Donald Trump’s ‘America First’ policy barrage has tested markets over his first 12 months back as US president, yet there have been strong gains from stocks outside of the US and precious metals.

Markets wobbled repeatedly during the 12 months following Trump’s inauguration on 20 January 2025. Yet each sell-off proved short-lived as investors learned to digest his relentless policy announcements and to reposition portfolios accordingly.

Nina Stanojevic, senior investment specialist at St. James’s Place, said: “Since the inauguration, one year of Trump 2.0 has delivered no shortage of policy surprises.

“It is easy to lose count of the number of tariff announcements alone, most recently with new threats of tariffs tied to developments in Greenland. This has all unfolded against a backdrop of major geopolitical challenges, from developments in Venezuela and the ongoing war in Ukraine to tensions surrounding Taiwan, the conflict in Israel and broader questions over European security.”

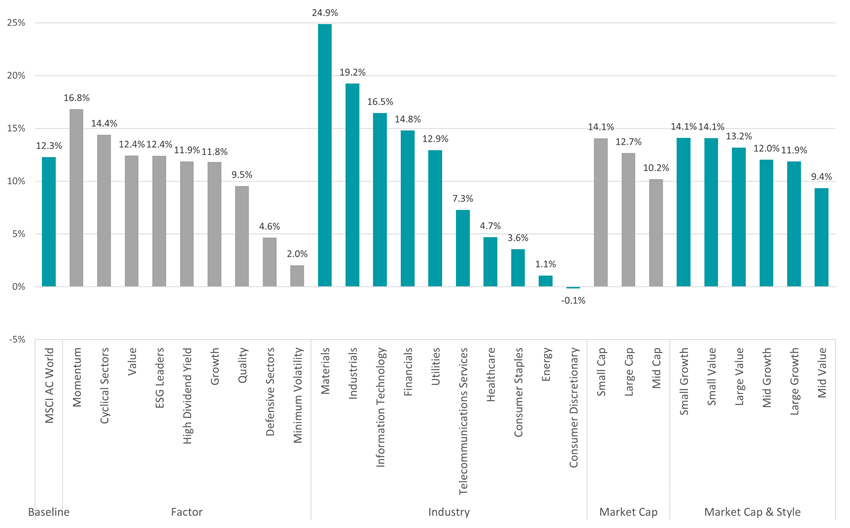

The MSCI AC World index has made a 12.3% total return in sterling terms over the past 12 months as investor sentiment remained buoyant despite several flashpoints through the year that rattled markets.

Performance of MSCI AC World and sub-indices during Trump’s first year

Source: Finxl

Dan Coatsworth, head of markets at AJ Bell, said: “Trump’s decisions have shaken up the status quo and put the world on a different path. Financial markets have been tested by a barrage of events and investors have had a lot to digest as Trump doles out new initiatives at a relentless pace. What’s interesting is how financial markets have often wobbled and then quickly resumed their upward path during the first year of his second term.

“Initially, it was down to the TACO view that ‘Trump Always Chickens Out’ and wouldn’t follow through on his policy decisions. More recently, Trump has shown greater determination and persistence, yet markets continue to stay resilient. Investors have typically followed the same pattern – initial shock at each new policy, then time to reflect before recalibrating risk and rejigging portfolios.”

The most noteworthy example of this was ‘Liberation Day’. On 2 April, Trump unveiled tariffs on almost every trading partner of the US and, upon realising that they were higher than expected, the market sold off aggressively.

However, the risk-off sentiment lasted little more than a week before markets started to recover. This meant 2025 was a decent one for investors, with companies in the materials, industrials and technology sectors faring particularly well.

