North America funds have taken investors on a volatile ride this year, as tariffs, questions over central bank independence and a weaker dollar have all given investors cause for concern.

Many have grown weary of the US and for most of 2025, investors have preferred looking elsewhere, with the idea that “US exceptionalism is over”. This week, however, a prospective rate cut by the Federal Reserve is keeping spirits elevated.

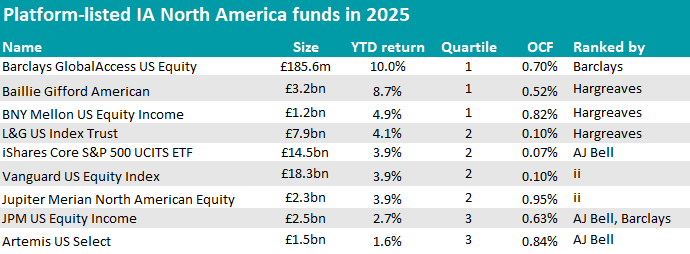

This level of unpredictability made choosing funds in the IA North America sector particularly tricky, but Hargreaves Lansdown analysts got it right more than other platforms so far this year.

Across the five main UK platforms who produce best-buy lists (Hargreaves Lansdown, Fidelity, AJ Bell, interactive investor and Barclays), Hargreaves stood out for recommending two out of the three first-quartile recommended funds over the year to date.

Best-buy lists are built with portfolio construction in mind, so not all funds are meant to outperform in any given year and at the same time. However, strong showings can highlight where platforms’ fund-picking teams have successfully identified managers able to navigate the sector’s most recent challenges.

Source: Trustnet

There were nine US funds recommended across all platforms, three of which achieved a first-quartile performance over the year to date. The two highlighted by Hargreaves are Baillie Gifford American and BNY Mellon US Equity Income, with an 8.7% and 4.9% return, respectively.

The former was selected as a large-cap fund that “could work well in a portfolio with little exposure to the US, invested for long-term growth” or, that would “sit well alongside a US equity fund focused on medium-sized or higher-risk smaller-sized companies, or a US fund with a value bias”.

Some of Baillie Gifford’s most recognisable names run the fund, including FE fundinfo Alpha Manager Tom Slater, Gary Robinson and Kirsty Gibson, who maintain a relatively concentrated portfolio of between 30 and 50 stocks.

“The share prices of well-known US companies can react very quickly to new information. This makes it difficult to consistently perform better than the broader market over the long term, but we think the Baillie Gifford American team are well equipped to do so,” said Hargreaves analysts.

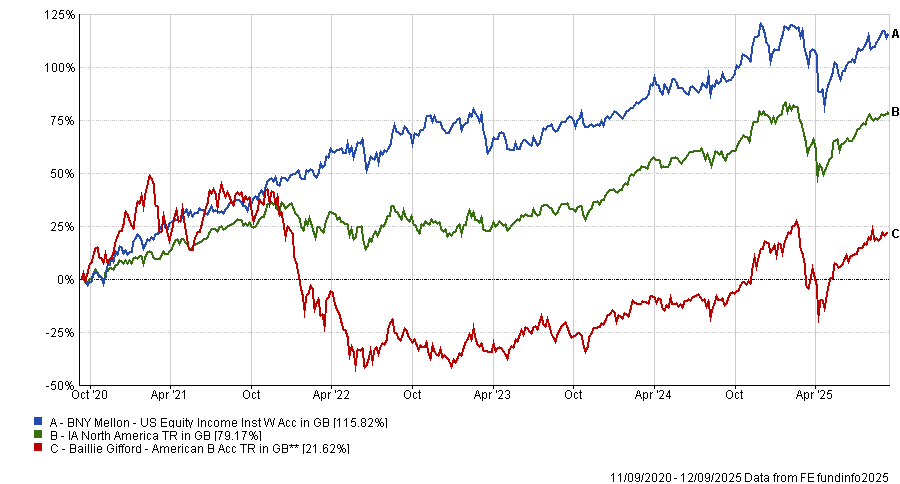

In recent years, the fund has struggled following a weaker backdrop for growth-style investments, but it has been on a recovery trajectory this year, as the chart below shows.

For an income pick, Hargreaves turned to BNY Mellon US Equity Income, managed by John Bailer, which aims to maximise total returns by growing both the income it pays to investors and the capital value. It can invest across the US market but tends to be invested in large companies.

Hargreaves analysts said it is a good way to add US exposure to a global portfolio; alternatively, it could sit alongside other US funds focused on more growth-style companies.

They also highlighted John Bailer’s “established, clear and effective” investment process as well as the fund’s strong performance, particularly when its value-style of investing has been in favour, as has been the case in recent years.

Performance of funds against sector over 5yrs

Source: FE Analytics

The final first-quartile fund in 2025 so far is Barclays Global Access US Equity, a multi-manager option backed by independent Barclays analysts. Its 10% return in 2025 is the highest across the nine funds on the list.

It invests in funds run by US companies AllianceBernstein, Ceredex and T Rowe Price, with each of the three contributing a particular style to the mix.

“By investing in three very different managers together, the aim is to deliver more consistent performance, as when one underperforms, we hope that the other managers have the potential to deliver,” Barclays analysts said.

“This variety of skills and expertise is packaged together in a single product, making the Global Access US Equity fund an easy way to access a diversified investment in the US stock market.”

In the second quartile for performance, Jupiter Merian North American Equity sits alone with a number of passive and index-tracking funds, while JPM US Equity Income and Artemis US Select, both recommended by AJ Bell, sit in the third quartile so far this year.

This article concluded our review of the year-to-date performance of funds currently backed by the main UK investment platforms. In the series, we covered Europe, global equity, UK All Companies, UK equity income and multi-asset funds.