Ditching UK active funds for passive exposure is a mistake, according to several experts, even despite the poor performance of active funds this year.

In 2025, just 14% to 24% of active funds have beaten the benchmark in each of the main Investment Association (IA) equity sectors (IA UK All Companies, IA UK Equity Income and IA UK Smaller Companies), according to recent Trustnet research.

This comes at a time when the UK market has been thriving, benefiting from investors searching for diversification away from the US, and may leave some wondering if they can get all they need from the UK with a low-cost passive, rather than relying on an active fund that may not deliver.

Dan Coatsworth, investment analyst at AJ Bell, said: “Too many active funds have drifted along, failing to add value for investors. This situation is unsustainable.”

Below, Trustnet asks experts if investors still need an active UK equity fund in a period where tracking the market has done so well.

Performance

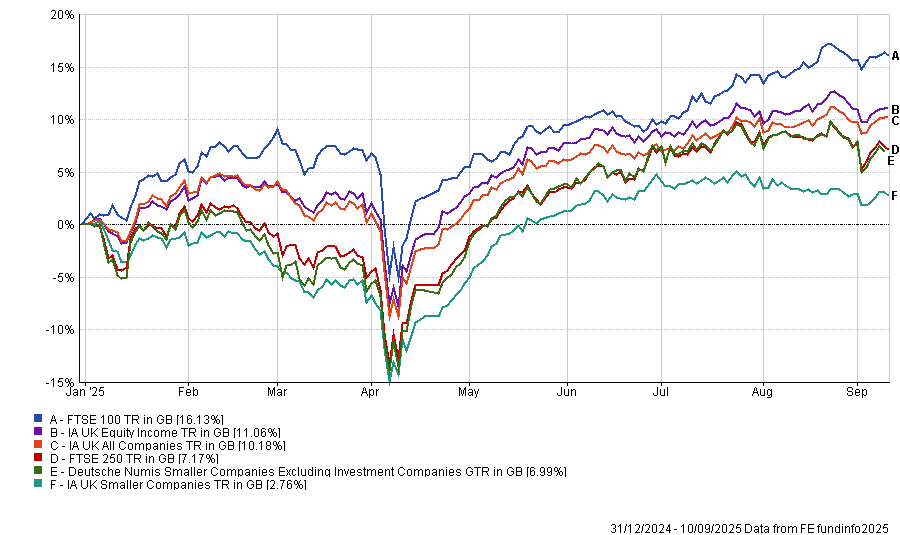

Chris Rush, investment manager at IBOSS, agreed that active funds have struggled to make their mark, in part due to the extraordinary performance of the FTSE 100.

The blue-chip index has surged this year, ranking in the top decile against the various UK IA Sectors, he explained. Meanwhile, there has been a large variance in active fund performance, with the best UK strategy up by almost 25%, while the worst has slid 7%.

“This means it has been very possible to get the asset allocation call right this year (i.e. buy the UK) and still underperform considerably due to poor fund selection,” Rush explained.

Performance of UK indices and sectors YTD

Source: FE Analytics

Despite this backdrop, the IBOSS team maintained a bias towards active funds for their UK exposure.

There are still some “very impressive” fund managers who have benefited from being flexible this year, instead of sticking rigidly to something that was not working.

