The Nordics are not traditionally a favourite region for equity income managers, particularly compared to dividend-rich markets such as the UK. However, Michael Crawford, manager of Chawton Global Equity Income, has more than 20% of his fund in the Nordics and believes the opportunities for income in the region have been consistently underestimated.

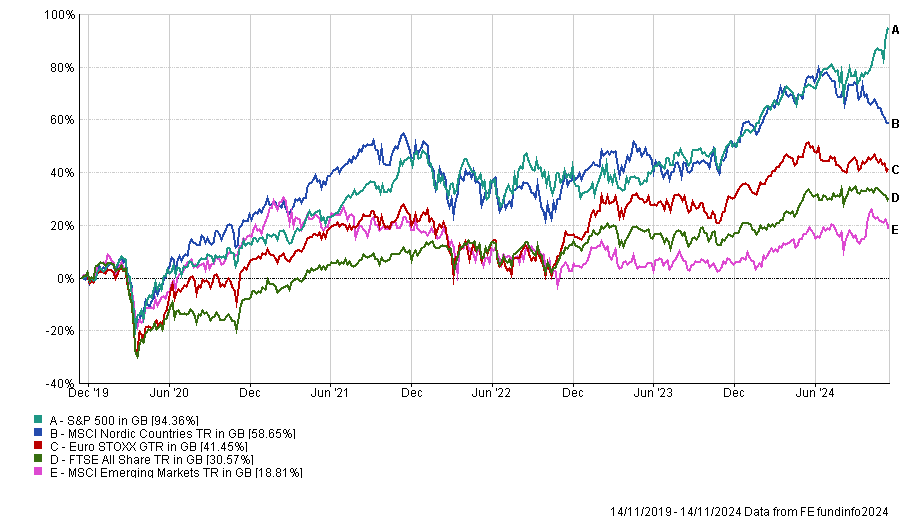

As well as delivering strong dividends, the region has enjoyed impressive results in recent years, matching or surpassing many of the leading indexes. Indeed, over half a decade, the MSCI Nordic index has performed well, rising in value by 58.7%, better than the Euro STOXX, the FTSE All Share and the MSCI Emerging Markets indices.

Performance of indices over 5yrs

Source: FE Analytics

Nordic stocks generally benefit from a long-term focus and emphasis on decentralised management, particularly in the mid-level, which has allowed the region to produce industry leaders such as Skype, Spotify and Nokia. For Crawford, a former investment manager at Deutsche Asset Management, this makes the Nordics a “prime hunting ground” for both income and return opportunities.

Below, Crawford outlines his favourite Nordic stocks, encompassing both industry leaders and some lesser-known plays that are benefitting from the Nordics' unique approach to business management and wider trends.

Atlas Copco

Crawford identified Swedish industrial company Atlas Copco, which manufactures vacuum and compressed air technology, as a favourite stock. Its share price has risen by 95% over the past five years.

Performance of stock over 5yrs

Source: Google Finance

Atlas Copco has benefitted from its efforts to diversify rather than specialise. “The company has exposure to many areas of the industrial cycle and extensive end-user markets and is enormously diversified geographically. The huge scale benefits and R&D have helped ensure Atlas Copco remains more innovative than the competition.”

One area of particular interest is semiconductor manufacturing. As the latest transistors and microchips get smaller, it becomes more difficult to remove potential contaminants, he explained. As a result, most semiconductor production is now done in a vacuum, enormously benefitting businesses such as Atlas.

As a result, for Crawford, Atlas is a great play on the rise of companies such as Nvidia and other microchip-dependent technologies such as smartphones.

“Rather than being content sitting where they are, Atlas is constantly trying to identify new areas where their skills may apply”, he added.

Elopak

Another favourite for Crawford was the cardboard carton/liquid storage manufacturer Elopak. Priced at just €3.65, he feels the stock is exceptionally undervalued despite playing well with global trends.

Performance of stock over 5yrs

Source: Google Finance

Similar in offering to the current market leader Tetra Pak, Crawford said Elopak has enormous disruptive potential and particularly benefits from a global push for sustainability. New regulations, such as EU countries' goal to reduce plastic packaging by 15% by 2040, have served as a tailwind for the growth of cardboard carton producers such as Elopak.

Moreover, the company has enormous potential for further geographical expansion. It is increasingly pushing into the US, where the liquid food packaging industry is comparatively less mature, and into developing markets such as India and Africa.

Crawford added: “They are barely used in emerging countries where the product would be a massive advance on existing packaging, especially given the lack of cold storage.”

This programme of both geographical expansion and wider regulations has given the firm enormous growth potential. Indeed, with a forward price-to-earnings ratio of just 13x but a dividend yield of 3.8%, Crawford concluded that the stock was a highly underappreciated play in the equity income space.

Novo Nordisk

Finally, Crawford identified leading pharmaceutical company Novo Nordisk, which currently has a 4.8% weighting in his fund.

Over the past five years, the company has gone from strength to strength, with the share price swelling by 282% over the past half a decade to DKK723.

Performance of stock over 5yrs

Source: Google Finance

For Crawford, what separates Novo Nordisk from its competitors is that it remains highly specialised. “When you put it in the context of the overall pharmaceutical sector, its most distinctive characteristic is simply its focus,” he said.

Rather than diversifying into other pharmaceutical products, Novo Nordisk has remained entirely focused on treating diabetes, which means its medicines in this field have advanced much faster than its competitors.

For Crawford, this is a unique characteristic of being based in Denmark. “Because it is in Denmark, which has this culture of innovative, organic R&D development, the whole ethos of the company is to generate profits and cash flow to pursue further research,” he explained.

If Novo Nordisk had been based in the US or Europe, Crawford thinks the business would have become more diverse. However, by diversifying, the business would have lost many of the advantages that originally made it unique.

Crawford admitted that Novo Nordisk's rise in some ways owed to “an element of luck” but the fact that diabetes medication requires constant advancements means the firm is well positioned to grow further.