Over the past five years, with a global pandemic, rising geopolitical tensions and economic uncertainty, fund managers have faced a true test of skill as they worked to outperform their benchmarks.

While some funds may have benefited from being in the right place at the right time, others delivered consistent outperformance that points to genuine manager skill. So how can investors tell the difference?

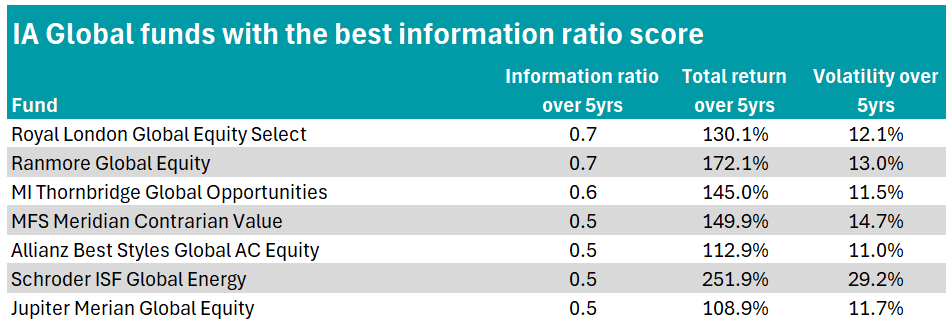

In a new series, Trustnet is looking for funds with the highest information ratio in their sector, starting with IA Global.

The ratio takes the portfolio’s active return (the difference between the portfolio return and the benchmark return) and divides it by the tracking error (the standard deviation of the active return). A score of 0.5 or higher indicates a better risk-adjusted performance.

Although individual funds select their own, to allow for comparison we have selected the most common index for the sector – MSCI World – against which to calculate scores.

Below, are the seven actively managed funds in the sector which managed a score of 0.5 or higher over the assessed five-year period.

Source: FE Analytics

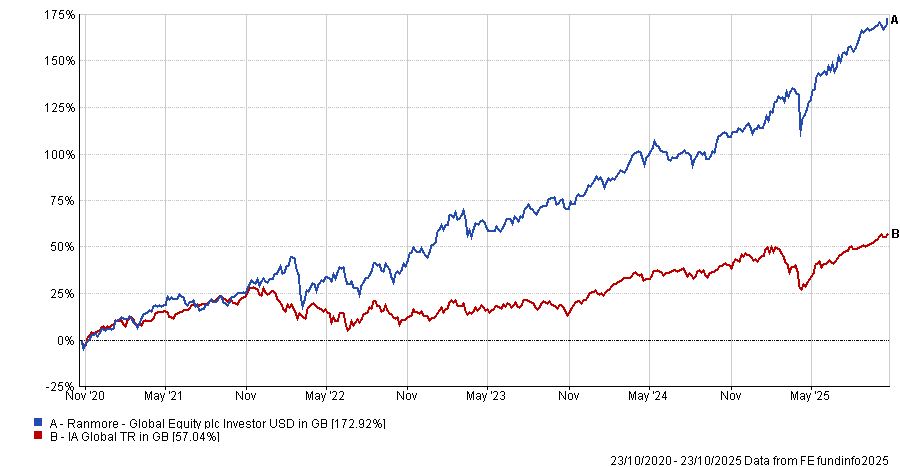

Ranmore Global Equity topped the table with an information ratio score of 0.7 over five years, paired with a total return of 172.1%.

The fund has an FE fundinfo Crown Rating of five out of five and has been managed by Sean Peche since 2008.

In contrast to many other global funds, Ranmore Global Equity maintains a comparatively low allocation to the US equities at just shy of 24%, with a broader sweep across Japanese equities (16.5%), UK equities (13.4%) and money market funds (11.1%).

The top holding is nonetheless an American company, with 2.4% allocated to specialty retailer and distributor of professional beauty supplies Sally Beauty Holdings.

With Peche at the helm, the fund has consistently delivered over the medium to long term, delivering top-quartile returns over one, three, five and 10 years – gaining 273.8% over the decade.

