Higher National-Insurance contributions and a chunkier-than-usual self-assessment tax take have brought more cash into government coffers, according to latest government data.

Self-assessment tax receipts were £2.7 billion higher than the same period last year and compulsory social contributions were also up by £2.6 billion after changes to employer National Insurance (NI) in April.

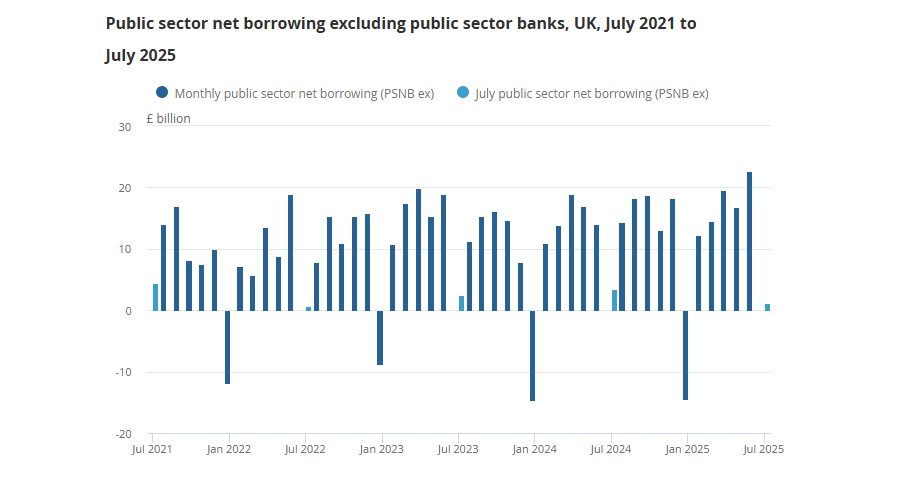

This brought public borrowing down to £1.1bn in July 2025, £2.3bn less than July 2024 and the lowest level of July borrowing for three years.

There is “a great deal of good news to be found” from these figures, according to Danni Hewson, head of financial analysis at AJ Bell. However, “the overall predicament the chancellor finds herself in hasn’t changed”.

Borrowing for the financial year so far was up to £60bn, the third-highest April to July borrowing figure since monthly records began. Additionally, the current budget deficit for the financial year has now reached £42.8bn, around £5bn more than the same period in 2024.

Spending also increased, she noted, with additional cash required to cover public-sector pay rises, inflation-linked benefit increases and “all that extra investment the government is ultimately hoping will power growth”.

Throw higher borrowing costs into the picture and “it’s clear the UK is still stuck in the cycle of spending more than it brings in”.

Source: Office for National Statistics.

This leaves big questions about the choices the chancellor Rachel Reeves will have to make in the future, according to Lindsay James, investment strategist at Quilter. With debt interest “at massive levels”, additional borrowing will be difficult, and unless the fiscal rules are changed, tax rises will be “inevitable”.

“Today’s figures show that the government is going to be forced to become more creative in its tax gathering methods if it doesn't want to break its manifesto promise of no tax rises on working people or breach the fiscal rules,” she said.

“While this situation goes on, economic growth will prove elusive, and this doom loop will become nigh on impossible to get out of.”