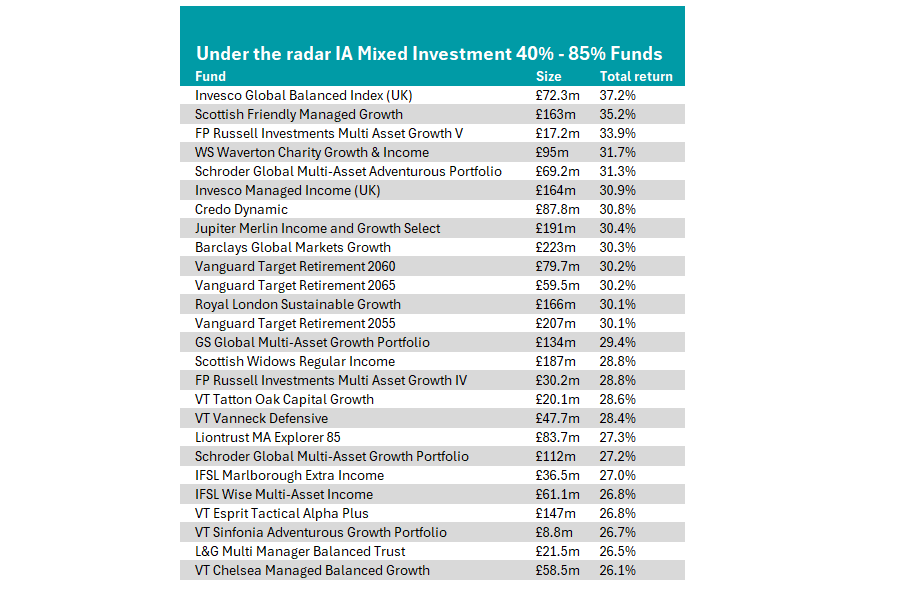

IA Mixed Investment 40-85% Shares

Moving down the risk scale, the top-performing hidden gem fund in the IA Mixed Investment 40-85% sector is the passive Invesco Global Balanced Index portfolio.

Managers Georg Elsäesser and Moritz Brand use a risk optimisation process that recommends stocks which match their pre-determined risk parameters, which managers will then assess based on their current macro-views. They also have the freedom to implement derivatives or other alternatives to the portfolio.

Source: FE Analytics. Data as of 31 July. Total return over three years

Over the past three years, it is up 37.2%, the third-best return in the peer group.

The fund follows a systematic approach to investing, based on three core values – momentum, quality and value. It tightly controls portfolio risk, targeting a tracking error of around 3% to its four constraining benchmarks (50% FTSE All-Share, 25% MSCI World, 15% FTSE Actuaries UK and 10% 3 Month SONIA).

The extent to which managers Georg Elsäesser and Moritz Brand can stray from the benchmark is therefore limited, but they have the freedom to adjust exact allocations and weightings based on their current views.

Notably, it is not the only strategy from the Invesco stable to match our criteria for a ‘hidden gem’ in this peer group. The Invesco Managed Income fund has also delivered a top-quartile result of 30.9%

Unlike its stablemate, this is an actively managed fund of funds, which allocates to markets through owning other Invesco funds.

