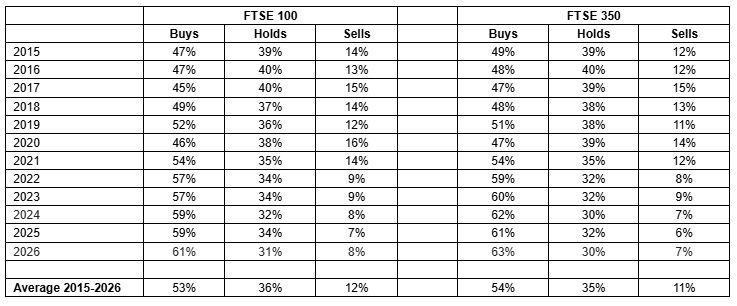

Investment analysts covering FTSE 350 stocks have issued their most bullish ratings in 12 years, with 63% of recommendations tipping ‘buy’ and just 7% ‘sell’ as 2026 begins, according to AJ Bell.

For the FTSE 100, 61% of all analyst recommendations are buys and just 8% are sells, representing the highest and joint-second-lowest scores over the past 12 years respectively. The shift reflects a steady increase in analyst confidence that has built since 2022.

The trend marks a significant departure from historical averages, where buy recommendations on the FTSE 100 stood at 53% and sells at 12% between 2015 and 2026.

Analysts’ views on UK equities by calendar year

Source: LSEG Refinitiv data, Marketscreener, analysts’ consensus, London Stock Exchange. 2026 data as of 7 Jan 2026.

Russ Mould, investment director at AJ Bell, said: “This is understandable in the context of how mood tends to follow price and the FTSE 100 is now trading above 10,000 for the first time in its history.

“Further all-time highs could stoke further confidence and fresh interest in the still much-maligned UK equity market, especially as the rising percentage of ‘buy’ recommendations and falling percentage of negative ratings is finally translating into strong positive returns on an absolute basis and also now relative to the previously all-conquering US markets.”

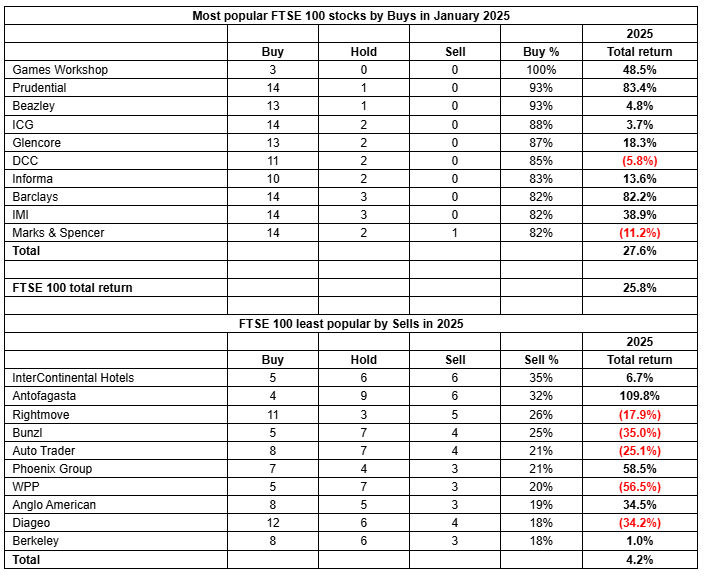

Analysts have reason to feel confident entering 2026 after delivering strong results in 2025. Their top 10 FTSE 100 picks generated a total return of 27.6%, beating the index’s 25.8% return, AJ Bell found.

“Analysts’ top picks failed to beat the FTSE 100 index in 2015, 2016, 2017, 2018, 2020, 2021 and 2022,” Mould said. “However, they have done so in 2023, 2024 and now 2025, to repeat the success of 2019.”

Source: LSEG Refinitiv data, Marketscreener, analysts’ consensus, London Stock Exchange. 2025 analysts’ recommendations data as of 10 Jan 2025.

Strong gains from three companies drove the outperformance. Prudential returned 83.4%, Barclays 82.2% and Games Workshop 48.5% to lead what Mould described as “thumping gains” from the most popular stocks.

What’s more, analysts’ least preferred names significantly underperformed the market. The 10 stocks with the highest percentage of sell ratings generated a positive total return of just 4.2% in 2025.

Five stocks in this group fell during the year despite the broader bull market. Rightmove, Auto Trader, Diageo, Bunzl and WPP all posted negative returns, with WPP suffering particularly badly.

WPP fell 56.5% and dropped out of the index after what Mould described as “a shocking run, a profit warning and the departure of its chief executive”. Diageo declined 34.2% while Bunzl fell 35%.

“Analysts covered themselves in glory in 2025, as their top picks outperformed and their least preferred names did less well than the FTSE 100,” Mould said.

“Perhaps momentum, US equities and tech are no longer the only game in town, as investors seek to at least calibrate their exposure to richly valued, dollar-denominated assets and hunt out alternatives.