Performance of the fund vs sector over 5yrs

Source: FE Analytics

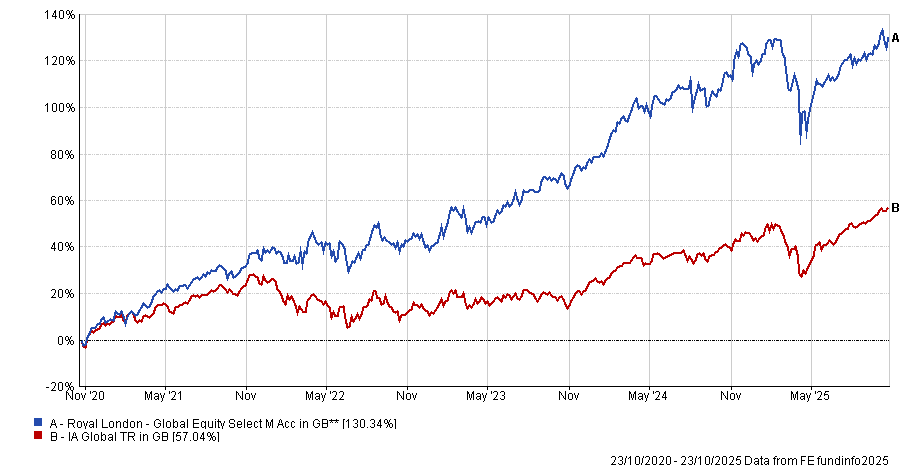

With the joint highest information ratio score of 0.7, Royal London Global Equity Select also managed a total return of 130.1% over five years, with top holdings including notable US mega-cap tech names, such as Amazon, Nvidia and Microsoft.

The popular fund also has top holdings in more defensive financials, such as Visa and Banco Santander.

It is important to note that the portfolio has only been managed by current managers Francois de Bruin and Paul Schofield since late last year, following the departure of former FE fundinfo Alpha Managers Peter Rutter and James Clarke, alongside Will Kenney.

The fund managed top-quartile returns over three and five years but dropped to the third quartile over one year, gaining 7.9%.

Performance of the fund vs sector over 5yrs

Source: FE Analytics

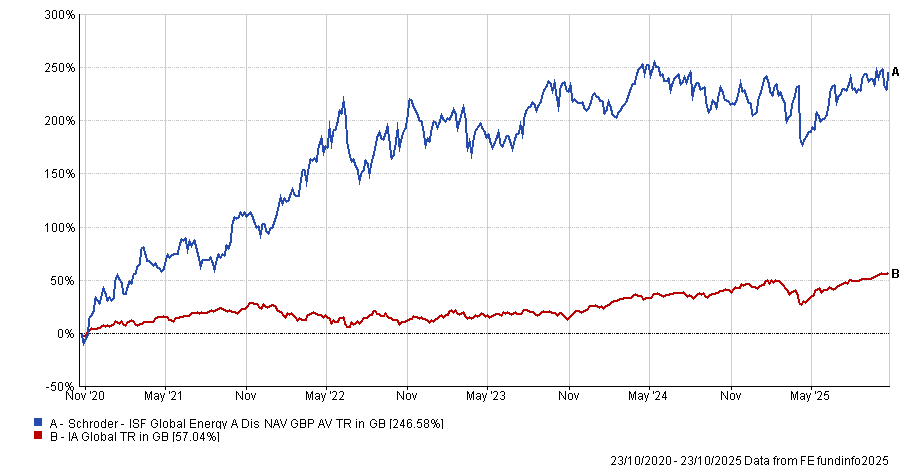

At 251.9%, the best five-year returns in the sector were delivered by Schroder ISF Global Energy, which also managed an information ratio score of 0.5.

However, the road to getting those returns was the most volatile of the seven funds at 29.2%, which can be explained by the fact that the $314.4m thematic fund targets companies in the energy sector, which are sensitive to commodity price changes, geopolitical factors and regulatory and policy shifts.

