IA UK Smaller Companies funds have been the worst place for equity investors to allocate their precious capital over the past decade, according to data from FE Analytics.

The peer group is up 74% over 10 years, some 10 percentage points behind the IA UK All Companies and IA UK Equity Income sectors, the second and third-worst equity fund sectors in the Investment Association universe.

Despite this, Artemis fund manager Mark Niznik has invested all of his pension in the beleaguered asset class.

The manager of the Artemis UK Smaller Companies fund and Artemis UK Future Leaders trust said “people think I’m nuts” when he tells them his entire retirement fund is wrapped up in small-caps, but added “I’ve done this because I think I’m going to make lots of money”.

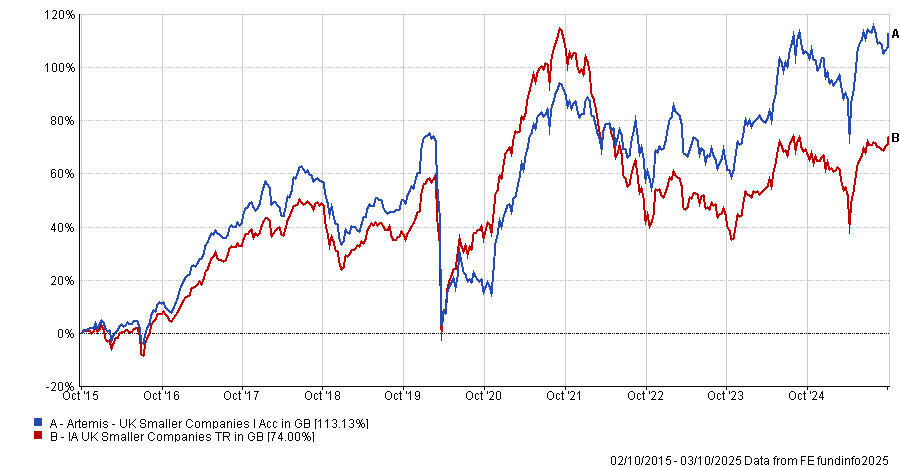

Performance of fund vs sector over 10yrs

Source: FE Analytics

Next year marks 10 years since the Brexit referendum, a decade in which political instability and a lack of returns has caused investors to withdraw £6bn in net outflows from the peer group.

But the “malaise” goes even further back to 1997, when pension funds cut their exposure to UK equities from 53% to just 4%, with small-caps “arguably [taking] a disproportional hit”.

However, now this is changing. While the Labour government under Keir Starmer “may not be winning many plaudits”, they have brought stability, he argued.

At the same time, the US political landscape under president Donald Trump has become far less stable. This, coupled with “historically expensive” shares (the average US company trades on a price-to-earnings ratio (P/E) of 22x, far above the 30-year average of 17x.

“I feel this could encourage some investors to shift attention from the US, which in recent years has been like a powerful magnet, drawing money from all quarters of the world. A few scraps from the giant US investor table heading this way could really boost UK smaller companies,” said Niznik.

With issues in Europe, including news this week that the latest French prime minister has already resigned after less than a month and the ongoing war in Ukraine, it means some could look to the UK as a home for their cash.

There are signs things are already changing, he said. For example, 21 holdings in the Artemis UK Smaller Companies fund bought back more than 0.5% of their shares in the first half of this year.

“I’ve not seen anything like it in more than 30 years of investing in this area,” said Niznik.

Meanwhile, in the past six-and-a-half years there have been 35 takeovers for the fund’s companies at an average 48% premium to the share price.

So what should investors look for?

Niznik has put all of his money into his own funds, with “a large part” in the Artemis UK Future Leaders trust that he took over last year alongside Will Tamworth.

But whether investors choose his funds or not, there are lessons he thinks all should learn when investing in small-caps. First is to favour companies with no debt. Second is to buy companies that are growing at a sustainable rate and are leaders in their niche categories.

“Finally, pick companies that are making money – not ones borrowing like crazy to develop their technology and build a customer base,” he said. While this may be “boring”, he said this “fits my pension perfectly”.

Niznik highlighted three stocks that fit this rationale. First is Mony Group, which owns online comparison site Moneysupermarket.

“Its rewards programme, SuperSaveClub, goes further in helping to convert a one-off transaction into a recurring revenue stream and therefore reduce the business’s reliance on Google or television advertising, we believe,” he said.

It trades on a P/E of 11x and the shares deliver a 9% free cashflow yield.

Next up is Mears Group, which maintains houses owned by local councils and housing associations under long-term contracts, where the money is ring-fenced to provide the service.

Shares are on a P/E of 9x, and the company has a 11% free cashflow yield, while it also has 15% of its market value in cash.

Lastly, online greetings card company Moonpig “dominates” its market with a 70% share, said Niznik, who noted that the data it collects is “immensely valuable”.

“Knowing who a card is bought for and why it was sent helps convert a one-off purchase into a repeat purchase,” he said, adding that its Moonpig Plus subscription business is moving towards almost 1 million customers, adding to the 100 million customer reminders that are sent out through its system each year.

Shares are on a P/E of 13x and the company has a 9% free cashflow yield.

“I’m not recommending this strategy to anyone else, but I am suggesting it’s time investors reconsidered this unloved area of the market,” Niznik concluded.