It has been a tough year for investment trusts with discounts widening, forcing some companies to merge or wind down while others opted for less extreme measures such as manager changes or aggressive share buyback policies.

Although the average discount has narrowed from its October low of 16.9%, investment companies still trade at a double digit discount (11.1%). Indeed, the average discount remained above 10% all year, the first time this has happened since the financial crisis in 2008.

Trusts have suffered from the rising interest rate environment, which has increased the yield on cautious investments such as bonds and weakened the case for owning higher-risk assets.

This has led to a number of changes across the space, including four mergers, eight liquidations and eight manager changes, according to data from the Association of Investment Companies (AIC), although one further manager switch is in the cards before the year’s end.

Yet it was not all bad news. It was a record year for share buybacks with some £3.6bn repurchased by boards, an increase of 32%, while a total of £6.3bn was paid out in dividends, up 14% on last year, the AIC found.

Richard Stone, chief executive of the AIC, said: “Investment company boards have worked hard this year to deliver value to shareholders in challenging market conditions. For some, this has meant buying back shares, while others have taken the more radical steps of changing manager, merging with another investment company or even winding up the company.”

Below, Trustnet looks at the main changes to the investment trust landscape over the past 12 months.

Mergers, liquidations and manager changes

Starting with those that could no longer continue, eight trusts agreed to go into liquidation this year, as the table below shows.

Source: The Association of Investment Companies

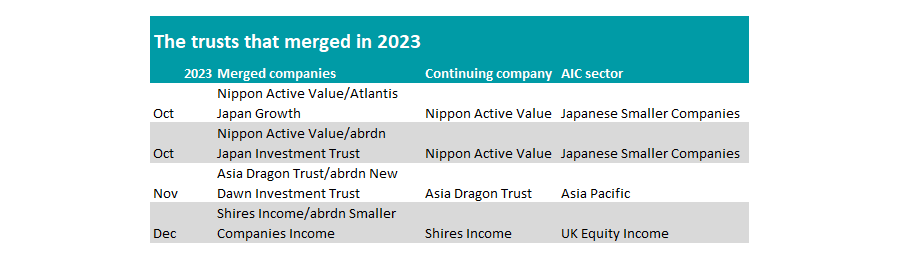

Turning to the mergers, two trusts were absorbed into Nippon Active Value: Atlantis Japan Growth and abrdn Japan Investment Trust.

Asia Dragon Trust merged with abrdn New Dawn Investment Trust, taking the combined investment company into the FTSE 250, with a number of changes made to the portfolio as a result.

Lastly, scheduled to take place in December is the merger between Shires Income and abrdn Smaller Companies Income.

Source: The Association of Investment Companies

However, there were also an additional four mergers announced this year that are scheduled to take place in the first half of 2024 – pending shareholder approval.

These are: Henderson High Income with Henderson Diversified Income; JPMorgan Mid Cap with JPMorgan UK Smaller Companies; Troy Income & Growth with STS Global Income & Growth; and abrdn China Investment Company with Fidelity China Special Situations.

In terms of manager changes, several large trusts changed hands this year. Most notably, Mid Wynd International is to be run by Lazard after Artemis’ Simon Edelsten announced his retirement.

MIGO Opportunities is another name on the list, although it will remain under the stewardship of Nick Greenwood, who is moving from Premier Miton to Asset Value Investors (AVI).

Source: The Association of Investment Companies

Launches, buybacks and fee changes

On the positive side, two trusts came to market this year – Ashoka WhiteOak Emerging Markets Trust listed on the London Stock Exchange after raising £31m and Onward Opportunities was quoted on AIM raising £12.8m.

Meanwhile, £1.1bn was fundraised by existing trusts through share issuance this year, down from £5.2bn in 2022. Hedge fund BH Macro raised the most cash (£315m), capitalising on Brevan Howard Capital Management’s ability to exploit market inefficiencies in times of economic change and monetary policy movements.

The higher interest rates allowed UK and Global Equity Income trusts to take in more money (£175m and £162m respectively). City of London (£106m) and JPMorgan Global Growth & Income (£153m) raked in the bulk of the new money from these sectors respectively.

Turning to buybacks, in addition to the £3.6bn of share buybacks in the year to date – the highest since records were first recorded in 1996 – there has been an additional £637m of shares repurchased through tender offers and redemptions, making £4.2bn in total.

Stone noted: “Discounts on investment companies were historically wide this year and that has increased the attraction of share buybacks. Towards the end of the year we have seen discounts narrow as investors begin to believe that interest rates have peaked and could be heading downwards in the not too distant future.”

For consumers, there were some positive fee changes as companies vied to become more competitive. In total 26 investment companies changed their fees with 11 directly reducing their base costs, while 10 moved to reduce their tiered fee structure.

A final word on performance

Despite the tough backdrop this year, the average investment company has generated a share price total return of 5.1% in the year to date (to 8 December), the report found.

The best performing sector over this period has been IT Private Equity with a 48.7% return, followed by IT Technology & Technology Innovation (38.8%), IT North America (16.6%) and IT India/India Subcontinent (15.5%).