Nick Train is one of the most well-known equity managers in the UK market, responsible for funds and trusts with more than £6bn in assets under management. But his core process across his fund range is based on three simple principles.

The first is patience, inspired by fund management superstars such as Warren Buffett and Peter Lynch, with Train noting that some of the best-performing stocks in his Finsbury Growth and Income portfolio took the longest to pay off.

Although this comes with the temptation to sell, particularly when periods of underperformance can “test his patience”, Train said he remembers the words of Buffett, who said the market is a “mechanism to transfer wealth from the impatient to the patient”, adding: “We’ve always wanted to be on the right side of that trade.”

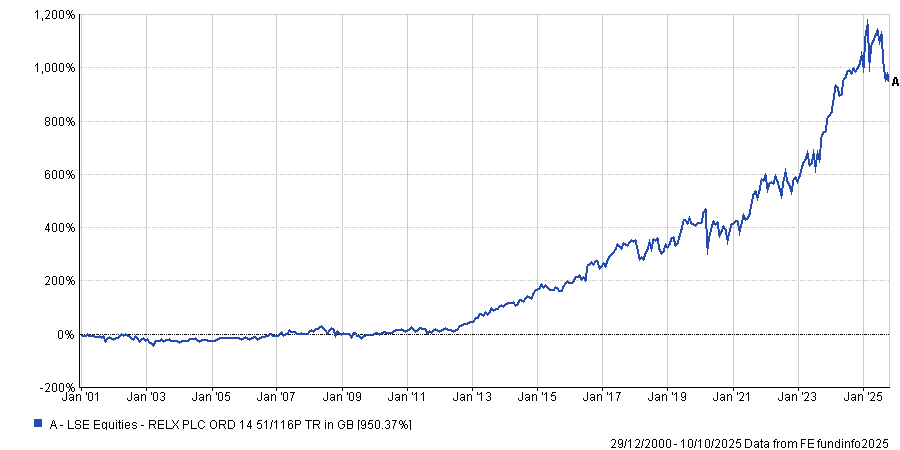

One example of this is data analytics company RELX, which was up just 20% in the first 10 years the manager owned it. “Even I got a bit twitchy during this period,” Train said.

However, his confidence was rewarded in 2012, when the chief executive officer, Erik Engstrom, transformed RELX into a “digital analytics company of some significance”. Ever since, shares have surged, returning more than 900% over the past 25 years.

Total return of RELX Group since 2000

Source: FE Analytics

Train’s second core principle is to fill his portfolio with “semi-eternal” stocks. These can be “very rare” but are worth seeking out because they have the potential to remain relevant for decades, which is useful for long-term investors.

“At least part of your portfolio should be populated by these enduring assets,” said Train. While they may not always perform over shorter time frames, “I promise you, there are times when that enduring value will protect your wealth,” Train continued.

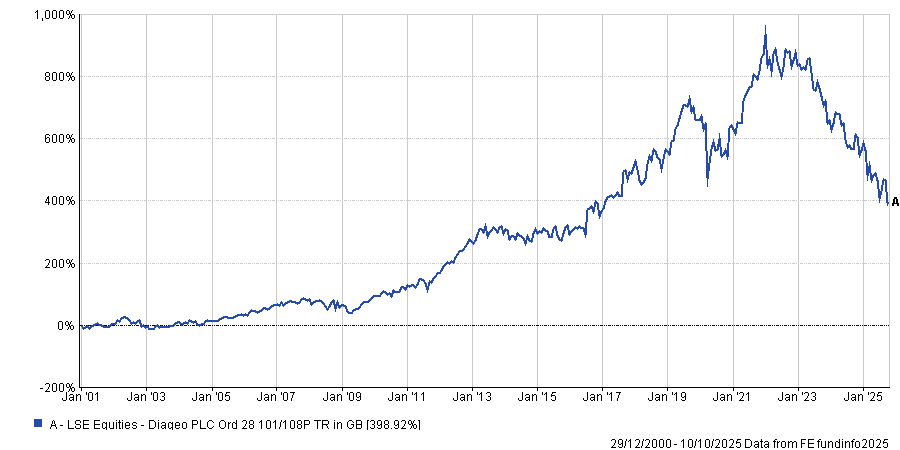

Train pointed to Guinness owner Diageo as a good example of this. Since 2000, shares have risen from £4.98 to around £17 – more than tripling investors money over 25 years.

However, the stock has been an “absolutely wretched share” in recent years, said Train, who noted that the price has more than halved from its peak of £40 and could have left some investors feeling “pretty miserable”.

Despite this more recent setback, the manager noted that it has been difficult to find investments that have tripled investors’ money over the past 25 years, so it remains a top holding regardless of more recent struggles.

Total return of Diageo since 2000

Source: FE Analytics

Part of the stock’s appeal is the “incredible” assets, such as Guinness and Johnnie Walker, which he said are likely to still be enjoyed in 20 years, “perhaps in higher volumes than they are now”, although he caveated that “nothing is certain in business or market life”.

Train’s third key investment principle is to “direct [his] feet to the sunny side of the street”. In other words, be optimistic. While this has been tough in recent years as the UK market has struggled, he said the way to win in the equity market has historically been to be optimistic, despite the notion sounding “absurd”.

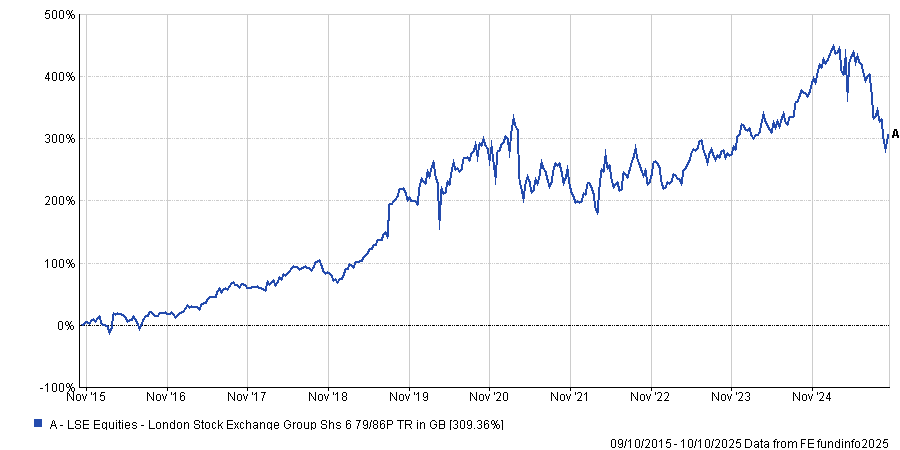

His way of demonstrating this is to invest in UK growth stocks that have previously made strong returns, such as financial data company London Stock Exchange Group.

The stock has generated a 300% total return over the past decade and as a natural optimist, Train believes there is plenty of reason for it to do so again.

Total return of the London Stock Exchange Group over 10yrs

Source: FE Analytics

The group owns several cash-generative businesses with high profitability. Indeed, while there are 14 larger UK companies by market capitalisation, only one (British American Tobacco), is more profitable than LSEG.

Train noted there are very few companies that offer double-digit earnings growth and profit margins – something the firm offers.

Paired with its artificial intelligence data parentship with Microsoft, it also has future growth potential and can continue to “delight its customers”, he said.