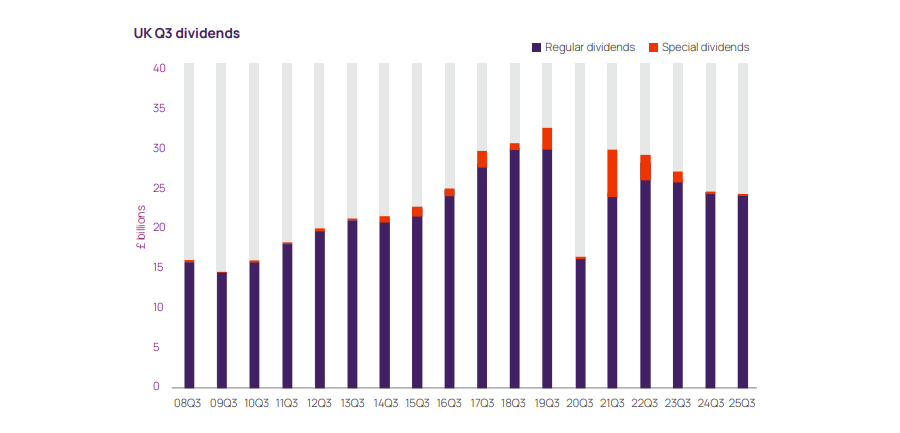

UK companies paid out £24.6bn to shareholders in dividends in the third quarter of 2025, down 1.4% on the same period last year, with analysts at Computershare now expecting income investors to be worse off by the end of 2025 than initially feared.

Much of the fall was due to a handful of names cutting their previous payouts, particularly in the mining sector, where dividends fell by a quarter as profits among the biggest companies came under further pressure, the firm revealed in its Dividend Monitor.

Payouts from the sector are now down £1.2bn compared with 2024, and more than £10bn off their peak in 2022. Anglo American, Rio Tinto and Glencore all cut their dividends due to lower profits driven by falling iron ore prices.

There were also large cuts from giants such as Vodafone and Burberry, which also had a significant impact on the third-quarter numbers, although Rolls-Royce made the largest positive contribution with its first interim payment since before the pandemic.

Other notable positives came from the banking sector, where NatWest raised its dividend by more than half on the back of strong earnings growth, while Lloyds also made a large increase.

Despite this, weaker figures between July and September mean the full-year expectations for total UK dividends of £87.2bn this year are down 2.3% on a headline basis compared to the 1.4% decline estimated three months ago.

Source: Computershare Dividend Monitor

Mark Cleland, Computershare chief executive of issuer services for the UK, Channel Islands, Ireland and Africa, said: “We are seeing some further cuts for the fourth quarter and little prospect of higher payouts from global multinationals like those in the oil sector.

“The combined effect of widely reported falls in business and consumer confidence, sticky inflation and high market interest rates also make for a challenging economic backdrop for domestically-focused companies.”

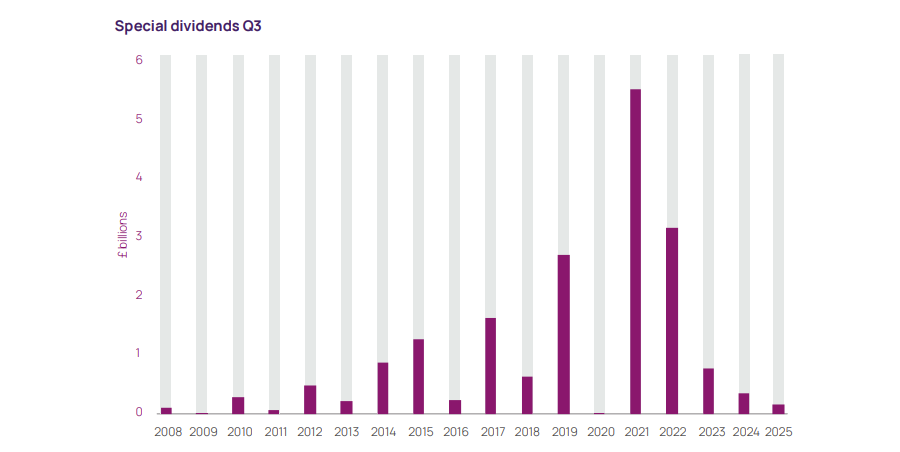

Special dividends have also tanked, falling below £93m. The only other quarters where these one-off payments dropped below this figure came during the pandemic and in the immediate aftermath of the global financial crisis, the firm said.

Source: Computershare Dividend Monitor

It expects special dividends in the final quarter of the year to stand at just £100m, taking the total for 2025 to £2.5bn, less than half the £5.2bn paid out in 2024.

Part of the reason for this is share buybacks, the report noted. While special dividends are one-off payments typically used as a way to return extraordinary or temporary profits to shareholders (such as from selling a portion of the business or other supranormal short-term windfalls), firms are now using this cash to buy their own stock.

Computershare estimated 160 companies currently operate active buyback programmes, including some of the largest dividend payers in the country, such as banking group HSBC and oil titan Shell, which have both bought up around 6% of their respective share registers in the past year.

The latter has now paid twice as much on share buybacks as it has on distributing dividends in the past 12 months, the report said.

Cleland said: “Companies are diverting a lot of cash to share buybacks, and this is a significant factor slowing dividend growth. All this adds up to a projected unusual second consecutive annual decline in dividends for 2025, leaving payouts a long way short of the pre-pandemic highs.”

Currency also had a negative impact in the third quarter, the report found, with the pound weakening slightly. As a result, headline growth was nudged 0.3% lower. If the pound retains its current level versus the dollar (£1-$1.35), this would knock 1.7 percentage points off the growth rate, the report said.