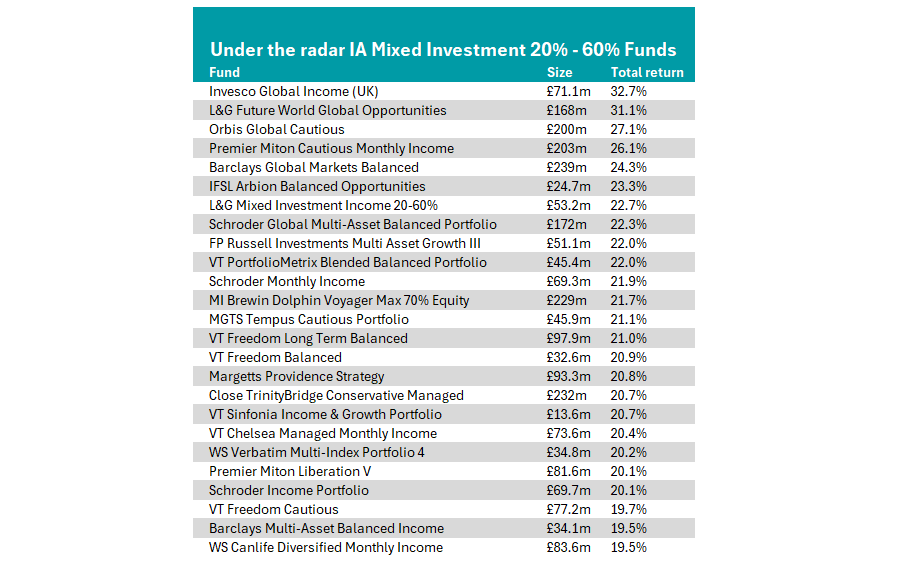

IA Mixed Investment 20-60% sector

Some investors might favour a less adventurous portfolio, with a more balanced allocation to bonds and equities. For them, 25 funds matched our criteria for ‘hidden gems’ in the IA Mixed Investment 20-60% sector.

Source: FE Analytics. Data as of 31 July. Total return over three years

An Invesco strategy took the top spot again, with the Invesco Global Income fund up by 32.7%. Led by Stephen Anness, Alexandra Ivanova, Asad Bhatti and Stuart Edwards, it delivered a top-quartile performance each calendar year since 2023.

It currently holds a 38% weighting to equities, which the managers said allowed for strong performance last year. The biggest contributors to the portfolio in 2024 included Broadcom, Rolls-Royce Royce and Standard Chartered.

On the fixed income side, the team currently favours high-yield bonds with roughly 30% of the portfolio invested in sub-investment grade bonds.

Despite the election of Donald Trump making the inflation outlook “more complicated” than the managers expected and despite very tight spreads, they said there are still opportunities to find good securities in high-yield markets.

However, there are several other options available for investors who were not convinced by the Invesco portfolio, such as the L&G Future World Global Opportunities, which trailed by 1.6 percentage points. Managed by FE Fundinfo Alpha Manager Colin Reedie, the portfolio has roughly 40% in bonds and 60% in the equity market, which led to top-quartile performances in 2022 and 2023.

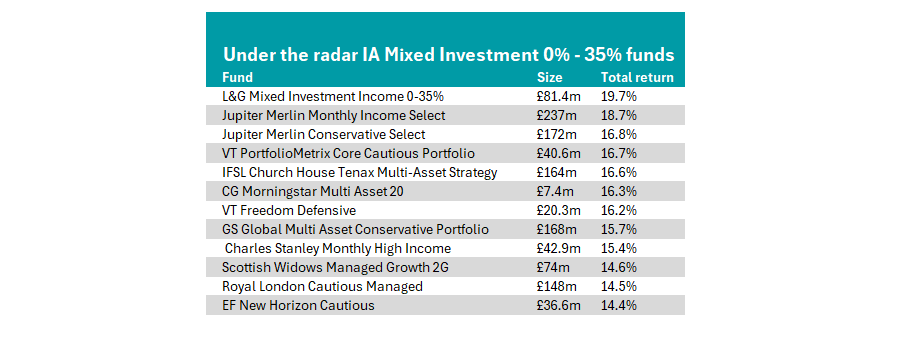

IA Mixed Investment 0-35% Shares

The IA Mixed Investment 0-35% shares peer group also included a fair amount of under-the-radar top performers.

Source: FE Analytics. Data as of 31 July. Total return over three years

For example, L&G’s Mixed Investment Income 0-35% fund, managed by Bruce White and Chris Teschmacher.

The fund invests at least 45% of its portfolio in the money market or investment-grade bonds, with around 31% of the portfolio currently invested in developed market corporate bonds, followed by equities.

This set of allocations has performed well for the portfolio, which has posted a 19.7% return over the past three years, outpacing the average peer by nine percentage points. Part of this return has been the top-quartile performance it has delivered so far this year.

White and Teschmacher attributed this to the allocation towards UK and European equities, which have rallied this year as investors have pivoted out of the US in favour of value stocks. They also credited strong performances to good decisions on the fixed income side, such as reducing US government bonds in response to volatility over tariffs and uncertain US trade.

Following just behind in second and third on our short list are two funds from the Jupiter Merlin range – the Jupiter Merlin Monthly Income Select and Jupiter Merlin Conservative Select funds.