Long overshadowed by legacy issues and years of lacklustre performance, the £2.6bn Invesco UK Equity High Income and £1.1bn UK Equity Income funds have staged something of a resurgence, inviting a fresh look at their numbers.

Invesco UK Equity High Income has logged a muted 10-year return of 37.8%, placing it in the fourth quartile of the IA UK All Companies sector. Its one-year performance (calculated to year-end) is much more promising, with the fund gaining a first-quartile 26.7%.

It is a similar story with Invesco UK Equity Income, which went from a fourth-quartile 33.4% gain over 10 years to a first-quartile one-year return of 24.5%.

Their resurgence follows a period of significant transition, with the funds passing through different management regimes.

The funds in question were most prominently managed by star manager turned disgraced investor Neil Woodford until he left Invesco Perpetual for pastures new in 2014.

Mark Barnett took over both mandates in 2014 and managed the funds until May 2020, after which he exited following a sustained period of underperformance.

They are now in the hands of Ciaran Mallon and James Goldstone.

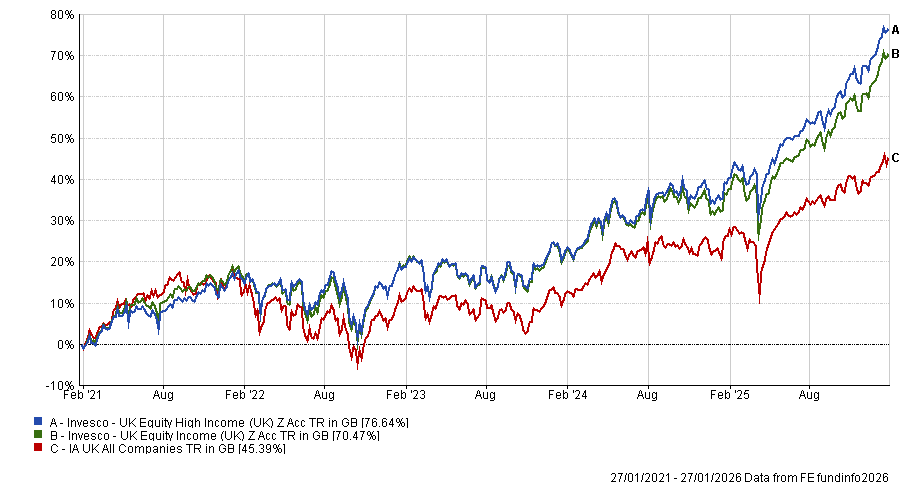

Performance of the funds vs sector over 5yrs

Source: FE Analytics

As shown above, under Mallon and Goldstone’s tenure, the performance of the funds has seen some improvement but is this enough to make them attractive to fund pickers?

To find out, Trustnet asked fund selectors whether they would buy, hold or fold Invesco UK Equity High Income and Invesco UK Equity Income.

First up, Ben Yearsley, director at Fairview Investing, said he would sell both funds.

“These are yesterday’s funds and not tomorrow’s,” he said. “Invesco was the go-to for UK equities for many years, but where do they stand now? Where’s their edge? I’m not sure there is one.”

Despite the recent surge in performance, he said both funds have been in decline since the Woodford years and are “a fraction” of what they used to be.

“It’s clearly never easy managing shrinking funds,” he noted. “If I want a core holding, then I will buy a fund like Artemis Income or JO Hambro UK Equity Income.”

However, the majority view is to hold.

Darius McDermott, managing director at Chelsea Financial Services, said: “Both Invesco UK Equity High Income and Invesco UK Equity Income benefit from a clearly defined value style, which has been the right place to be in the UK market over the past five years.”

A disciplined approach, backed by a strong UK value team, helps explain the marked improvement in one-year performance after a much tougher longer-term period, he noted.

Despite the recent resurgence of both funds, he said he would not be tempted to buy. As for new investors, he said there are “stronger alternatives elsewhere in the UK value and income space”.

However, for existing holders the recent recovery is “encouraging”, with McDermott arguing against selling.

For Jason Hollands, managing director at Bestinvest, the two funds also sit firmly in the ‘hold’ camp, with recent performance proving to be “encouraging”.

“That said, we are not currently buyers of these funds as we believe there are stronger options available elsewhere for investors wanting funds that invest in dividend-generating UK stocks.”

He pointed to TM Redwheel UK Equity Income and its sibling the Temple Bar Investment Trust as alternatives – both of which tilt toward value.

Sheridan Admans, founder of Infundly, added the legacy underperformance of both funds has been shaped by weak stock selection and an unfavourable market backdrop – most notably the Brexit overhang – for UK value and income strategies.

The funds’ improving performance since 2020 appears driven less by wholesale strategic change and more by tighter portfolio construction, improved risk control and more consistent execution within a familiar income framework, he noted.

Investment style also plays a factor, Admans said, with the decade leading up to Covid dominated by growth and momentum, thanks to low interest rates and strong performance from long-duration assets.

Post-Covid, the regime shifted, with higher inflation, tighter monetary policy and a renewed focus on balance sheets and cash generation, which has favoured the types of businesses the Invesco funds hold.

“That said, long-term performance remains a constraint,” he said. “The pre-2020 period continues to weigh on headline metrics, explaining why both funds still screen weakly over extended horizons despite recent recovery. It is also worth noting that during the manager transition phase the funds were still experiencing strong outflows.”

Invesco UK Equity High Income has a stronger yield bias and higher sector concentration, making it more sensitive to value and income leadership, Admans said.

He noted it remains “unapologetically income-led” and has improved execution. Portion sizing and risk control also appear tighter, allowing the fund to translate its yield bias into relative performance when conditions are supportive.

“It is therefore best viewed as a ‘hold’ allocation within income-focused portfolios,” he said.

In contrast, Invesco UK Equity Income has a “more balanced emphasis on income and capital growth” and offers greater flexibility when selectively increasing UK exposure.

“Against a backdrop of still-discounted UK valuations driven by subdued growth expectations, the portfolio’s broader remit allows it to be better capture emerging growth opportunities alongside income,” said Admans.

“On this basis, the fund is best viewed as a ‘buy’ within a selective UK allocation.”