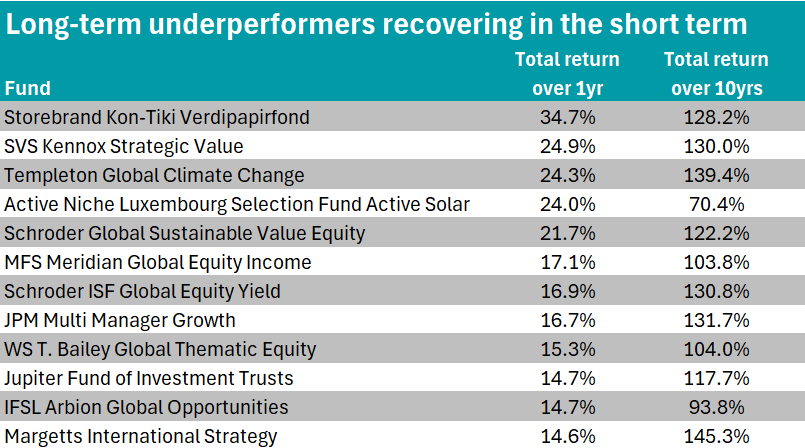

Twelve IA Global sector funds staged an impressive comeback in 2025, delivering first-quartile one-year returns after a decade trailing their peers.

In this new series, Trustnet identifies funds that languished in the fourth quartile for returns in their sector over 10 years but stormed into the first quartile over one year (to December 2025). We also look at the reverse. We are kicking things off with the IA Global sector.

The 12 funds in the table below delivered strong one-year returns in 2025, beating the sector average of 11.2% despite their weaker decade-long records.

Source: FE Analytics

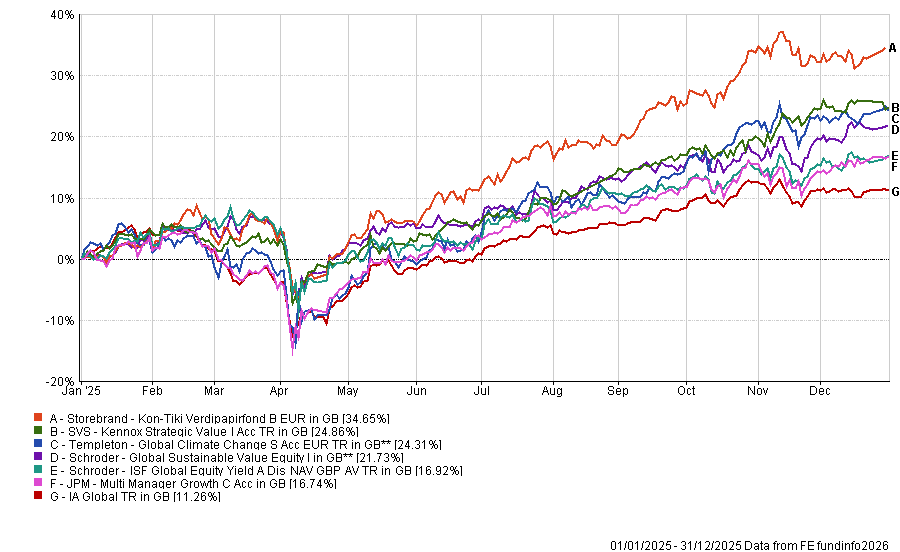

Their outperformance over the past 12 months can largely be attributed to 2025’s sharp style and sector rotation.

After years dominated by US mega-cap growth, geopolitical uncertainty, falling inflation and rate cuts triggered a rebound in value stocks, cyclicals and global equities outside of the US, with the likes of climate and energy transition, emerging markets and commodity-linked strategies benefiting.

Multi-manager and thematic portfolios also gained over the past 12 months as investors diversified away from concentrated benchmarks.

Leading the charge is the €1.6bn Storebrand Kon-Tiki Verdipapirfond, which vaulted to the top of the table with a one-year total return of 34.7% – a dramatic turnaround for a fund that spent years in the sector’s lower ranks.

Managed by Frederik Bjelland and Espen Klette, it was launched in 2002 and focuses on value stocks across emerging markets, which benefited last year as investors sought to diversify away from the US.

The second best one-year returns were delivered by SVS Kennox Strategic Value, which staged an impressive comeback and gained 24.9%.

In today’s environment of economic distortions, the £79.5m fund has capitalised on its disciplined value approach, seeking industry leaders that are more conservatively managed with shares trading at compelling valuations.

Current holdings in the fund include pan-Asian footwear group Stella International, South Korean outdoor apparel manufacturer Youngone and New Zealand-based sports and entertainment broadcaster Sky NZ.

Rounding out the top three is the €1.1bn Templeton Global Climate Change, which gained 24.3% over the course of 2025.

Climate-related funds have fallen out of favour in recent years, in large part due to the ongoing political pressures placed on environmental, social and governance (ESG) themes – especially in the US.

