Kopernik Global Investors will soft-close its $8.2bn Global All-Cap strategy on 30 April 2026 after a run of strong performance.

Existing investors who currently hold positions in the Global All-Cap strategy will be able to continue investing additional money. The Global All-Cap Mutual Fund, which soft-closed on 31 July 2025, will not hard close at this time.

Kopernik’s Global All-Cap strategy returned 66.5% in calendar year 2025 while the firm’s International strategy returned 56% over the same period.

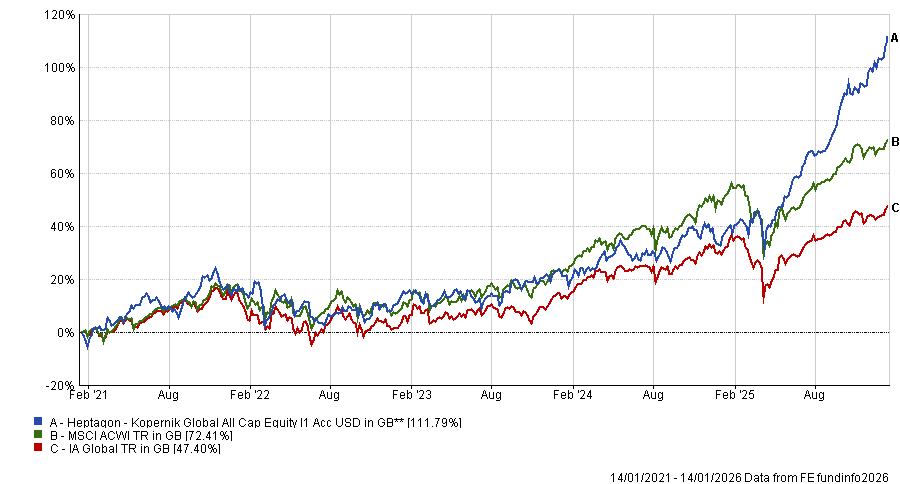

In the UK market, the Heptagon Kopernik Global All Cap Equity fund was the fourth best performing fund in the IA Global sector in 2025 with a 63.4% total return. The fund ranks in the sector's top decile over three and five years.

Performance of Heptagon Kopernik Global All Cap Equity vs sector and index over 5yrs

Source: FE Analytics

Heptagon Kopernik Global All Cap Equity is well-liked by fund pickers, having been one of Shard Capital’s choices for bullish investors and highlighted for doing something different to its peers in past Trustnet articles.

Kopernik said in a statement: “After significant consideration, and consistent with our approach of limiting capacity in order to enhance return potential, we have decided to proceed with the soft close of the Kopernik Global All-Cap strategy.”

Kopernik will also launch a Global Opportunities strategy on 30 April 2026,which will invest globally in mid- to large-cap stocks.

Dave Iben and Alissa Corcoran, co-chief investment officers at the deep value investment house, will co-manage the strategy. This is the first launch since Kopernik’s International strategy in 2015.

“Though traditionally, deep value is associated with SMID-cap companies, the Kopernik team continues to take a nuanced approach to determining which companies to invest in and is now finding considerable opportunities in securities with a market capitalisation greater than $3bn,” a representative noted.