Investing for income may not be the sexiest pick. In a world where artificial intelligence (AI) and growth stocks have dominated returns in recent times, it can be easy to overlook the dependable companies paying consistent and reliable dividends.

But income investing still has a place – and could arguably become more important in the coming years if fears of an AI bubble, lowering interest rates and a flight to safety encourage investors to look towards quality names once again.

For those interested in this school of thought, looking ahead to 2026 fund selectors are choosing the UK, Asia and high-yield bonds as their favourite income areas.

UK income

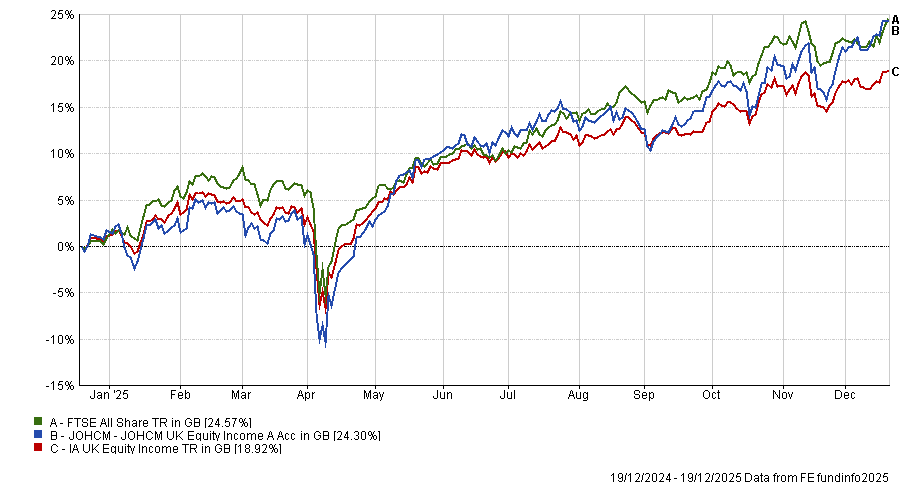

Starting with the domestic market, where Glenn Meyer, head of managed funds at R C Brown Investment Management, chose JOHCM UK Equity Income.

Managers Clive Beagles and James Lowen are appreciated for “not overcomplicating things”, focusing on taking a meaningful active position in stocks with good dividend growth potential.

They buy companies that pay dividends from generated cash and sells outperformers to fund the purchase of new holdings with greater upside potential.

“Over time, compound dividend growth and a bit of capital appreciation tends to translate into an attractive long-term total return,” Meyer said.

Performance of fund against index and sector over 1yr

Source: FE Analytics

“It’s not a fund for all seasons, but the performance is understandable from the comprehensive monthly reports,” he said. “It is a good counterweight to other, more go-go approaches in a portfolio of funds”.

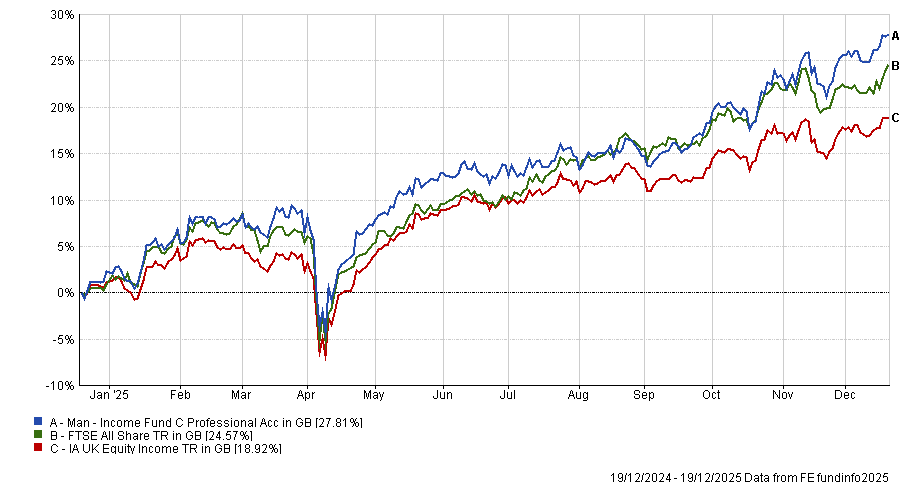

Paul Angell, head of investment research at AJ Bell, also kept thing close to home with his selection of the Man Income fund.

