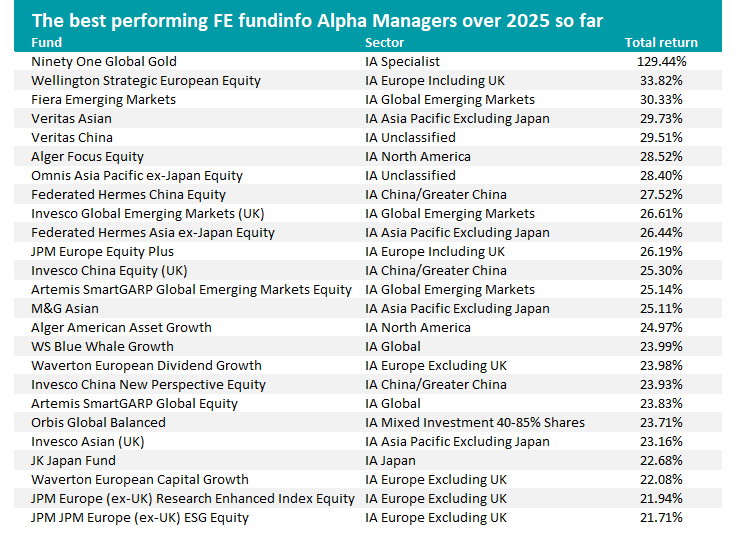

Funds run by FE fundinfo Alpha Managers at Ninety One, Wellington and Artemis are among those making the highest returns in 2025’s challenging markets, according to FE Analytics.

The FE fundinfo Alpha Manager rating, which is designed to identify fund managers who have consistently outperformed over the longer term, is awarded to the top 10% of investors with the strongest risk-adjusted alpha and consistent outperformance of their benchmark.

With the final quarter of the year upon markets, Trustnet has looked at all 356 funds in the Investment Association universe that have an Alpha Manager working on them to discover which have made the highest return over 2025 so far.

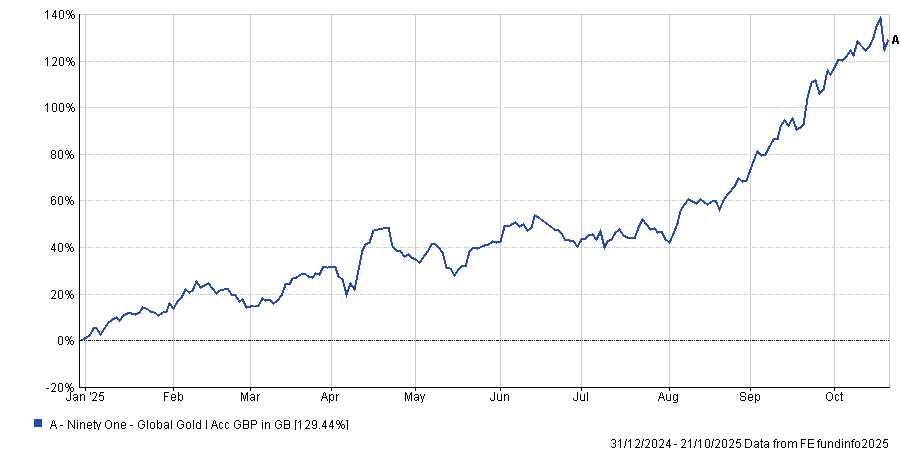

The Alpha Manager at the top of the list is George Cheveley, as his £651m Ninety One Global Gold fund has made a 129.4% total return. This also makes it the second-best fund of the entire Investment Association universe (behind SVS Baker Steel Gold & Precious Metals’ 147.6% return).

Gold has been one of the standout performers of 2025, with the yellow metal surging to record highs on the back of nervous sentiment, central bank buying and retail investors piling into the trade.

This means that the 11 strongest funds this year all invest in precious or strategic metals, although Ninety One Global Gold is the only one with an Alpha Manager at the helm.

Performance of Ninety One Global Gold over 2025

Source: FE Analytics. Total return in sterling between 1 Jan and 21 Oct 2025

Analysts at FE Investments, which has the fund on its Approved List, said: “Due to the preference for equities over gold bullion, the fund typically outperforms the gold price when the precious metal rises, but underperforms when the gold price drops – that is, the fund is more sensitive to the change in the price of gold.

“In the current environment, with heightened geopolitical tensions and central banks providing ample liquidity, precious metals should be supported. On the other hand, a rising interest-rate environment could prove to be a headwind for gold.”

Gold and its miners have performed so strongly in 2025 that it is a big step down to the remaining Alpha Manager funds with the highest returns. Dirk Enderlein is in second place with his Wellington Strategic European Equity, which is up 33.8% this year – almost 100 percentage points behind Ninety One’s gold fund.

Wellington Strategic European Equity is a high-conviction and low-turnover fund that looks for ‘structural winners’, or companies that could grow earnings and cash flow faster than the market average. It is among the top four IA Europe Including UK funds over three, five and 10 years, but is currently soft-closed and therefore not open to new investors.

In a recent update, Enderlein said: “We are monitoring broader inflation trends, longer-term yields, recession risk, the geopolitical situation in Russia, Ukraine and the Middle East, and the evolving European regulatory framework. We continue to think that many stocks in the market are still mis-priced, trading at unsustainable valuations and/or are reflecting unrealistic expectations.

“We think that we are experiencing a market regime shift that has led to increased volatility and dispersion within European equity markets which can create market dislocations and expand the opportunity set for fundamental equity long-only investors that take a long-term view.”

Source: FE Analytics. Total return in sterling between 1 Jan and 21 Oct 2025

Fiera Emerging Markets is in third place, making a 30.3% total return amid a rally in emerging markets. The fund is run by senior portfolio managers Ian Simmons, Dominic Bokor-Ingram and Stefan Bottcher; Bokor-Ingram holds FE fundinfo Alpha Manager status.

The managers look for emerging market stocks with quality characteristics, strong fundamentals, attractive mispricing opportunities and clear catalysts for unlocking value. Around 40% of the portfolio is invested off-benchmark in the hope of finding “the next generation of emerging market winners”.

In a recent update, the managers said: “Despite the rally, emerging markets remain highly dispersed and conducive to active management. There is little consensus across major regions, with distinct macro and structural debates shaping sentiment.

“The strategy remains focused on reform-oriented and innovation-driven markets, where policy normalisation, digital transformation and capital market deepening continue to create long-term opportunities for active investors.”

Other notable FE fundinfo Alpha Managers with funds on the above list include Jonathan Pines. His Federated Hermes Asia ex-Japan Equity fund is up 26.4% while Federated Hermes China Equity (where he is deputy for lead manager Sandy Pei) has gained 27.5%.

Square Mile Investment Consulting & Research described Pines as “an opportunistic investor, looking to invest where there is a valuation discrepancy between the market valuation and the team’s analysis of valuation”.

Raheel Altaf has two funds on the list of top performers run by Alpha Managers: Artemis SmartGARP Global Emerging Markets Equity (up 25.1%) and Artemis SmartGARP Global Equity (up 23.8%).

Artemis’ SmartGARP process – which aims to identify companies that are growing faster than the market but are trading on lower valuations than the market – is having a strong 2025. All four of the funds using this approach are in the first quartile of their respective sector over the year to date.