Investors flocked to multi-asset funds with higher equity exposure in 2025 as falling inflation and resilient global equity markets tilted risk appetite upwards, with funds like Vanguard LifeStrategy 80% Equity, Orbis Global Balanced and Coutts Managed Balanced leading the charge, according to the latest FE Analytics flows data.

IA Flexible Investment – which gives funds free rein over percentage allocation to equities – was the best-performing multi-asset sector in the Investment Association (IA) universe last year, gaining 12%. Performance of the remaining mixed asset sectors went according to equity exposure, with IA Mixed Investment 40-85% Shares delivering the next best performance with an 11.6% gain, then IA Mixed Investment 20-60% Shares (10.2%) and IA Mixed Investment 0-35% Shares (7.8%).

Delving deeper into each sector, Trustnet has used the FE Analytics’ Market Movements tool to identify the equity unit trusts and open-ended investment companies (OEICs) with the highest net inflows and outflows in 2025. We specifically looked at funds with attracted or lost more than £200m.

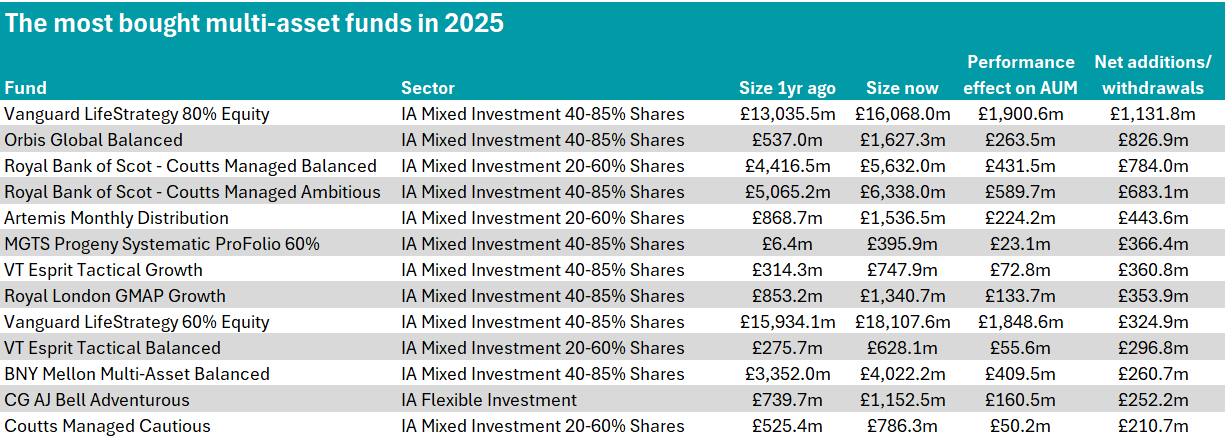

Multi-asset funds with the largest inflows

Lower‑risk funds lagged during a strong equity year, with no IA Mixed Investment 0-35% Shares funds logging inflows greater than £200m.

Aviva Investors Multi-Asset Stewardship I saw the highest inflows in the sector, attracting £155m in net new money from investors and added a further £9.8m through performance. The fund has £182m in assets by the end of 2025.

Funds with inflows greater than £200m across other multi-asset sectors are in the table below.

Source: FE Analytics. Market movements data for unit trusts and Oeics

Most of these funds come from the higher equity IA Mixed Investment 40-85% Shares sector.

Top of the table is one of the popular Vanguard LifeStrategy range: Vanguard LifeStrategy 80% Equity, which grew its assets from £13bn at the end of 2024 to £16bn by the end of 2025. Performance added £1.9bn and the fund further attracted £1bn in net new money – the most across all four assessed sectors.

Over one year, the fund is also in the top quartile in its sector, gaining 13.8% versus the IA Mixed Investment 40-85% Shares average of 11.6%.

Vanguard LifeStrategy 60% Equity also attracted more than £200m in flows, with investors adding £325m. Alongside £1.8bn in performance gains, the fund’s assets reached £18.1bn in 2025. Despite this, the fund languished in the third quartile of the IA Mixed Investment 40-85% Shares sector over one year, gaining 11.6% – roughly two percentage points lower than its 80% equity counterpart.

Meanwhile, CG AJ Bell Adventurous is the only fund in the IA Flexible Investment sector to attract investor inflows over £200m. The fund’s assets grew from £740m in 2024 to £1.2bn by the end of 2025, with performance adding £161m and investors adding £252m.

The fund delivered an 18% return over one year – a first quartile performance compared to the sector’s 12% average return. It is also in the top quartile for returns over three and five years.

Top holdings for CG AJ Bell Adventurous include SPDR S&P 500 ETF, Vanguard FTSE UK All-Share Index and Vanguard FTSE Developed Europe ex UK Equity Index Plus.