“Pragmatic and analytical” FE fundinfo Alpha Manager Henry Dixon invests in undervalued UK companies across the market-cap spectrum that are paying a yield at least in line with the market. In order to avoid value traps, he also looks at a firm’s cashflows and assets.

The investment process centres on identifying two types of stocks: those trading below their replacement cost (what it would cost today to replace a company's assets and operations) that are also cash-generative; and those where the market appears to be undervaluing profit streams.

The fund is up 27% in the past 12 months, comfortably ahead of its benchmark and peer group, as the chart below shows. Banks were a key contributor over the period, led by Lloyds Banking Group, but with strong contributions also coming from Barclays and Standard Chartered.

The financial services sector remains an overweight at 32% of the fund, with basic materials, consumer cyclicals and energy companies making up the fund’s other largest sector weights.

Performance of fund against index and sector over 1yr

Source: FE Analytics

“The team seek out undervalued and unloved companies, of which the UK market continues to present opportunities,” said Angell, who noted how cheap the fund remains compared to the market, on a 10x price-to-earnings (P/E) ratio and a distribution yield of 4.5%.

Global fixed income

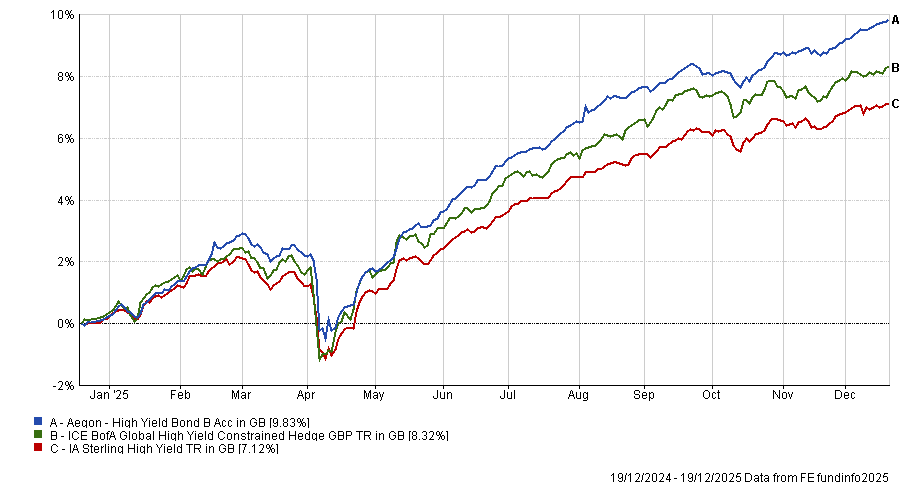

The AJ Bell researcher was also a fan of the Aegon High Yield Bond fund, a global strategy paying out a yield approaching 9%, delivered alongside a low level of duration thanks to high-yield bonds being typically shorter maturity than their investment grade counterparts.

Angell particularly appreciated managers Thomas Hanson and Mark Benbow’s index agnosticism, as a passive allocation to high yield would increase exposure to the most indebted businesses.

The fund is managed from a top-down perspective, with the co-managers assessing the fundamentals, valuation, technicals and sentiment of the market.

Performance of fund against index and sector over 1yr

Source: FE Analytics

“Aegon’s global team of credit analysts are crucial to the success of the fund, generating the individual bond ideas that populate the portfolio,” Angell said.

“The co-managers have successfully navigated both up and down markets, inclusive of the Covid pandemic and rising interest rates, delivering top quartile returns within their peer group.”

