Brunner investment trust headlines four portfolios given an ‘Elite Rating’ by investment research house FundCalibre in its latest rebalance, the firm confirmed on Wednesday.

FundCalibre awards funds the Elite Rating title based on quantitative and qualitative screenings alongside a peer group review. It is generally awarded to only 10% of funds per sector.

Three additional funds were put on the Elite Radar, which identifies portfolios on the firm’s watch list that have strong potential but currently lack some of the necessary criteria to justify a full rating.

Darius McDermott, managing director of FundCalibre, said: “Our ratings are designed to highlight managers we believe can consistently deliver for investors. From global equities and financials, to India, technology and flexible credit, each of these funds brings something different to a portfolio. We are confident they offer investors bother diversification and strong long-term return potential.”

First up is Allianz’ Brunner Investment Trust, which has been managed by Christian Scheider since 2022 after he replaced Matthew Tillit as the head of the investment company.

The global, all-weather £627.1m equity portfolio offers a “unique” balance across quality, growth and value, according to FundCalibre analysts.

The trust is benchmarked against the FTSE World ex-UK Index and FTSE All Share Index at 70% and 30% respectively, and almost half (45%) of the portfolio is invested in the US, alongside 23.7% in the UK and 22.3% in Europe ex UK.

It outperformed both indices and its sector over three (47.1%) and five years (109.3%) and is currently trading on a 0.9% discount to the net asset value (NAV).

The trust is also an Association of Investment Companies’ ‘Dividend Hero’, having increased its payouts for 53 years. This “speaks volumes,” the FundCalibre team said, adding that the current team has “already proven its mettle through a challenging market backdrop”.

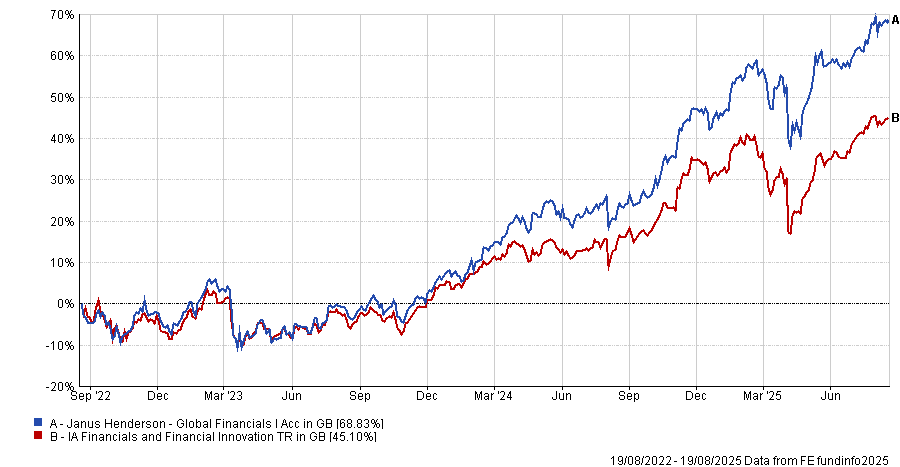

Another of the four funds to be awarded an Elite Rating is Janus Henderson Global Financials. Managed by John Jordan since 2017, the £206m fund targets the best-performing financial services businesses globally.

It is the best-performing fund in the sector over five and 10 years, delivering a 232.6% total return over the decade and has made strong returns consistently over the 10 years.

Janus Henderson Global Financials aims to outperform the FTSE World Financial Index by 2% per annum, before the deduction of charges, over any five-year period. Its top 10 holdings include JPMorgan Chase, BNP Paribas and Mastercard.

Performance of fund vs sector and benchmark over 3yrs

Source: FE Analytics

The next fund to be awarded an Elite Rating is the £93.6m Chikara Indian Subcontinent.

It is managed by Andy Draycott and Abhinav Mehra and has outperformed the FO Equity – India sector over one, three and five years.

“A high-conviction, index-agnostic fund focused on quality Indian companies benefiting from structural growth. With rigorous research and strong governance standards, this fund offers direct exposure to one of the world’s most attractive economies,” the analysts noted.

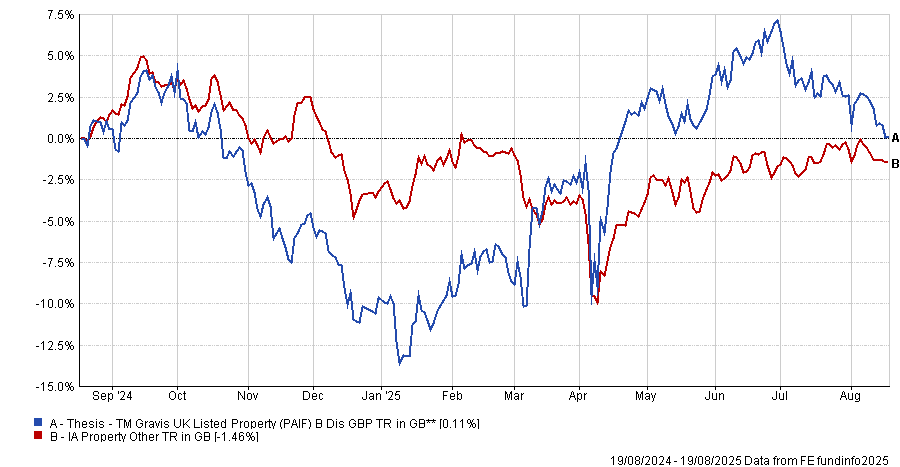

Finally, TM Gravis UK Listed Property has been awarded an Elite Rating. The £123.5m listed-property investment strategy, which is managed by Matthew Norris, and offers investors “both sustainable dividends and defensive characteristics,” the FundCalibre analysts said.

