The continued evolution of artificial intelligence-driven (AI) technological innovation is likely to be slowed by mounting policy and geopolitical uncertainty, Robeco’s investment solutions team has warned.

A report outlining their latest expected returns for 2026-2030 penned by Laurens Swinkels and Peter van der Welle, noted that AI systems are expected to continue to evolve rapidly, yet their “transformative impact” will be constrained by a tense and restrained geopolitical environment, growing doubts about US leadership due to inconsistent policies, sustained high levels of inflation in developed countries and continued scrutiny on climate goals, with funding for green initiatives increasingly dependent on proven impact rather than ideals.

Swinkels, head of solutions research, said: “Investors must look beyond traditional assets and embrace unloved hedges like commodities and real estate investment trusts to navigate the comings years. Diversification and strategic hedging will be key.”

The Robeco team has outlined three possible macroeconomic trajectories for the continued evolution of AI.

The stale renaissance

This base case has a 50% probability, according to the report. In this central scenario, the US economy would slow down due to inconsistent policies, such as limiting immigration, rising populism and wielding tariffs aggressively.

As such, the US would become less attractive on the global stage, meaning more moderate global growth at 2.1% real GDP per year.

In comparison, other regions such as Japan, the eurozone and emerging markets would improve their relative growth positions, with developed markets also better managing inflation at 2.5% compared to the US at 2.75%.

The luminous renaissance

Van der Welle and Swinkels gave the bull case scenario a 15% probability. Along this path, AI adoption would accelerate across industries globally, allowing for a strong and coordinated economic upswing and removing barriers to productivity.

Real GDP growth would exceed trend levels, with broad-based investment opportunities emerging. In addition, inflation would remain at target levels and geopolitical tensions would ease, potentially reviving globalisation.

The exorbitant decay

With a 35% probability, the bear case scenario envisions a reality where the global economic system deteriorates due to US policy missteps.

Central bank independence would erode, due to trade wars and geopolitical instability, and the dollar’s dominance would be undermined, triggering stagflation and fiscal dominance.

What does this mean for expected returns?

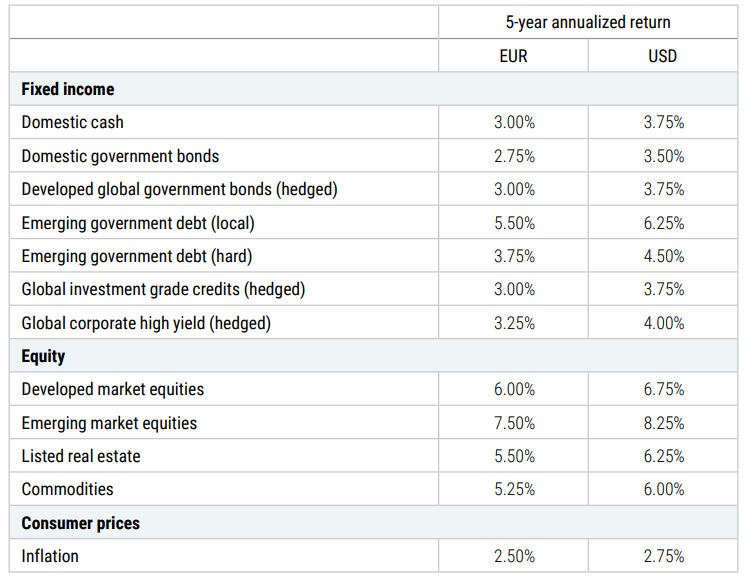

With Robeco’s investment solutions team placing more likelihood on the base case scenario becoming reality, the report also considered what this could imply for expected returns from 2026 to 2030.

Source: Robeco, September 2025

Multi-asset solutions strategist Van der Welle said: “While AI promises a renaissance in productivity, we believe this revival will appear stale upon closer inspection.

“Structural inhibitors – from constrained monetary policy to geopolitical restraint – will limit the breadth of economic gains.”

The report further noted that valuation levels for some asset classes – most notably US equities and risky fixed income – looked stretched and more reflective of the outlined bull case.

This would suggest elevated downside risk in these asset classes in the coming years, they said, which makes “unloved hedges more appealing like commodities and Reits [Real estate investment trusts]”.

The investment solutions team also introduced emerging market debt in hard currency into its projections this year, noting that it expects to see strong relative returns for emerging market assets over the next five years.

“We have to navigate a world where fewer risky asset classes are expected to earn above historical average risk premiums,” they said.

“The good news for investors is that in a world where paradox abounds, great inventions and progress will be made.”