Heptagon Kopernik Global All Cap Equity and Ranmore Global Equity are the best top-performing global funds to diversify from other high returners, according to a Trustnet study.

In this series, we used the FE fundinfo Crown Rating system, compiling funds with the highest score of five, then created a correlation table to see which have performed differently from one another.

A score of 1 shows the funds are perfectly correlated (meaning they move up and down at the same time). Most portfolios in the same asset class have high scores but some stand out.

Having previously looked at the main UK sectors, here we tackle the behemoth IA Global sector, which houses 575 funds, 41 of which have been awarded five crowns.

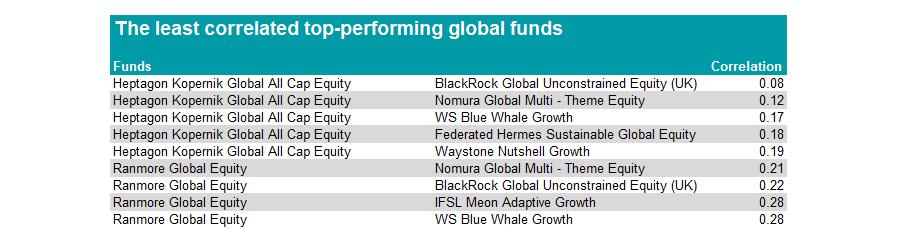

The lowest correlation between top-rated global funds is between Heptagon Kopernik Global All Cap Equity and BlackRock Global Unconstrained Equity, which has an extremely low correlation score of 0.08.

Run by David Iben and Alissa Corcoran, the former fund is the main differentiator here, with correlation scores below 0.2 to four other portfolios: Nomura Global Multi-Theme Equity (0.12), WS Blue Whale Growth (0.17), Federated Hermes Sustainable Global Equity (0.17), and Nutshell Growth (0.18).

It is a value fund, with next to nothing (0.1%) in the high-flying technology sector, giving it a much different profile to its peers.

Two platinum miners – Valterra Platinum (4.1%) and Impala Platinum (3.1%) – are among the fund’s top three holdings, split by South Korean mobile network provider LG Uplus (3.2%).

Overall, the fund is heavily overweight miners and includes old producers Seabridge Gold and NovaGold Resources in its top 10 positions. It also currently holds some 19.7% in cash.

Ernst Knacke, head of research at Shard Capital, highlighted the fund as a unique portfolio doing something genuinely different to its peers earlier this year, noting the asset management firm was a “phenomenal” house for global value.

Source: FE Analytics

The other high-flying fund proven to be a strong diversifier to other diversify other top performers is Ranmore Global Equity. Managed by Sean Peche since 2008, it is another value fund with low exposure to technology (4%). The bulk of the portfolio is invested in consumer discretionary names (33%), while it also holds a higher-than-average cash position of 11%.

Sally Beauty (2.4%) is the top holding in the fund. It is the world’s largest distributor and retailer of professional beauty products with more than 3,000 stores across 10 countries including the US, UK, Germany, Canada and France.

Barbie owner Mattel, Japanese broadcaster TV Asahi and Hong Kong-listed home appliance provider Haier Smart Home (all at 2.3%) are in joint second position.

The fund has captured 99% of the upside of the MSCI World index over the past five years, while delivering just 54% of the downside and stocks in the portfolio have an average price-to-earnings ratio of just 8.7x, more than half of the index’s 20.1x.

Analysts at Fundcalibre added the portfolio to their Elite Ratings list in February, stating it was a “differentiated global value fund” that has delivered strong performance across various market environments.

They said: “In a world where the number of value managers available to investors has started to dwindle, Ranmore stands out like a shining star. Ranmore has delivered excellent returns over a very long time period.

“Performance has been particularly impressive considering its value style and bias in favour of mid-sized and smaller companies, which have generally struggled in recent years. We think this fund is a hidden gem and should be a big consideration for those looking to add in some value exposure to balance out their portfolios.”

Ranmore Global Equity is gaining traction, however, among retail investors and so may not stay hidden for long.

It was the third most-bought fund among interactive investor clients in September and ranked in the top 10 funds bought by Hargreaves Lansdown customers with SIPPs in drawdown in the third quarter of the year.

Both Ranmore Global Equity and Heptagon Kopernik Global All Cap Equity are top-quartile performers over the past three years, with the former up 93.6% while the latter has made 76.2%.

However, despite being value funds, they do not cross over as much as investors might expect. They have a correlation of 0.46 to one another which, while above the numbers listed above, is still low.