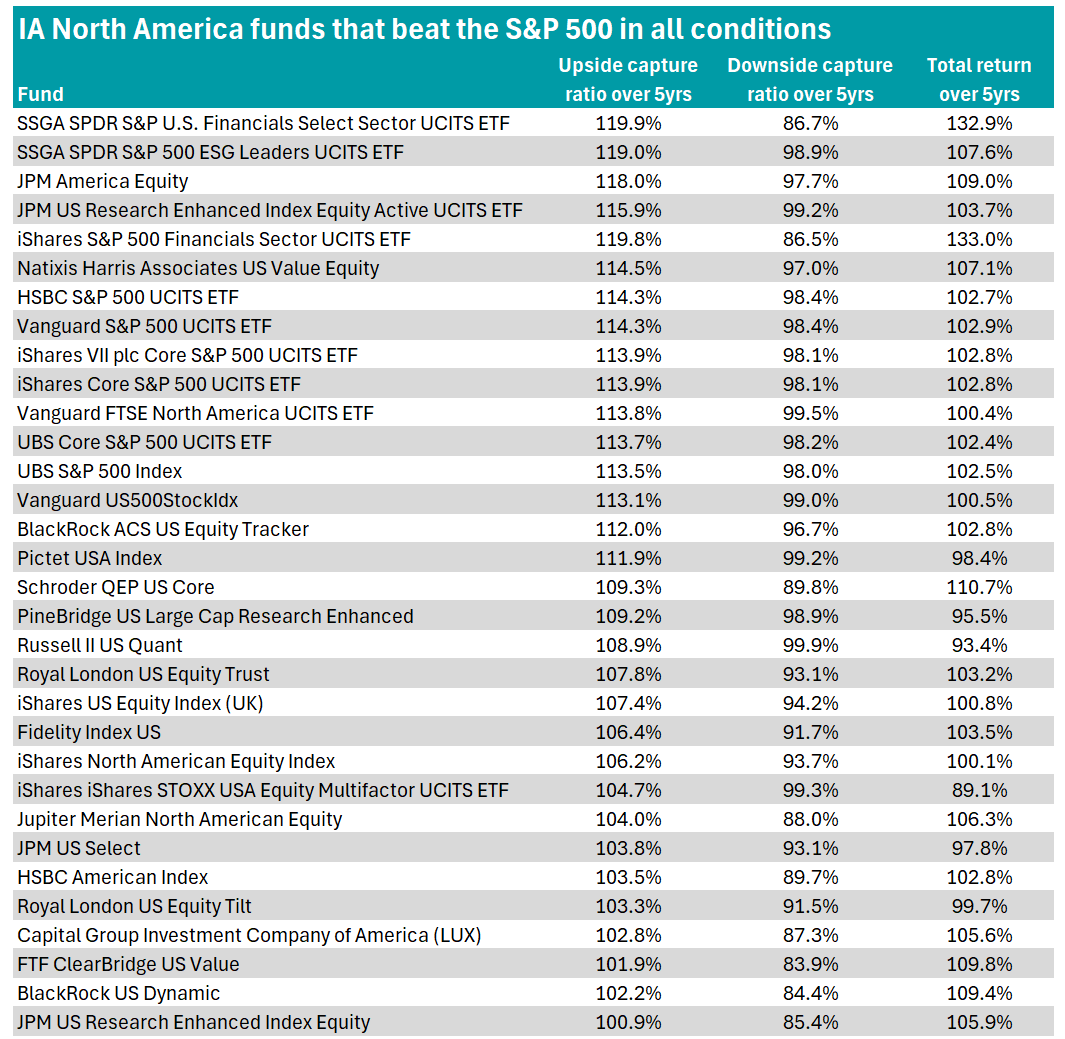

US equities have long been a cornerstone of global portfolios but not all IA North America funds have weathered market swings equally. In fact, just over 12% of funds in the sector managed strong returns when the S&P 500 index rose and stayed resilient when it fell.

Trustnet used the upside capture ratio to identify funds that have made the most money during rising markets and the downside capture ratio for those that did well when markets fell.

