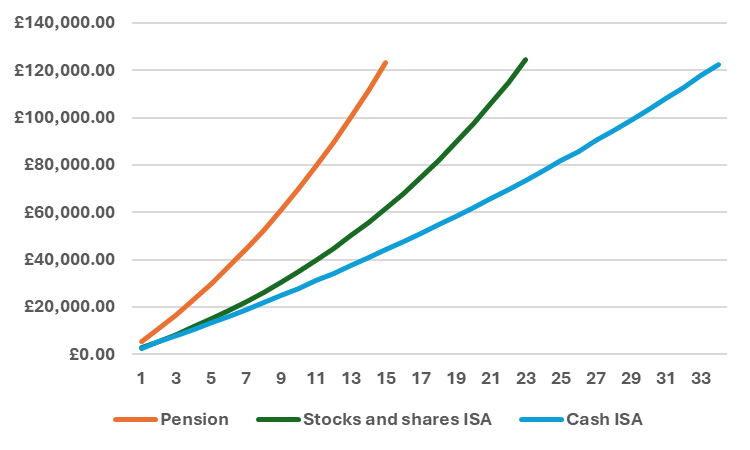

Boosting your savings by £120,000 is eight years quicker if done through a pension rather than a Stocks and Shares ISA, new data from Murphy Wealth suggests.

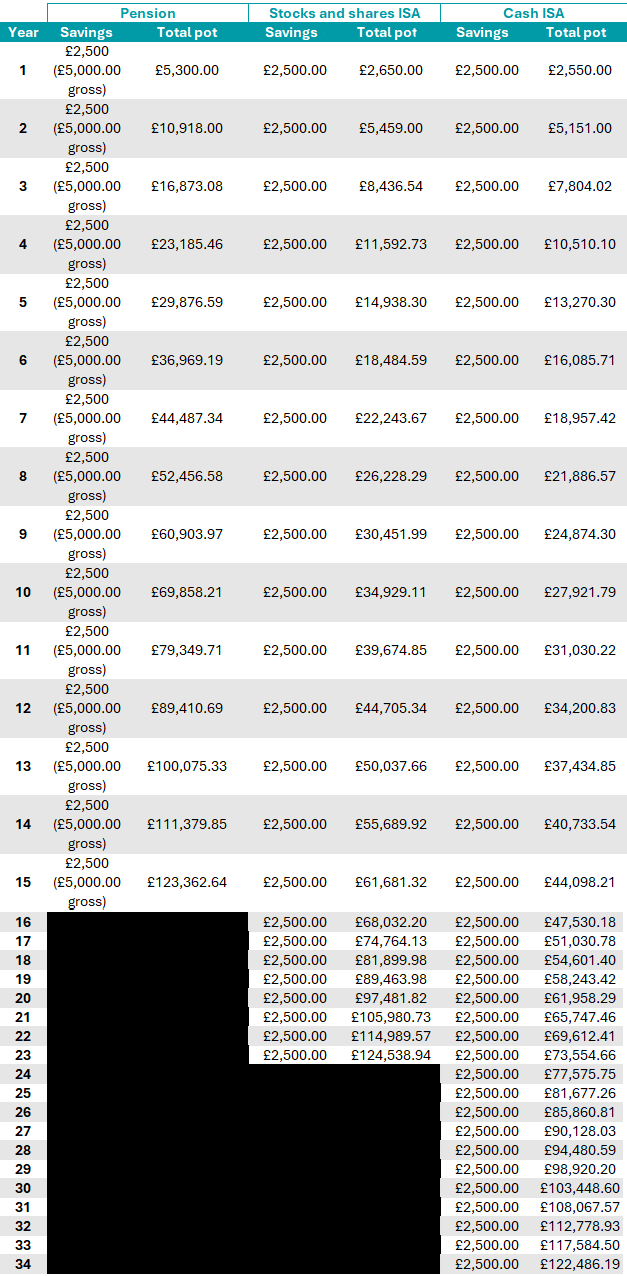

According to the wealth manager, saving £208.34 a month (£2,500 per year) with a workplace pension gets you there in 15 years instead of the 23 needed with an ISA account (this is assuming an average annual growth of 6% and not accounting for costs, which vary by provider).

Pensions are quicker for two main reasons: employer contributions and government relief.

Typically, employers contribute a minimum of 3% of qualifying earnings as part of a mandatory 8% total contribution, meaning that investors can enjoy a minimum top-up of £125 to their monthly £208.34. This may be higher if an employer matches personal contributions.

The government would then provide another 20% worth of tax relief, taking the overall monthly payment to £416.67. For every £2,500 saved, a total of £5,000 accrues over the course of a year.

Building a £120,000 prize pot via pension, stocks and shares and cash

Source: Murphy Wealth

But there is a catch: a private pension cannot be accessed until at least 55 years-old (rising to 57 from April 2028), and while withdrawing up to 25% of your pension as a lump sum is free of tax up to £268,275, the remainder may be taxable as income depending on circumstances.

There is, therefore, a trade-off to getting there more quickly. Anyone who plans to use the £120,000 as soon as they have reached that target should choose an ISA instead.

Contributing the same £208.34 per month would be equivalent to £2,500 per year, with no employer contribution or upfront tax relief from the government. The same average growth rate of 6% would mean investors took 23 years to reach the same £120,000 target.

These figures underline the power of pensions as a long-term savings vehicle, according to Adrian Murphy, chief executive of Murphy Wealth.

“Employer contributions and the tax relief provided by the government can make a huge difference over time and take years off reaching the same target compared to other forms of saving – at the extreme, more than halving the timescales to reaching £120,000 on the same level of contributions,” he said.

“Many people are questioning the effectiveness of pensions now that they are set to become part of people’s estates for inheritance tax purposes and the age of access keeps rising, but they are still the best way to build wealth and fund your retirement.”

For too many Britons, however, the choice isn’t between a pension or an ISA account but between cash or investing. Investing has historically been better, as long-term returns tend to outpace interest offered on savings products. Yet most people prefer the security of cash.

Indeed, in its latest ISA data, HMRC revealed the number of cash ISAs subscribed to in 2023/24 was almost 10x more than stocks and shares ISAs. In total, cash ISAs accounted for two-thirds of new money added via the tax wrapper.

Assuming an average annual growth rate of 2%, which is above the 1.21% average of the past decade, it would take 34 years contributing the same £208.34 a month before a cash ISA would reach £120,000.

Source: Murphy Wealth

While the market can be volatile, stocks and shares have tended to outperform cash over the vast majority of timeframes by “a substantial amount”, Murphy said.

“The UK is too faithful to cash, which means most people are missing out on better returns – and that needs to change.

“Whatever you are saving for, don’t just go with your gut. Speak to a professional financial adviser about your plans and they can create a portfolio of investments suitable for your goals as well as your appetite for risk,” he concluded.