“This in turn may be giving active stock pickers their chance to shine, after a period where running with the herd and using passive investment strategies has worked so well.”

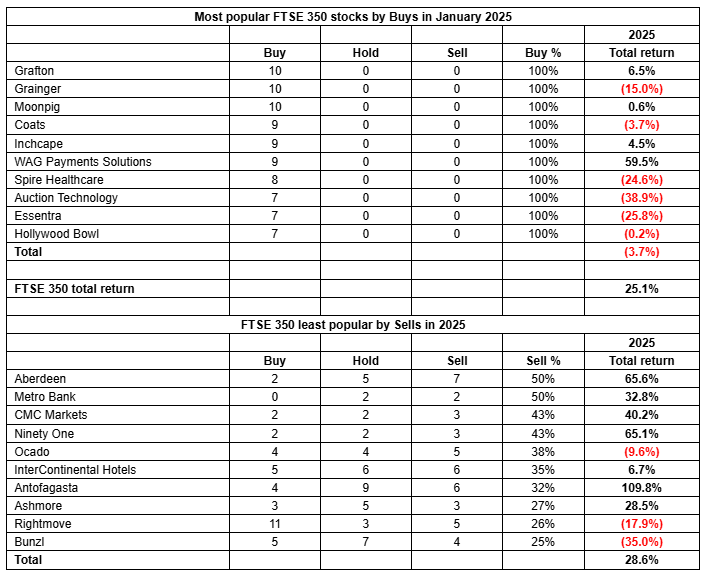

But results were less clear-cut across the broader FTSE 350 index. The 10 most popular stocks by buy percentage fell 3.7% in aggregate, markedly underperforming the index’s 25.1% return.

Source: LSEG Refinitiv data, Marketscreener, analysts’ consensus, London Stock Exchange. 2025 analysts’ recommendations data as of 10 January 2025.

The least popular FTSE 350 picks returned 28.6%, marginally outperforming the benchmark. WAG Payment Solutions helped the buys with a 59.5% gain, but Essentra, Spire Healthcare and Auction Technology all fell sharply despite their 100% buy ratings.

Yet the successful year does not eliminate the inherent difficulties of stock selection. “It is easy to poke fun of analysts, not least because picking individual stocks is hard, even if it is your full-time job,” Mould said.

“Markets will tend to do what causes the greatest degree of surprise and analysts do not intentionally set out to sit on the fence. Their views and research shape the debate and help to form opinion, but markets will price in the prevailing consensus pretty quickly.”

Investors should treat broker research with particular caution when stocks attract universal enthusiasm, especially when they seem universally popular.

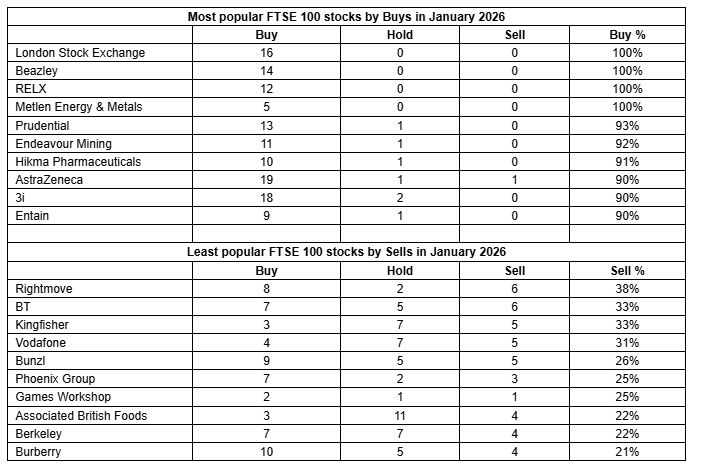

Analysts’ current favourites include London Stock Exchange, Beazley and RELX, which all go into 2026 with 100% buy ratings from analysts covering them.

Other heavily favoured names include Prudential with 93% buy ratings and both AstraZeneca and 3i at 90%. Endeavour Mining, Hikma Pharmaceuticals and Entain also feature amongst the top 10 most popular stocks.

Source: LSEG Refinitiv data, Marketscreener, analysts’ consensus, London Stock Exchange. Data as of 7 Jan 2026.

Rightmove leads the least popular stocks with 38% of recommendations rated as sells, followed by BT and Kingfisher both at 33%. Vodafone carries a 31% sell rating while Bunzl sits at 26%.

Phoenix Group, Games Workshop, Associated British Foods, Berkeley and Burberry are in the list of least favoured FTSE 100 names.

However, Mould said individual investors must conduct their own analysis regardless of analyst opinion: “Anyone prepared to pick their own stocks rather than pay a fund manager or index tracker fund to do it for them simply must do their own research on individual companies before they even think about buying or selling any of its shares.”

The most and least popular stocks therefore provide a starting point for further investigation rather than ready-made recommendations.

“At least 2025's results give credence to the case that analysts’ research can provide some genuine added value,” Mould finished.