Hargreaves Lansdown has cut its headline platform and dealing fees for the first time in more than a decade, narrowing the gap with cheaper rivals in an increasingly competitive market.

But while many investors will pay less under the new structure, higher caps and newly introduced charges mean the changes will not benefit everyone equally.

The headline reduction in platform fees from 0.45% to 0.35% is “clearly welcome”, said Chris Bredin, consultant at the lang cat, “and brings Hargreaves Lansdown closer to where the wider market has been heading for some time. However, the details matter.”

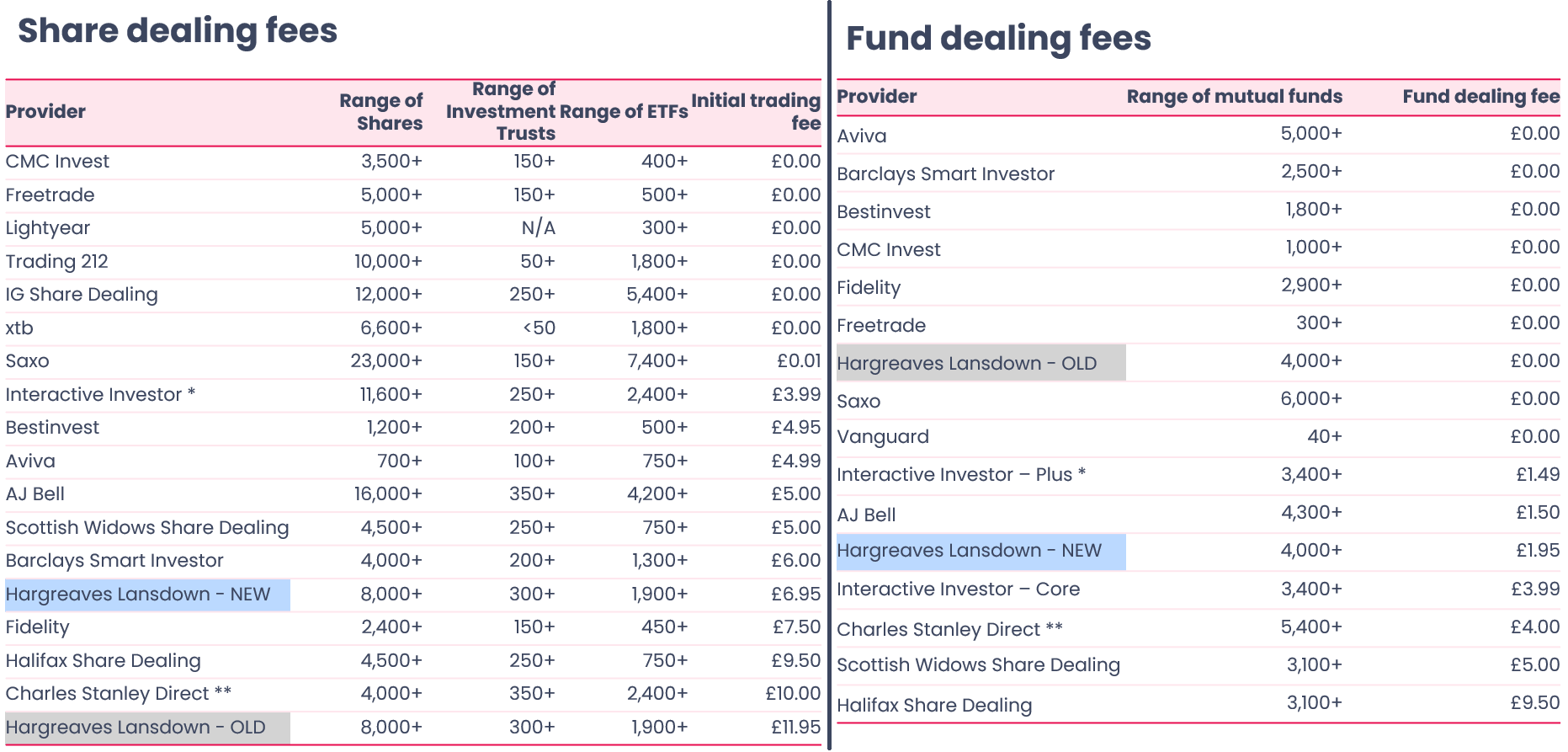

From 1 March 2026, the platform fee on ISAs and SIPPs will fall from 0.45% to 0.35%, while online share dealing costs will be cut from £11.95 to £6.95, as shown below. At the same time, Hargreaves Lansdown will introduce a £1.95 dealing charge on fund trades and increase the annual cap on charges for holding shares in certain accounts.