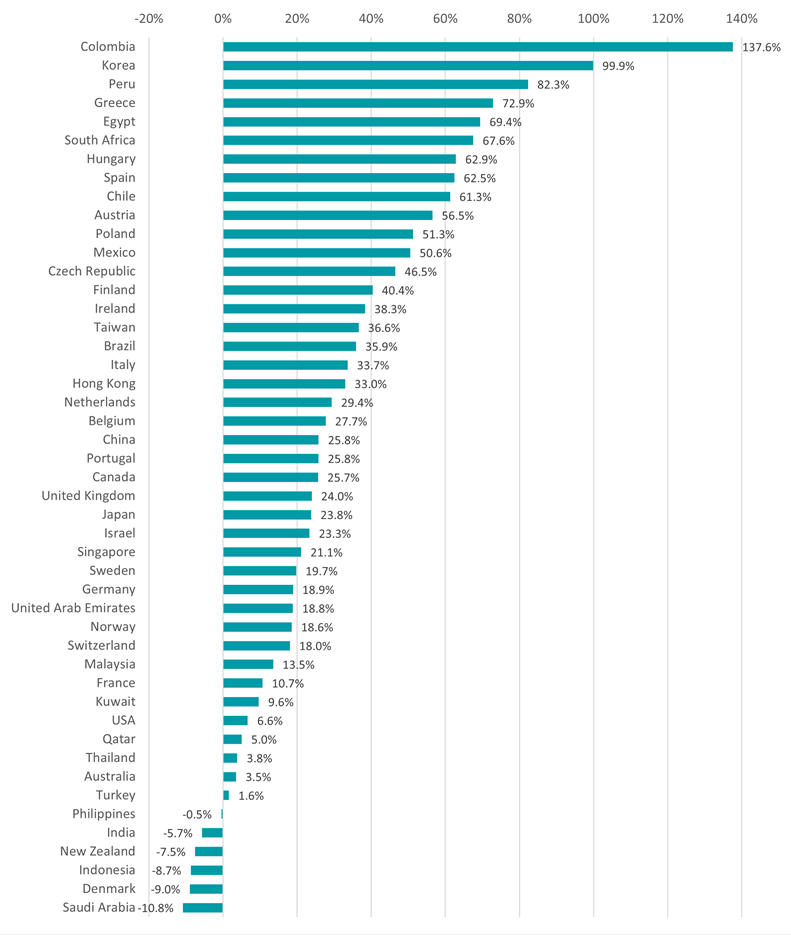

Performance of countries in MSCI AC World index during Trump’s first year

Source: Finxl

However, as the chart above shows, this has not always been to the benefit of the US market itself. The past year has seen significant debate around the US exceptionalism trade, which defined markets for much of recent history but has come under pressure as Trump’s unpredictable actions caused investors to diversify into other markets.

Columbia has been the best performer, which analysts have attributed to low valuations, improving investor sentiment, hopes of a more market-friendly government and a heavy skew to financials in the index.

The MSCI USA index, on the other hand, was much further down the ranking, as its 6.6% total return since Trump returned to office ranks it in 37th place of MSCI AC World constituents.

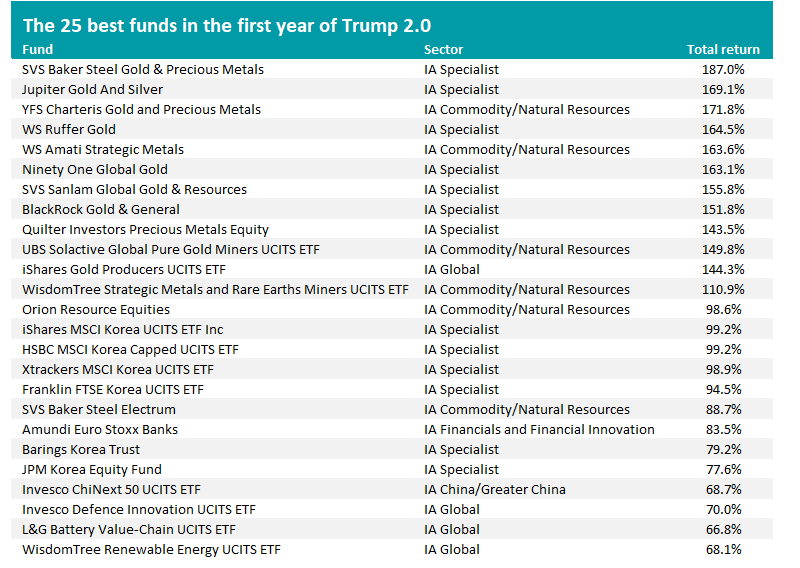

When it comes to how funds have performed over Trump’s first year, one trend is a standout winner: gold. The price of the yellow metal has set successive record highs over the past 12 months, sitting at more than $4,700/oz after an eye-catching rally.

Source: Finxl

Coatsworth said: “Aside from central bank purchases, demand has come from investors seeking to add so-called havens to their portfolios in the face of uncertainties. Trump’s policies have weakened the US dollar, which makes gold more affordable for buyers using other currencies. Sticky inflation has also led to more people buying gold as a natural hedge.

“Shares in gold miners often rise by more than the appreciation in the gold price in a rising market. The higher the value of the metal, the greater the potential for gold miners to enjoy fatter profit margins and juicier cash flows. They were the hot trade in 2025 and Trump’s non-stop actions so far in 2026 have retained the sparkle in this part of the market.”

The table above shows that SVS Baker Steel Gold & Precious Metals made the highest return of the entire Investment Associate universe since Trump’s inauguration, gaining 187%.

The 13 best funds of the past year all invest in the miners of gold, precious metals or critical minerals, reflecting the heightened levels of investor interest in these commodities. These include Jupiter Gold And Silver, Ninety One Global Gold and BlackRock Gold & General.

Korean equity funds also feature heavily in the table. Korean stocks have surged thanks to cheap valuations, chip makers Samsung Electronics and SK Hynix’s dominance of the index and a drive by president Lee Jae Myung to overhaul the country’s corporate governance standards.

Invesco Defence Innovation UCITS ETF hints at another strong theme of the past 12 months: the increase in defence spending caused by the war in Ukraine and Trump’s demands for countries to boost their contributions to NATO.

“One of the first points on Trump’s agenda for his second term was pressuring NATO members to spend 5% of their GDP on defence, up from a traditional 2% guideline. He got his way and NATO leaders agreed to boost spending by 2035. The earnings outlook for defence companies suddenly looked a lot stronger and investors raced to buy relevant shares,” Coatsworth said.

“The US strikes on Venezuela at the start of 2026 and Trump’s desire to get a hold of Greenland gave the defence sector another leg-up as investors wondered if his actions would set a new precedent globally.”

Coatsworth also highlighted other investment winners from Trump’s first year, including big US banks. These rallied as Trump campaigned on a platform of looser regulation, which should mean banks have to hold less capital and have more money to channel into lending and investments.

“Investors holding UK and European shares have a lot to thank Trump for,” he finished. “Many people were shocked at his policies and chose to fish elsewhere in the world for investment opportunities. They looked for the cheapest markets and the UK and Europe fit the bill nicely.”