Coutts Managed Balanced is the only fund in the IA Mixed Investment 20-60% Shares sector to have attracted more than £200m in investor inflows, growing from £4.4bn to £5.6bn over the course of a year.

Although the fund’s 9.2% one-year return falls under the sector average of 10.2%, performance ultimately added £432m to the fund while investors added a further £784m in net new money.

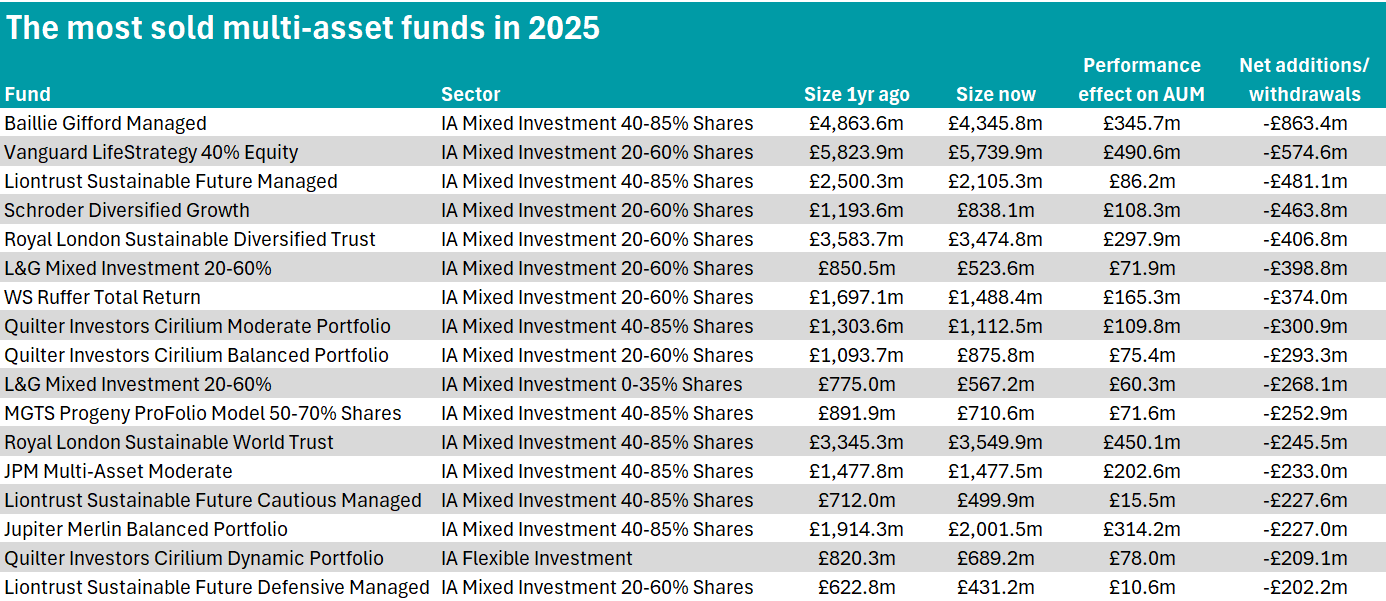

Multi-asset funds with the largest outflows

Source: FE Analytics. Market movements data for unit trusts and Oeics

Unlike its LifeStrategy counterparts, Vanguard LifeStrategy 40% Equity haemorrhaged £575m in 2025 – although performance added back £491m. This meant the fund’s assets only fell by around £100m between 2024 to 2025, from £5.8bn to £5.7bn.

However, Baillie Gifford Managed was the most sold fund across the four assessed sectors in 2025, with investors claiming £863m in redemptions.

Co-managed by Iain McCombie and Steven Hay, the fund targets capital growth over five-year rolling periods through investing predominantly in growth stocks.

RSMR analysts noted that the fund is diversified at the individual stock level but that “its factor risk through the growth bias is not low”.

The fund managed an 8.9% gain over one year, falling below the IA Mixed Investment 40-85% sector average of 11.6%. Going into 2025 with £4.9bn in assets, the fund subsequently shrank to £4.3bn.

Meanwhile, the only fund from the IA Flexible Investment sector to see investor withdrawals creep over £200m in 2025 was Quilter Investors Cirilium Dynamic Portfolio, causing assets under management (AUM) to fall from £820m to £689m. Performance gains of £78m were overshadowed by outflows of £209m.

The fund, which is co-managed by Ian Jensen-Humphreys, Sacha Chorley and CJ Cowan, also fell short of the 12% one-year return average in the IA Flexible Investment sector with an 11.4% gain.

Finally, L&G Mixed Investment 20-60% was the only fund from the IA Mixed Investment 0-35% Shares sector to have more than £200m in outflows over the assessed 12-month period, shrinking from £775m to £567m.

It beat the sector average one-year return by over one percentage point, gaining 11.6% (or £60m). However, it lost £268m through investor redemptions.