Comparison of share and fund dealing fees

Source: Boring Money

The changes make Hargreaves Lansdown look more competitive at first glance. But equity analysts at Jefferies described the changes as likely “a response to outflows to other, cheaper platforms”, noting that while ongoing account fees are falling, Hargreaves Lansdown “remains higher than, for example, AJ Bell”.

That interpretation is reinforced by the way the changes redistribute costs across different investors. While those holding funds in ISAs or SIPPs will generally benefit from the lower platform fee, others may see the impact diluted – or even reversed – once new charges and higher caps are taken into account.

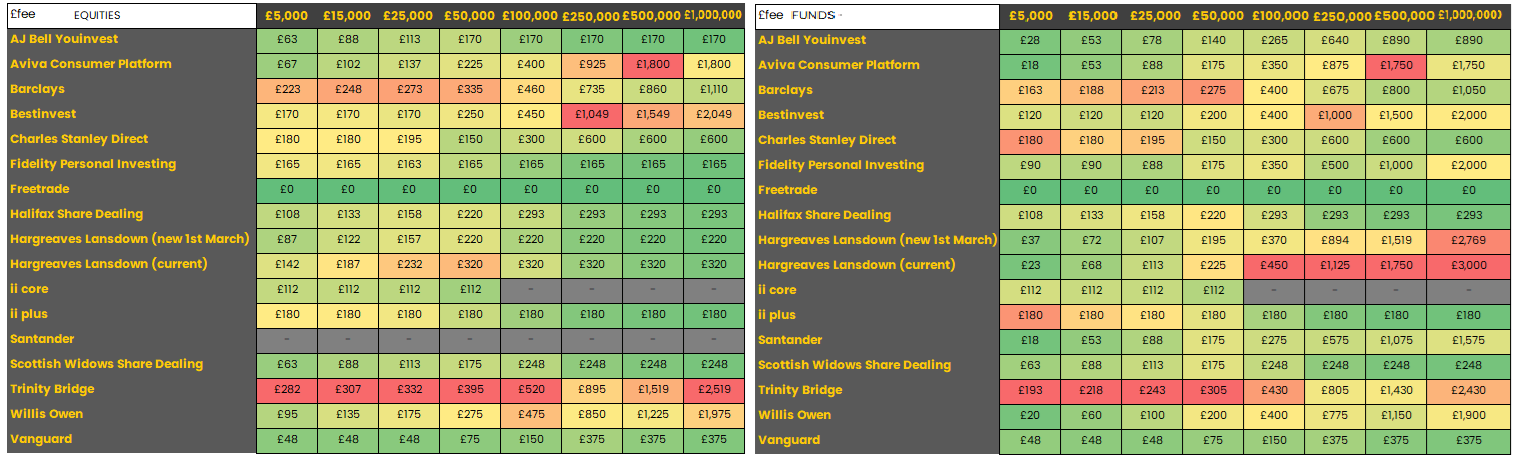

For buy-and-hold fund investors, the direction of travel is broadly positive. Analysis by consumer group Boring Money suggests that many customers who mainly hold funds and trade infrequently will pay less overall, bringing Hargreaves Lansdown closer to the middle of the pack among large platforms, as the charts below suggest. However, it added that AJ Bell and Barclays are still likely to be cheaper in most cases.

Lower share dealing charges will also appeal to more active investors who trade equities regularly, particularly those using regular investment plans, which remain free.

These changes align Hargreaves Lansdown more closely with a market that has steadily pushed transaction costs down over the past decade.

Where the picture becomes more complicated is for investors with mixed portfolios or large holdings of shares and exchange-traded investments. Under the new structure, the annual cap on charges for holding shares in an ISA will rise from £45 to £150, while a new 0.35% charge will apply to shares held in Fund & Share accounts, also capped at £150 a year.

“For some investors, these changes may dilute the benefit of the headline fee cut,” Bredin said. “The increase in the ISA charge cap from £45 to £150 for exchange-traded investments, the introduction of charges for Fund & Share accounts and the new fund trading fee may not be well received, especially among long-standing customers who have become accustomed to simple pricing structures.”

The effect, he added, depends heavily on how investors use the platform. “The type of account, how often and what investors trade in can make a huge difference to the overall fees.”