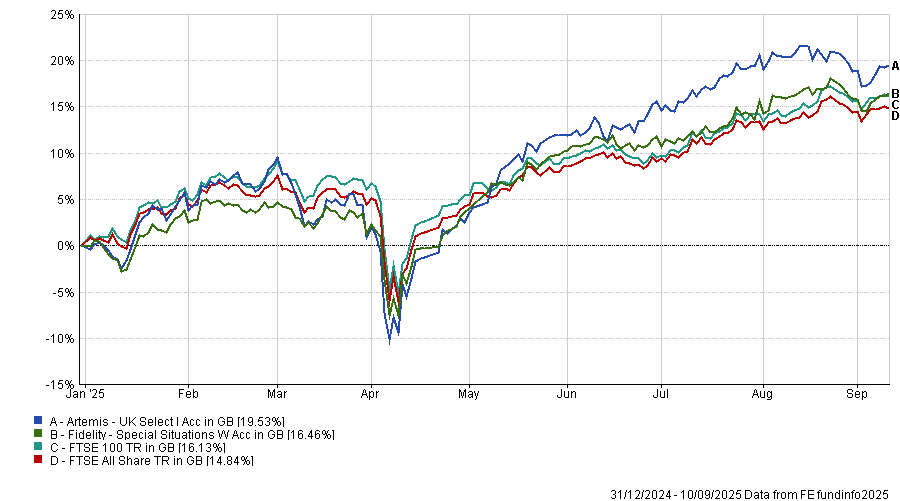

For example, he pointed to Artemis UK Select and Fidelity Special Situations, which have both smashed the FTSE All-Share, while also beating the FTSE 100. Outperforming funds are difficult to find, but certainly not impossible, he explained.

Performance of funds vs indices YTD

Source: FE Analytics

AJ Bell’s Coatsworth agreed: “There are some smart fund managers in the industry and their skills, together with technological advancements in stock research, suggest that active management still has a future. The strong could get stronger, but the weak could fade away.”

A truly great active fund, he continued, is one that has proven to be a consistent outperformer, rather than posting an occasionally exceptional return.

For a good example, he pointed to Artemis SmartGARP UK Equity, which has posted top-quartile returns over the past one, three and five years in the IA UK All Companies peer group.

Rob Burgemann, wealth manager at RBC Brewin Dolphin, added that, when buying an active fund, investors need to understand that “active managers offer the potential – if not always the reality of outperformance”. If they are comfortable with this, active funds can remain a good choice for many investors.

Diversification

Equally, experts noted that passives were not flawless products when it comes to investing in the UK market.

First and foremost, they are generally highly concentrated, Rush explained. When buying passively, investors tend to favour a market-cap-weighted index, giving more exposure to the blue-chip FTSE 100 at the expense of smaller stocks, he explained.

Yet minnow stocks are incredibly cheap versus their history, which has led active managers favouring them. As a result, active funds can look significantly different to the average tracker, as managers target stocks they think have exciting growth potential, he explained.

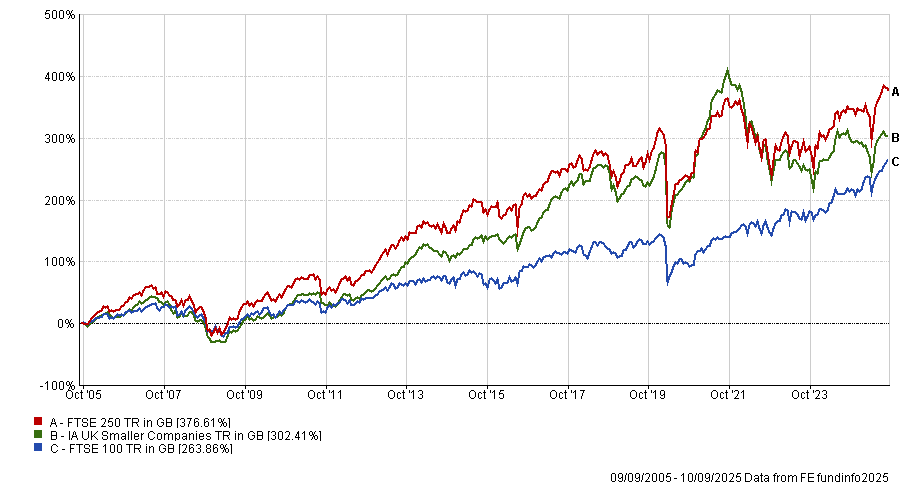

This approach has paid off over the very long term, Rush said, with both the FTSE 250 and IA Smaller Companies peer group beating the FTSE 100 over the past 20 years, even after major falls such as following the Liz Truss mini-Budget.

Performance of UK indices over 20 years

Source: FE Analytics

Brewin’s Burgeman added that, while passives are very good at tracking the large caps that dominate the index, their record tracking small and mid-caps is “far more variable”.

This allows active managers to “add some real value” by giving more exposure to opportunities further down the market that may not be as prominent in a tracker.

Additionally, active funds can come in “all different shapes and sizes”. Investors could choose a thematic fund, a certain style, or a strategy focused on a specific sector, allowing investors to add “a spin to their portfolio” that reflects the market environment and their views, he said.

“A mixture of passives and actives offers – to us – the best way of capturing returns from the UK market," Burgeman concluded.