Mark Lacey has been the lead manager since 2013, with co-managers Alex Monk and Felix Odey joining in 2021. Lacey previously worked as an energy specialist and investor across firms including Goldman Sachs, JPMorgan and Credit Suisse Asset Management.

Performance of the fund vs sector over 5yrs

Source: FE Analytics

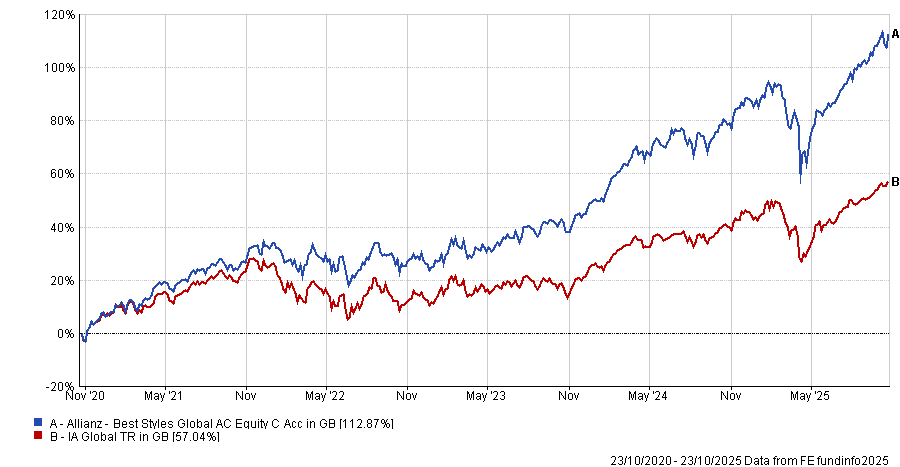

In contrast, Allianz Best Styles Global AC Equity was the least volatile of the seven funds at 11%, with an information ratio score of 0.5 and a five-year gain of 112.9%.

Erik Mulder has been the lead manager of the £224.1m fund since 2017, with Andreas Domke joining the management team in 2022.

Performance of the fund vs sector over 5yrs

Source: FE Analytics

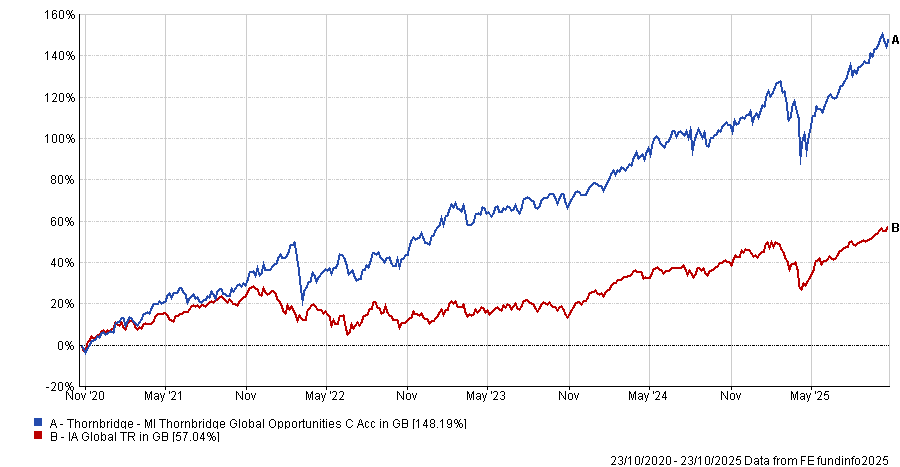

Meanwhile, MI Thornbridge Global Opportunities managed an information ratio score of 0.6. The £395.3m fund has been managed by Robert Oellermann since 2022. Before that, Anthony Eaton had been managing the fund since 2005 – originally under JM Finn before it was sold to Thornbridge.

Top holdings in the fund are a mixed bag of growth and value stocks, including Microsoft, AstraZeneca, Bank of America and Shell.

Despite the change in management, the fund has maintained top-quartile returns over one, three, five and 10 years.