However, the fund has benefited from its 22.9% allocation to the information technology sector, which enjoyed another overall strong year. Two of its largest positions in the portfolio are tech behemoths Microsoft and Alphabet at 7.2% and 6.2% respectively.

Along a similar vein, the sustainability-focused £1.3bn Schroder Global Sustainable Value Equity managed first-quartile gains in the sector over one year.

Co-managed by Schroders head of value Simon Adler, Liam Nunn and Roberta Barr, the high conviction value fund invests in sustainable companies trading at discounted valuations that the management team believes can deliver earnings growth.

Titan Square Mile analysts said that the fund’s focus on value is a big differentiator. “The sustainable sector is heavily biased towards growth stocks, whereas this fund provides a style diversification, looking for value companies that are better positioned from a sustainability perspective when compared to industry peers.”

Another Schroders fund sits in the fourth quartile over 10 years but the first quartile over 12 months. The $244.6m Schroder ISF Global Equity Yield, also managed by Adler and Nunn, gained 16.9% in 2025, with top holdings including defensive big pharma names such as GSK, Bristol-Myers Squibb and Pfizer.

Following the strong showing from Schroder’s value-focused strategies, JPM Multi-Manager Growth also delivered top-quartile returns over one year, highlighting the breadth of approaches benefiting from 2025’s market rotation.

The £309.8m fund posted a 16.7% one-year return, investing at least 80% of its assets in investment trusts across global sectors, providing diversified exposure through high-conviction vehicles.

Its top holdings include Scottish Mortgage Investment Trust (8.7%), Polar Capital Technology Trust (5.6%) and Edinburgh Investment Trust (3.7%), reflecting a blend of growth and thematic strategies.

Performance of the funds vs sector in 2025

Source: FE Analytics

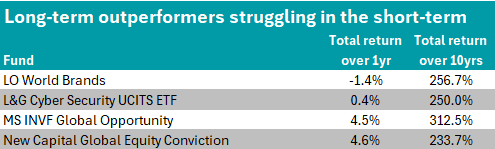

While some funds basked in the glow of a comeback in 2025, others saw their long-standing dominance dim. Growth-heavy strategies, in particular, found themselves out of step with a market favouring value and diversification.

Source: FE Analytics

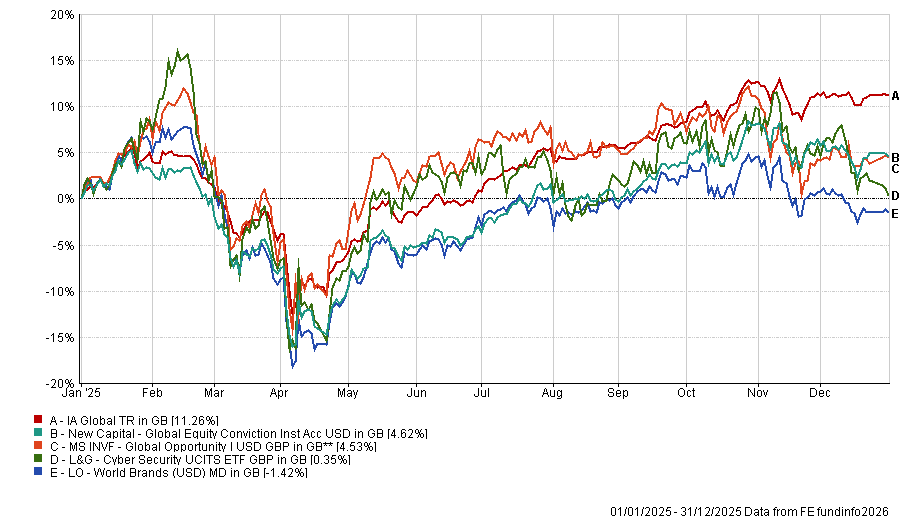

LO World Brands has been a standout performer over the long term, delivering a 10-year return of 256.7%, but it slipped into negative territory and lost 1.4% in 2025.

The high-conviction strategy, run by Juan Mendoza and Andrew Gowen, targets high-quality companies with sustainable financial models and resilient business practices.

In the fund’s November 2025 factsheet, the managers acknowledged that the consumer-focused investment universe sits “at the crossroads of key long-term structural growth trends such as global demographic shifts, multiple lifestyle changes and disruptive distribution channels”.

Elsewhere, MS INVF Global Opportunity’s disciplined focus on quality and growth has made the fund a long-term winner, racking up a 312.5% return over 10 years. However, its momentum slowed in 2025 as investors moved away from expensive growth, with the fund managing a modest 4.5% gain.

The $14.2bn strategy has been managed by FE fundinfo Alpha Manager Kristian Heugh since 2010.

New Capital Global Equity Conviction also lives up to its name with a high-conviction portfolio that delivered a 233.7% return over a decade. It also fell short in 2025, managing just 4.6% as last year’s style reversal clipped its wings.

Finally, the 2.8bn L&G Cyber Security UCITS ETF delivered an impressive 250% return over a decade but its performance has since flattened, with a gain of just 0.4% in 2025.

Performance of the funds vs sector in 2025

Source: FE Analytics