A fragmented and volatile year for investors, 2025 was dominated by geopolitical tension, a rush to safe-haven assets and tariff negotiations.

April’s so-called Liberation Day shook markets, yet in the months that followed several major indices climbed higher, forcing investors to reassess some long-held assumptions about risk and resilience.

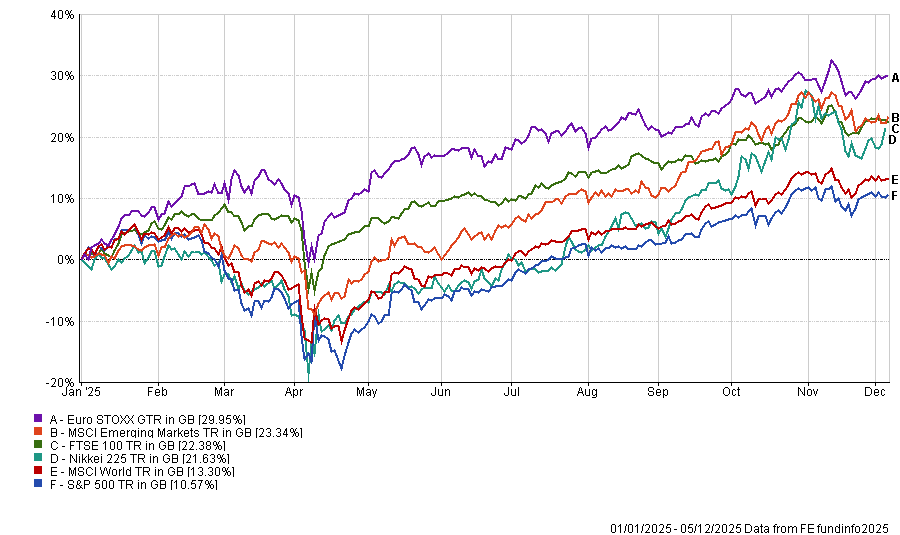

Performance of indices in 2025

Source: FE Analytics

Against this backdrop, Trustnet asked fund managers to reflect on the single biggest lesson they took from navigating markets in 2025.

Schroders’ Tom Grady: Markets are unpredictable

Tom Grady, manager of the Schroder Income and Schroder Recovery funds, noted that, despite the multi-regional geopolitical tensions which defined 2025, the S&P 500 continued to climb and hit all-time highs.

“The key lesson for me is that it’s impossible to predict market inflections when momentum is supportive and there is a narrative for people to get excited about – such as artificial intelligence (AI),” he said.

“This is not a new lesson but what is surprising is how, yet again, despite multiple precedents proving the opposite, the market is trying to justify why ‘this time is different’ and why high valuations are justified.”

The lessons of the past – such as the tech bubble, 1929 and many others – have given Brady the confidence to “resist this narrative and keep doing what we have always done to protect against the inherent uncertainty of the future: buying cheap companies with strong balanced sheets in a balanced and diversified portfolio”.

“My hope for 2026 is that market participants learn the importance of truly benchmark agnostic diversification.”

BlackRock’s Evy Hambro: Look through the short-term noise

For Evy Hambro, co-manager of the BlackRock World Mining trust, 2025 will be remembered largely for the increased global trade frictions that have entrenched inflationary pressures and supported gold.

“The related ‘currency aversion’ trade has led investors and central banks to seek gold as a hedge against the severe wealth erosion associated with fiat currencies,” he said.

For Hambro, 2025’s main lesson is that, as medium-to-long-term investors, “we must look through short-term noise and keep in mind that the market typically overreacts to news”.

“The high unpredictability of US policy has meant that, after announcements, it has broadly been the right strategy to take profits in the areas perceived as winners and lean into the areas seen as losers,” he said.

“The market panic post Liberation Day, for example, created a fantastic buying opportunity generally.”

As an example, Hambro pointed to July, when it looked like US-based copper producers would benefit as the Trump administration signalled 50% copper tariffs were coming.

“We were careful not to rotate too heavily towards such companies, which proved beneficial when it was later clarified that tariffs would only apply to semi-finished copper pipes,” he said.

“As a result, the premium of the US copper price versus international was wiped out.”

JPMorgan’s Timothy Lewis: Stick to the process and capitalise on recovery

On this side of the Atlantic, 2025 was a year of meaningful change for European equities.

Timothy Lewis, co-manager of the JPMorgan European Growth & Income trust, said: “After years of relative underperformance, improving consumer and business sentiment, falling inflation and bold fiscal policy – led by Germany’s €500bn defence and infrastructure plan – have fuelled a genuine resurgence.”

This has coincided with significant investment inflows from global investors, who were drawn away from a volatile US landscape toward Europe’s improving fundamentals, valuations and momentum.

“This year has underlined the importance of sticking to our process – focusing on valuation, quality and operational momentum rather than being distracted by short-term market noise,” said Lewis.

As such, he has “leaned into areas of operational strength and capital discipline while trimming more cyclical exposure”.

For example, the fund rotated out of more fashion-led consumer names and into companies such as Danone, which he said is “seeing strong demand from its more health-focused portfolio”.

“Similarly, our conviction in long-term holdings like Unicredit and Allianz reflects our confidence in high-quality businesses whose balance sheet strength supports capital returns.”

Lewis noted that he and his team have also identified new opportunities in Europe’s industrial recovery, pointing to holdings such as industrial services and engineering business Bilfinger and construction materials company Heidelberg Materials.

“We expect the [European] recovery to broaden in 2026 – rewarding quality, disciplined companies – and believe the opportunity set in Europe has rarely been stronger.”

Invesco’s David Aujla: All factors have impact

David Aujla, multi-asset fund manager at Invesco, acknowledged that many of the events this year were “unlikely to be on many people’s 2025 bingo cards” – not least the extent of the ‘Liberation Day’ announcement and its ongoing implications.

“What is interesting is that, despite periods of pronounced volatility, it has generally paid off to stay invested, and equity markets in particular have ultimately seemed fairly dispassionate to some of the worries that have arisen,” he said.

However, one of Aujla’s learnings from this year is that other factors, such as currency or investment style, can be key drivers of portfolio outcomes.

“The US equity market has been roaring in recent months driven by the AI trend, which has also dominated the news flow,” he said.

“Despite this, a sterling-based investor would still have been much better off investing in the UK, Europe or even Japan for 2025. This is because a weaker US dollar (or stronger British pound) has been a headwind to US equity returns for UK-based investors.”

To navigate this, Aujla said Invesco’s Summit Growth multi-asset funds have reduced their concentration risk within their US equity exposure.

“Around 20% of our US equity exposure is allocated to our own S&P 500 Equal Weight ETF,” he added.

When looking ahead to 2026, he said: “If we were to read multi-asset managers’ letters to Santa, the wish list would be long – less concentrated markets to reward diversification, calmer politics to reduce volatility and a more fundamentally driven market.

“But perhaps the biggest investment-related wish would be for fixed income to be a more reliable diversifier than it has been in recent years.”