Investing in the US market through an index tracker has been a no-brainer for at least a decade, but things have changed, with new questions arising.

As leadership has narrowed in the hands of just seven tech giants and valuations have stretched, investors have been wondering how to approach the index sensibly. Should they take profit after years of extraordinary outperformance? Should they buy more to remain on board the artificial intelligence (AI) train? Or does the more balanced exposure of an equally weighted version of the index serve them better?

We asked experts these questions and the answer was almost unanimous.

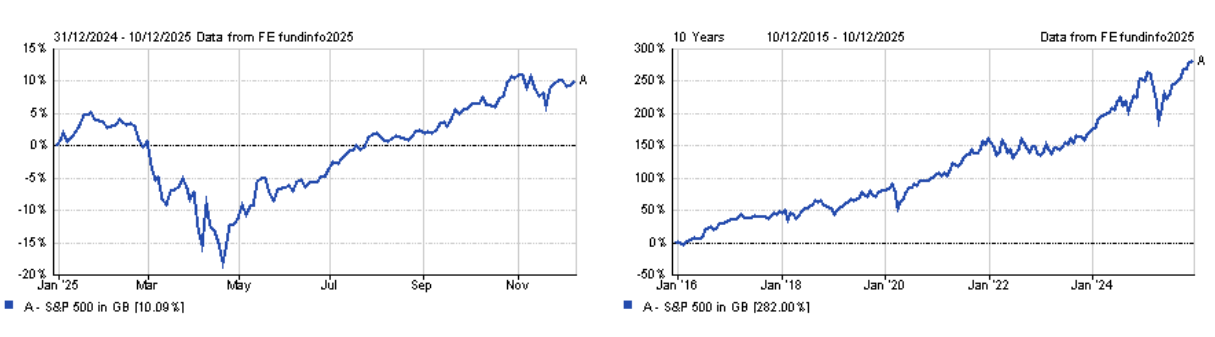

Performance of index over the year to date and 10yrs

Source: FE Analytics

Commentators have been forecasting the demise of the US bull market for a long time, but, as the chart above shows, it keeps powering on, led by continued confidence in the AI story.

The main problem with the S&P 500 is the utter dominance of just a handful of stocks. Does it matter what stock number 100, 200 or 500 does, when the top 10 represent 40% of the index, Fairview Investing director Ben Yearsley asked.

“You have to believe the AI story to be fully confident in continuing to hold a market-cap weighted S&P tracker,” he said.

For this reason, he suggested investors take profits and aim for a 50/50 split between an equal-weighted and market-cap weighted tracker. This way, investors still get access to US tech without it dominating their portfolio (incidentally, this is exactly what Bestinvest’s Jason Hollands told Trustnet he is doing with his portfolio).

Yearsley said: “I'm still a believer in the long term of AI and US tech, however you can't get away from the valuation issue. Outside the Magnificent Seven, valuation are much more normal.

“On the flip side, the talk is being turned into sales and cash flow so analogies with the dotcom boom and bust are wide off the mark.”

Rob Morgan, chief analyst at Charles Stanley, said it’s right to be wary about the concentrated, top-heavy nature of the S&P index and to mitigate that through appropriate position sizing, but it “still merits a place at the core of an equity portfolio”.

“While it is difficult to discern the winners from the losers at an individual stock level, constituents of the S&P will continue to be the titans of tomorrow and it makes sense to maintain exposure,” he said.

As part of a diversified portfolio, a US tracker accompanied by an active value-led fund is therefore “a perfectly reasonable compromise”.

Geographically, investors may wish to underweight the US given where valuations are, but 2025 has in fact been a year of significant ‘catch up’ by other areas such as Asia, Europe and Japan – especially for UK investors given weakness in the dollar.

“This broadening out is healthy and proves the benefits of diversification, and it’s something that could continue for a bit longer,” said Morgan.

“Yet many of the cheap areas are no longer as cheap as they were, which does imply that the opportunity to rebalance away from the US as a tactical move has now largely passed.”

The high cost of US equities by historical standards is something “there’s no getting away from”, according to Darius McDermott, managing director at FundCalibre, although valuation alone isn’t a reason to exit completely.

“I thought the same 12 months ago and since then the S&P 500 has risen another 13%,” he said. While he added that nobody should buy just because the US market has gone up, the US does continue to benefit from world-class innovation, deep capital markets and resilient earnings, so “for anyone with a 10 to 20-year time horizon, completely selling out would be a mistake as long-term investors will likely still make money”.

For most investors, selectively trimming makes more sense than selling everything, McDermott said.

“Trim if it has grown too large in the portfolio, but don’t abandon the US altogether,” he said. “The opportunity in AI could still be enormous, even if the journey involves volatility and structurally the US remains one of the best places in the world for long-term equity ownership.”

Locking in some of the gains and reallocating to cheaper, higher-potential areas can “improve future returns without losing the structural exposure the US provides” – for this, he highlighted emerging markets or UK smaller companies.

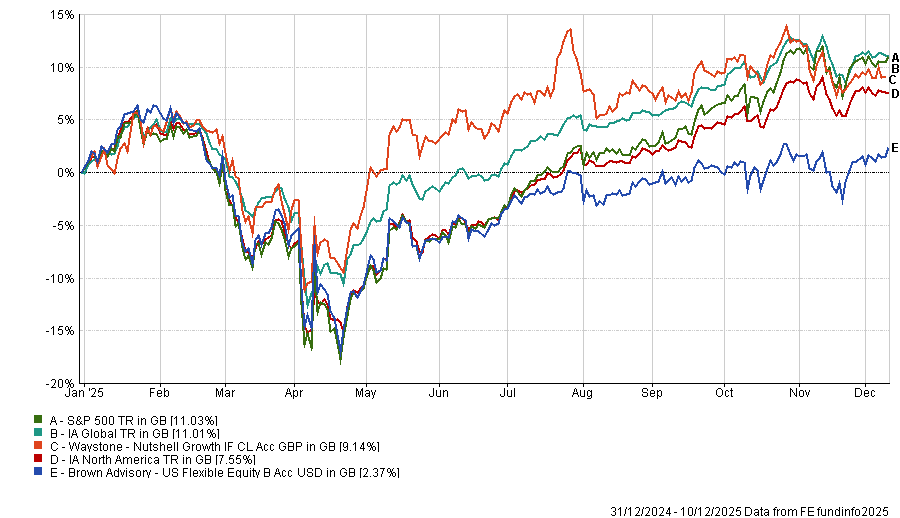

Alternatively, moving part of the allocation from a passive index into a high-quality active US or global fund, such as Brown Advisory US Flexible Equity or Nutshell Growth, can “help investors capture upside while avoiding the most expensive names”.

Performance of funds against index and sector over the year to date

Source: FE Analytics