An upside capture score of greater than 100% means a fund made more than the market when it was rising, whereas a downside capture score of less than 100% means a fund lost less money than the market when it was falling. Both scores have been calculated against the S&P 500 index.

Of the 262 assessed funds, 32 capitalised on the good times and protected when markets fell.

SSGA SPDR S&P U.S. Financials Select Sector UCITS ETF topped the table with an upside score of 119.9%, while JPM US Research Enhanced Index Equity delivered the strongest downside score of 85.4%.

Source: FE Analytics

However, of these funds, only one in the sector achieved a first-quartile performance across upside capture, downside capture and total return over five years: the iShares S&P 500 Financials Sector UCITS ETF.

It had an upside capture ratio of 119.8%, downside capture ratio of 86.5% and a five-year return of 133%.

This $2.5bn exchange-traded fund (ETF) tracks the S&P 500 Capped 35/20 Financials Index, which comprises US financial sector companies – primarily diversified banks and payment processors.

Top 10 holdings include Berkshire Hathaway, JPMorgan Chase and Visa. Such companies benefited from the US economy’s rebound following the pandemic-induced recession in 2020 amid rising consumer spending, lending and investment activity. Banks, in particular, were boosted when the US Federal Reserve aggressively hiked interest rates in 2022 to combat inflation.

Meanwhile, payment and fintech firms, such as Visa, have seen strong growth due to a surge in digital payments, e-commerce expansion and the global shift to cashless transactions.

At a higher level, the S&P 500 Financials index also outperformed the S&P 500 over five years, gaining 129.6% in dollar terms compared to 101.2%.

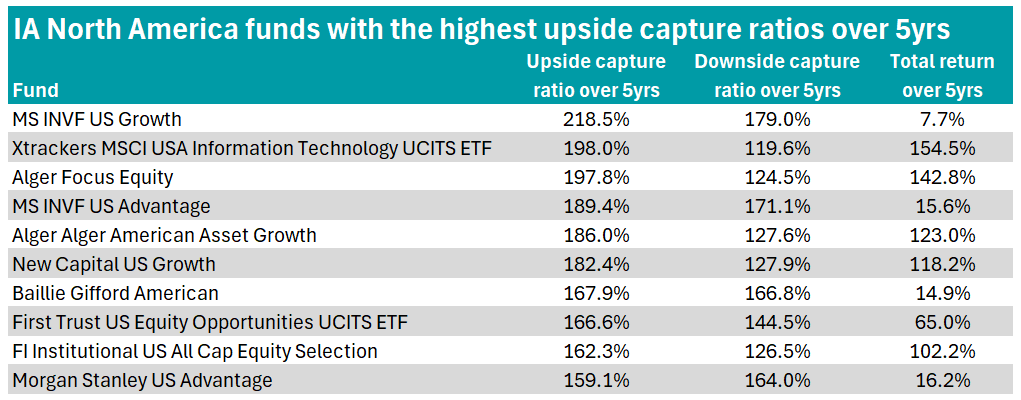

Turning to those that delivered when markets were rising, it will be unsurprising to many to learn that funds turbocharged by their exposures to large tech firms rocketed to the top of the table.

Source: FE Analytics

MS INVF US Growth had the strongest upside capture ratio over five years at 218.5%, meaning the $3.7bn Morgan Stanley fund made more than double the returns of the S&P 500 index during the good times.

Managed by a team headed by Dennis Lynch, it seeks long-term capital appreciation over five years and deploys a bottom-up stock selection process.

Although it is a growth and momentum-driven fund, MS INVF US Growth largely stays away from the Magnificent Seven stocks (apart from Tesla), despite their impressive rates of growth.

Instead, top holdings include content delivery and network services provider Cloudflare, fintech company Affirm and video game developer Roblox. The share price of each is up 99.7%, 24.9% and 135.8% respectively year-to-date.

Despite its strong performance during the good times, the fund had a downside capture ratio of 179% and returned just 7.7% over the half-decade.