Emerging markets

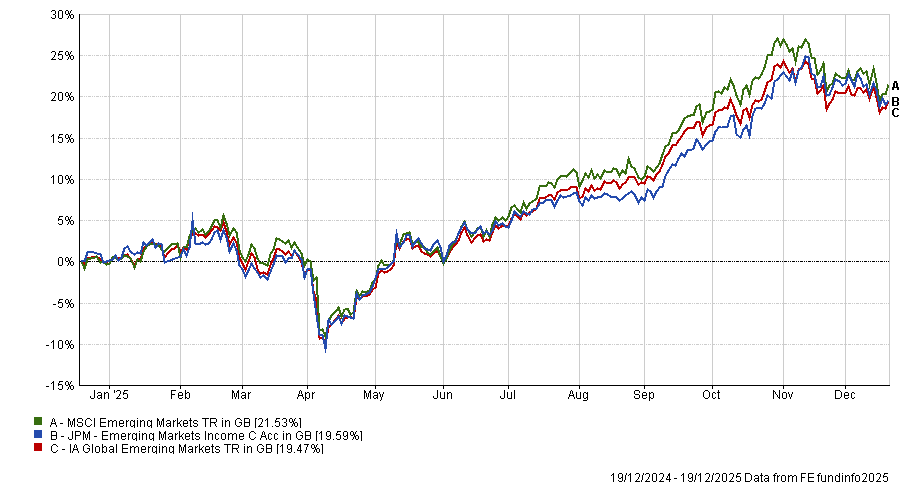

Not everyone was keen on Western markets, which are facing stretched valuations, high debt-to-GDP ratios and persistent policy uncertainty.

By contrast, with the drag from a strong US dollar easing, fiscal frameworks across many emerging market economies have strengthened after Covid and sovereign debt burdens remain well below developed-market levels, while equities continue to trade at compelling discounts.

If inflation and rate pressures continue to moderate in developed economies, the income case for emerging markets could strengthen meaningfully in 2026, according to for Sheridan Admans, director at Infundly.

He chose the JPM Emerging Markets Income fund, which could offer “timely and underappreciated diversification” for investors looking beyond traditional income sectors.

Led by experienced manager Omar Negyal, the strategy blends an “attractive income profile with a robust quality-value process”.

Performance of fund against index and sector over 1yr

Source: FE Analytics

“For those seeking a differentiated income source or growth investors looking for emerging market exposure with a bit more income stability, the JPM Emerging Markets Income fund provides a disciplined route into this opportunity set,” Admans finished.

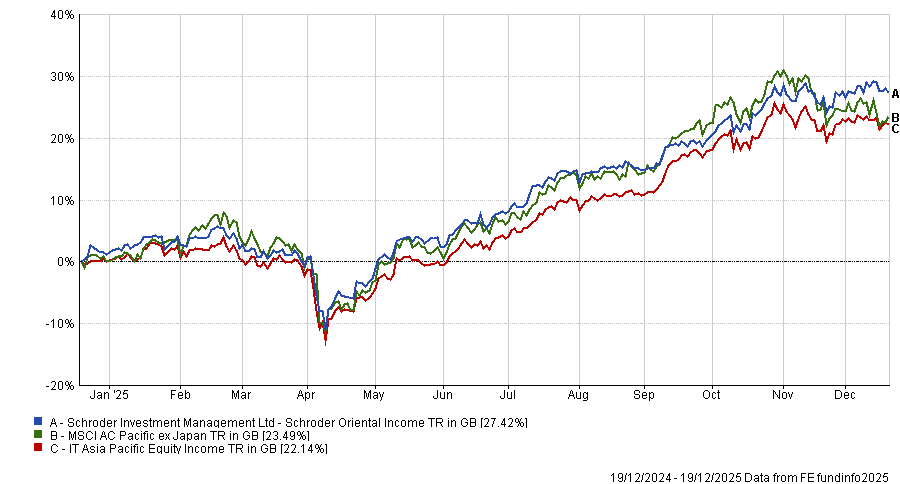

The final pick and the only trust in the list was Schroder Oriental Income, highlighted by FundCalibre managing director Darius McDermott.

“Asia Pacific is often overlooked for income despite having higher yields than many other regions in the world,” he noted, with Schroder Oriental Income “a compelling way to access that opportunity while still getting paid a reliable income”.

The trust maintains less than half the benchmark exposure to China and instead leans into developed Asia – markets such as Australia, Hong Kong and Singapore. These areas offer deep pools of dividend-paying companies, particularly in financials, resources and high-quality industrials – many of which with strong balance sheets, sensible payout ratios and the pricing power needed to defend profitability and grow dividends even in periods of higher inflation, he said.

Performance of fund against index and sector over 1yr

Source: FE Analytics

“The strategy is run by one of the strongest research teams on the ground in Asia and has increased its dividend every year since launch – a rare achievement that reflects the team’s stock selection and the region’s improving dividend culture,” McDermott noted.

"Manager Richard Sennitt has been investing in Asia for more than 30 years. His disciplined, bottom-up approach, combined with Schroders’ analytical depth across the region, gives us confidence the trust can continue to deliver both resilient income and capital growth over the long term.”