ISA pricing scenarios: mixed funds and shares

Source: Boring Money

Jefferies highlighted that the new structure shifts some of the cost burden towards investors holding shares rather than funds. It also noted that the £150 cap would be reached on a share portfolio of just over £42,000, compared with the previous £45 cap, materially increasing costs for some customers with medium-sized balances.

Investors have been expressing concerns in online forums too, with one Reddit user and Hargreaves ISA-only client deciding to switch.

“This change would mean my fees will more than triple (£45 to £150). I have decided to transfer to Fidelity to take advantage of their cashback offer,” they said. “I already have a SIPP with them, so the £90 fee cap won't change. Will reassess in 18 months and perhaps transfer to AJ Bell if the £42 cap remains.”

One area where Hargreaves Lansdown does stand out more clearly is its ready-made pension offering. The account charge on the Hargreaves Lansdown Ready-Made Pension Plan will fall from 0.45% to 0.15%, while the underlying fund charge remains at 0.30%, resulting in an all-in cost of 0.45%.

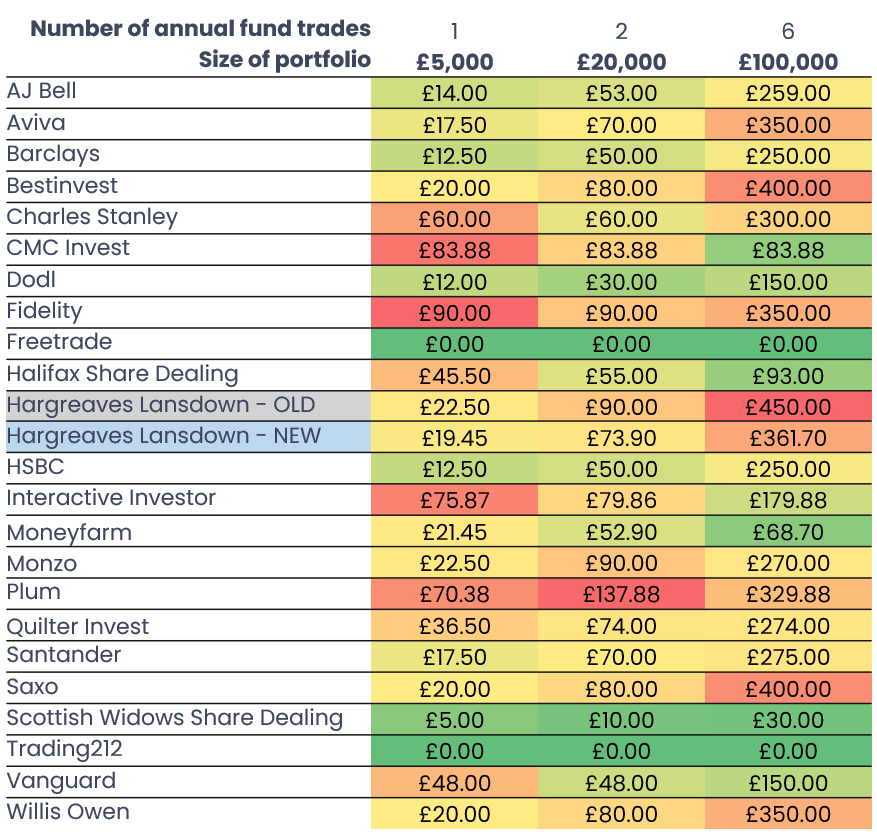

Comparison of costs for SIPP investors (10 trades per year)

Source: The lang cat

Boring Money said this places Hargreaves Lansdown “in the unusual position of being one of the cheapest solutions in the market” for investors who want a set-and-forget pension.

Its analysis suggests the ready-made pension undercuts Vanguard and most robo-advisers, and is now in line with key competitor AJ Bell, whose ready-made pension is also charged at 0.45%. Interactive investor remains marginally cheaper once pension pots rise above £100,000.

Holly Mackay, chief executive at Boring Money, said the changes were “broadly pretty good news for Hargreaves customers”, but stressed that the benefits were not evenly distributed.

Customers with ISAs holding a mixture of funds and shares could end up paying more on larger accounts because of the higher cap on shareholding charges, she said.

ISA pricing scenarios: funds

Source: Boring Money

How Hargreaves Lansdown now compares with the rest of the market therefore depends less on a single headline rate and more on individual behaviour.

For investors who primarily hold funds and trade infrequently, the fee cuts bring Hargreaves Lansdown closer to its peers. For those with larger portfolios of shares or a more complex mix of assets, cheaper alternatives remain available.

And for investors looking to outsource pension decisions entirely, the ready-made pension offering stands out as a bright spot.