Funds with a name for defensive investing, exposure to UK quality companies and the ability to invest in a wide range of bonds are among those tipped for cautious investors in 2026.

While 2025 delivered some strong returns for investors – most major stock markets have made double-digit gains – there are some reasons to be cautious, including lofty valuations among tech stocks, US political and trade uncertainty, and ongoing conflict between Russia and Ukraine.

With this in mind, here are four funds that aim to navigate these conditions through defensive positioning, geographic diversification and flexibility.

Ruffer Investment Company

Rob Morgan, chief analyst at Charles Stanley Direct said Jasmine Yeo, Alexander Chartres and Ian Rees’ Ruffer Investment Company could “act as a useful defensive counterweight” to a portfolio’s equity exposure in 2026. As the overall aim of the trust is to protect wealth as well as grow it over the long term, the managers balance different assets to pay off in a variety of economic scenarios rather than take too much directional risk.

Ruffer Investment Company’s managers are currently wary of high valuations in many parts of the stock market but are underweight US stocks in favour of areas such as UK equities, precious metals and the yen.

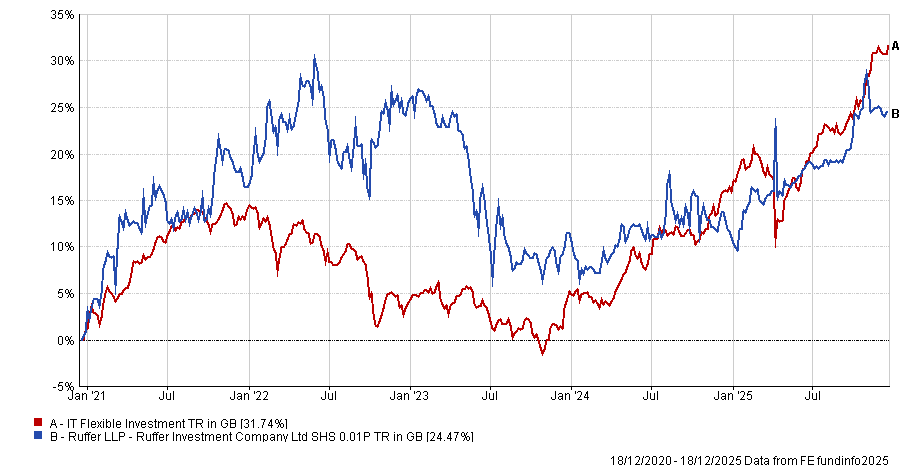

Performance of Ruffer Investment Company vs sector over 5yrs

Source: FE Analytics. Total return in sterling over 5 years to 18 Dec 2025

“This ‘all weather’ strategy could prove useful for the year ahead amid a landscape of high expectations and valuations in the dominant US market,” Morgan said.

“The current portfolio is characteristically defensive presently, with around a third invested in equities and gold mining shares, and is protected by equity derivatives and credit default strategies. Overall, it’s completely different to how most portfolios are currently aligned and should be capable of eking out decent returns come rain or shine.”

VT Castlebay UK Equity

Simon Evan‑Cook, fund manager at Downing Fox, said the best approach for cautious investors is to diversify across different assets, geographies and styles “because you never know where, when or how the next risk will strike”.

However, forced to choose a single fund for the purposes of this article, Evan‑Cook opted for VT Castlebay UK Equity, which is headed up by FE fundinfo Alpha Manager David Ridland, as an “interesting, albeit contrarian” choice. He pointed out that it invests in the unloved UK market and focuses on quality companies, which have struggled in recent years.

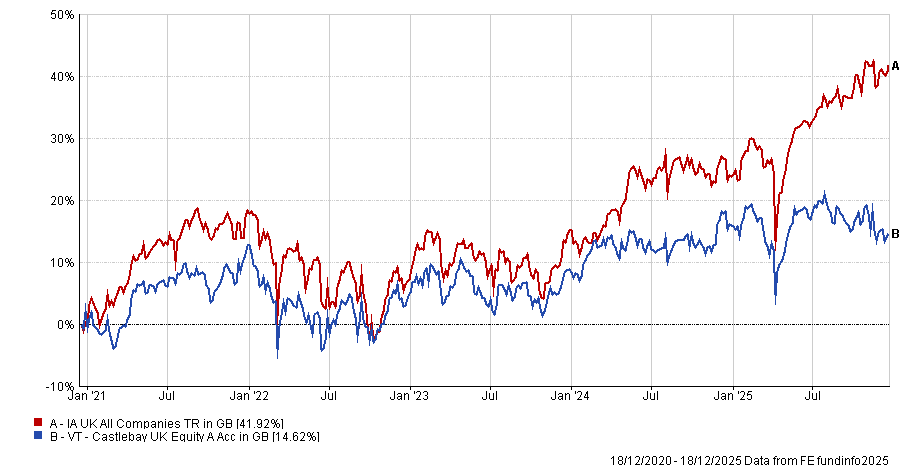

Performance of VT Castlebay UK Equity vs sector over 5 years

Source: FE Analytics. Total return in sterling over 5 years to 18 Dec 2025

“Often, the best time to buy quality is after it’s underperformed, which it tends to do in the later – often frothier stages – of a bull market. It then typically holds up well as wider markets retrench,” the fund-of-funds manager said.

“The fact that it’s UK-focused, meanwhile, gives it an extra valuation edge, as geographically speaking this is a cheap market on a global basis, particularly given the high levels of corporate governance.”