It is a “compelling diversifier”, with an experienced team and exposure to long-term real estate trends, they added.

Performance of fund vs sector over 1yr

Source: FE Analytics

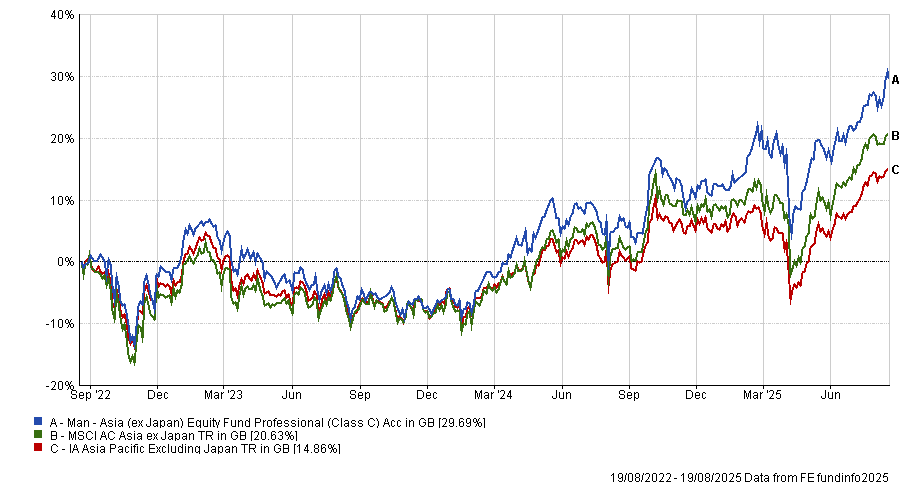

Meanwhile, among the funds put on the Elite Radar is Man Asia (ex Japan) Equity.

The fund offers a long-only, style-agnostic and fundamentally driven strategy, aiming to capture turning points in earnings revisions where there has historically been significant potential to generate alpha.

It has been managed by Andrew Swan – Man Group’s head of Asia ex-Japan equities – since 2020, with FundCalibre analysts noting he is “one of the most experienced Asian equity managers” around.

The fund has outperformed both the sector and MSCI AC Asia ex Japan over one (20.8%) and three (29.7%) years. Its top 10 holdings include Tencent, ICICI Bank and Taiwan Semiconductor Manufacturing.

Performance of fund vs sector and index over 3yrs

Source: FE Analytics

Allianz Global Hi-Tech Growth has also been added to the Elite Radar. Manager Jeremy Gleeson sits at the helm of this $605.2m global, multi-cap technology fund, which the analysts described as “a global, multi-cap technology fund that avoids speculation and focuses on proven business models”.

Launched in 2008, the fund has outperformed the FO Equity – Tech Media & Telecom sector over five years.

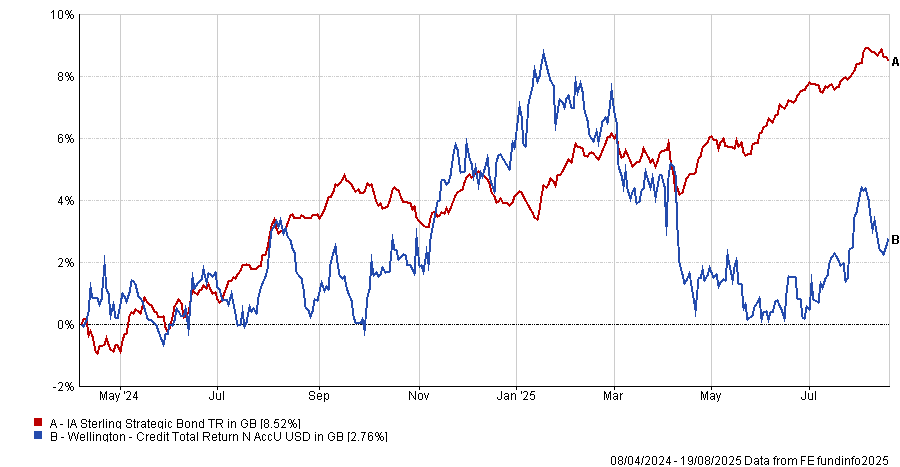

The $1.2bn Wellington Credit Total Return is the third fund to be added to the Elite Radar.

It has an FE fundinfo risk score of 32 and primarily invests in a global portfolio of US dollar-denominated treasury, corporate, high yield and emerging market fixed income instruments.

Performance of fund vs sector since launch

Source: FE Analytics

“An unconstrained global credit fund with the flexibility to shift allocations as markets evolve. This truly active approach makes it well-suited to today’s dynamic fixed income environment,” the analysts said.