Xtrackers MSCI USA Information Technology UCITS ETF came in second with an upside capture ratio of 198% and five-year return of 154.5%. Of the 10 funds, it also offered investors the best score on the downside, at 119.6%.

The $1.8bn ETF tracks MSCI USA Information Technology 20-35 Custom Index, which covers 85% of the information technology sector.

The ETF has likely benefited from its 23.1% weighting to artificial intelligence (AI) and semiconductor leader Nvidia, which has seen a huge growth spurt and added some $3trn to its market capitalisation since 2023, alongside Apple (18.3%), Microsoft (17.8%) and Broadcom (7.2%).

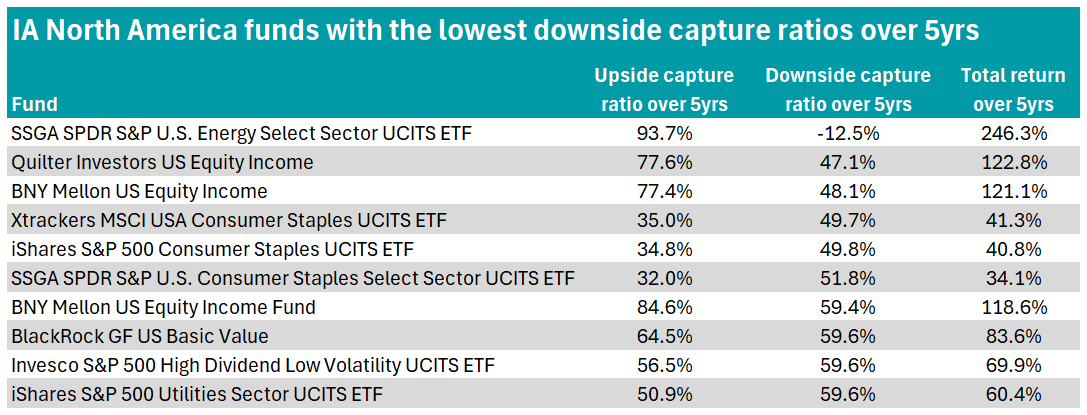

However, when looking at the sector preferences of funds offering the best protection when markets fell, energy stocks proved resilient, with SSGA SPDR S&P U.S. Energy Select UCITS ETF topping the table.

Source: FE Analytics

The $608.5m ETF offered by State Street Global Advisers tracks the S&P Energy Select Sector Daily Capped 35/20 index, with top holdings including ExxonMobil, Chevron and ConocoPhillips.

However, due to this high concentration in energy stocks, the fund is more sensitive to oil price fluctuations, geopolitical events and regulatory chances.

Perhaps reflecting the recent surge in performance from more tech-laden growth funds, the ETF has underperformed the IA North America sector over one and three years, gaining 5.6% and 14.3% versus 13.5% and 48.1%.

For the upside capture ratio, it was more than six percentage points short of the S&P 500 with a score of 93.7% but made a total return 246.3% over the five years.

Two income-focused funds rounded out the top three for best downside capture ratio scores. The £716.3m Quilter Investors US Equity Income managed a downside capture ratio of 47.1%.

It targets outperformance of the MSCI North America Value Index over rolling five-year periods, with a strong overweight positioning in financials, healthcare and industrials, which are traditionally resilient income-generating sectors.

The fund is also underweight technology, which perhaps speaks to Quilter Investors US Equity Income’s weaker upside capture ratio of 77.6%. Nonetheless, it gained 122.8% over the five-year period.

Meanwhile, BNY Mellon US Equity Income is managed by John Bailer and targets income and capital growth over five years or more with a yield of at least 50% in excess of the S&P 500.

RSMR analysts said they rate the fund due to its different composition to the index, consistent style, dividend growth and the fact it is “not focused on bond proxies to achieve [its] yield target”.

Although the fund is benchmarked against the S&P 500, the investment universe of the fund is the Russell 1000 index and it seeks to outperform the Russell 1000 Value index over a full market cycle.

The fund delivers a similar performance to Quilter Investors US Equity Income with a downside capture ratio of 48.1%, upside capture ratio of 77.4% and five-year return of 121.1%.