More than half of all savings accounts now beat inflation, according to data from Moneyfactscompare, with some 1,224 savings accounts offering yields above 3.6%.

Overall, there are 101 easy access accounts, 118 notice accounts, 85 variable rate ISAs, 297 fixed rate ISAs and 623 fixed rate bonds that can top the consumer prices index.

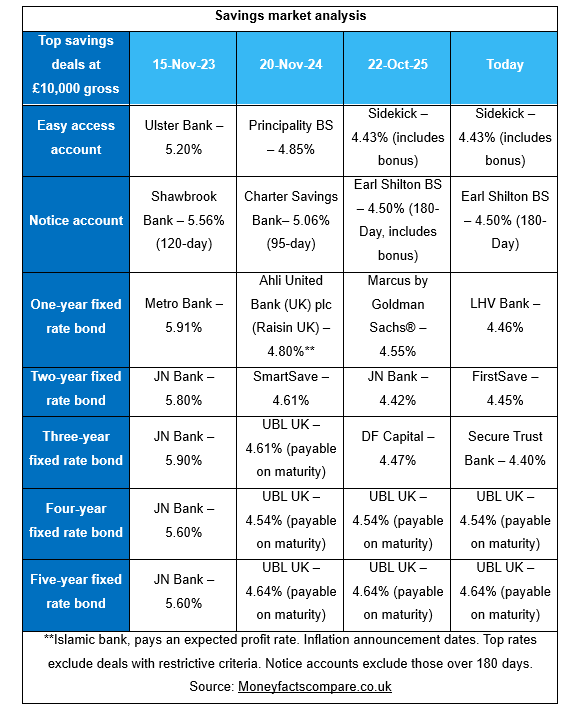

However, not all accounts are created equal. The Moneyfacts Average Savings Rate currently sits at 3.40%, meaning there are still many products that fail to match inflation.

Britons have felt the pinch over the past few years. Since 2022, a basket of goods that cost £1,000 would now be more than £100 more expensive.

Caitlyn Eastell, Spokesperson at Moneyfactscompare, said: “It has been three years since inflation reached its 11.1% peak and, unsurprisingly, there was then not a single savings account that could outpace this.

“Today, just over one in two accounts offer over 3.6% but with interest rates trending downward this number is likely to drop.”

Earlier today, figures released by the Office for National Statistics revealed inflation dropped to 3.6% in October, down from 3.8% in September. This could be enough to encourage the Bank of England to cut interest rates as early as December, according to experts, depending on the outcome of the autumn Budget next week.

As such, Eastell urged savers to shop around to avoid losing money in real terms, as savings rates often follow interest rate decisions quickly.

“If savers find they are getting a raw deal, it is crucial they immediately switch to a more competitive rate and, if they want more security against cuts, they should consider locking away their cash for a fixed period,” she said.

Source: Moneyfactscompare