Waverton Multi-Asset Cautious

Alex Farlow, associate director of multi-asset research at Titan Square Mile, chose James Mee’s Waverton Multi-Asset Cautious fund, which offers diversified exposure to equity, fixed income and alternatives. It holds a Titan Square Mile Positive Prospect rating.

“While [Mee] employs a relatively flexible approach to asset allocation, the portfolio will typically have neutral weightings of 45% equity, 28% bonds and 25% alternatives, with the remainder held in cash,” Farlow explained.

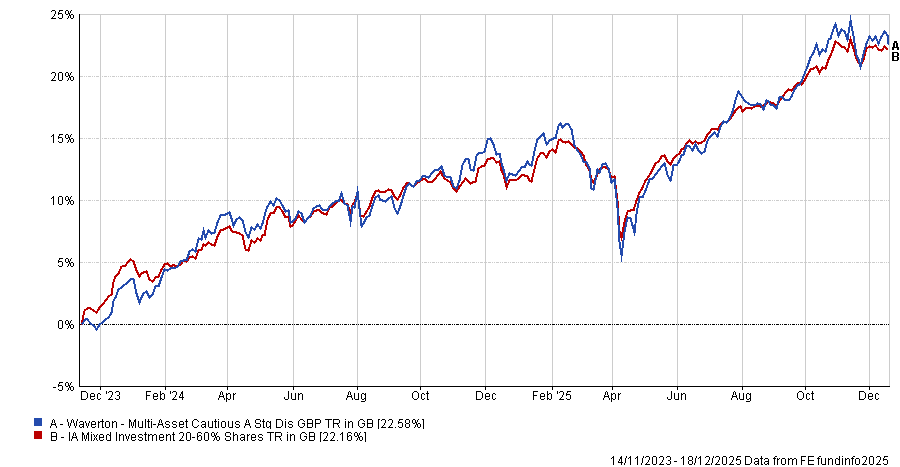

Performance of Waverton Multi-Asset Cautious vs sector since launch

Source: FE Analytics. Total return in sterling between 14 Nov 2023 and 18 Dec 2025

The manager is guided in his allocation by insights from W1M’s asset allocation committee, comprised of senior investors from across the firm, including Mee. But he has his own discretion when interpreting the committee’s output and applies this in line with the fund’s mandate.

Within Waverton Multi-Asset Cautious’ equity allocation, Mee draws on the W1M’s global recommended portfolio (30-40 stocks populated from the regional team’s best ideas), while the bond portfolio is outsourced to the W1M fixed income team.

The alternatives sleeve tends to hold real assets, including infrastructure, real-estate investment trusts (REITs) and renewable energy, although it can also own absolute-return funds and more bespoke structured opportunities. The fund can also actively buy portfolio protection to limit volatility in a significant market sell-off.

Invesco Tactical Bond

Kate Marshall, lead investment analyst at Hargreaves Lansdown, highlighted the role that bonds can play in protecting portfolios, thanks to the income, defensive qualities and potential stability they can provide when stocks struggle.

Added to this is the fact that inflation has started to come down, and central banks such as the US Federal Reserve and the Bank of England are expected to continue cutting interest rates next year, which creates a more supportive environment for bond investors.

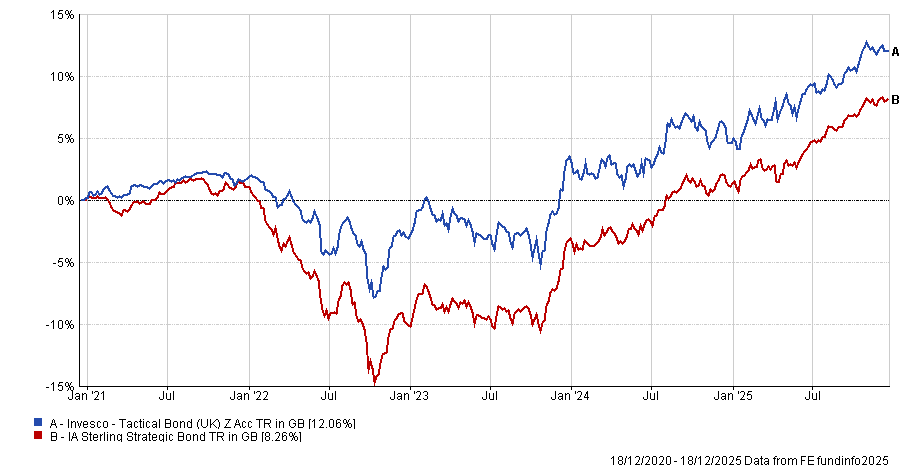

Performance of Invesco Tactical Bond vs sector since launch

Source: FE Analytics. Total return in sterling over 5 years to 18 Dec 2025

However, Marshall warned that “the path ahead is unlikely to be smooth", as economic conditions are uneven across regions, and political uncertainty remains rife. She suggested flexibility will be “key” in 2026, recommending funds that can adjust their exposure to different types of bonds while managing risk.

“The Invesco Tactical Bond fund aims to do exactly that. The managers have freedom to invest across government, corporate, high-yield and emerging-market bonds. Their approach is built on interpreting the wider economic picture and adjusting the portfolio accordingly,” she finished.

“They aim to shelter the fund when they see tougher times ahead and seek stronger returns when opportunities arise. This flexibility removes the burden on investors to pick which areas of the bond market to focus on and when.”