Performance of the fund vs sector over 5yrs

Source: FE Analytics

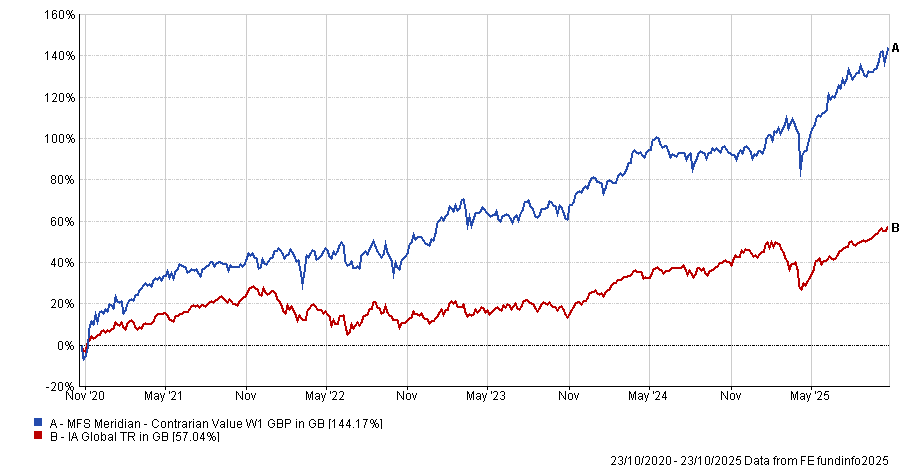

MFS Meridian Contrarian Value, which has been managed by Anne Christine Farstad since 2019 and Zahid Kassam since 2021, also achieved an information ratio score of 0.5.

The $2.8bn global equity fund focuses on contrarian value investing by identifying companies the management team deems to be trading significantly below their intrinsic value due to adverse sentiment, operational challenges or transitional phases.

This includes Italian branded beverage provider Davide Campari-Milano, multinational shipping and delivery company DHL and French tyre manufacturer Compagnie Generale Des Establissements Michelin.

Performance of the fund vs sector over 5yrs

Source: FE Analytics

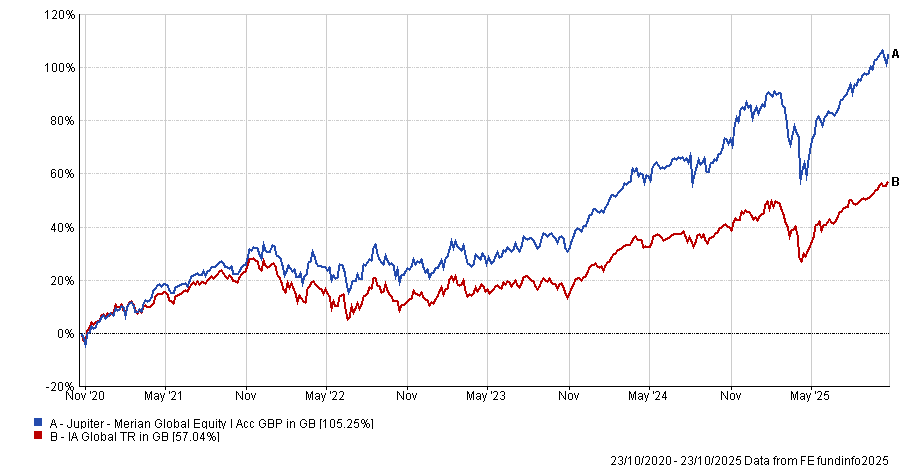

In seventh place was Jupiter Merian Global Equity, with an information ratio score of 0.5, total return of 108.9% over five years and volatility of 11.7%. It has been managed by Alpha Manager Amadeo Alentorn since 2008.

RSMR analysts rate the fund for its diversified approach, well-defined and consistently applied investment process.

“The philosophy of the team is that markets are not efficient and so stock prices often diverge from their fundamental value due to investors’ behavioural biases,” the analysts said.

“The strategy therefore seeks to exploit these inefficiencies through a dynamic model which aims to tilt the portfolio of stocks towards capturing favourable price movements and to build a style agnostic portfolio with sustainable returns.”

Performance of the fund vs sector over 5yrs

Source: FE Analytics