Caledonia, Oakley Capital and Invesco Bond Income Plus could all be good options this year, according to experts at Winterflood Investment Trusts, who added these names among others to its recommended list for 2024.

Having covered the equity trust moves yesterday, today Trustnet looks at the alternative assets space, including multi-asset, debt, private equity, property and infrastructure.

Multi-asset

We start with the IT Flexible Investments sector, where Caledonia Investments has come into the list for Personal Assets Trust. Neither beat the FTSE All Share benchmark in 2023 or the average fund in the sector, but Caledonia held up marginally better with a 0.5% gain versus a 0.4% gain for the Troy-managed trust.

Longer term the performance of Caledonia is significantly ahead. It has been the best trust in the sector over three, five and 10 years, making double the returns of Personal Assets over the past decade, although it has been significantly more volatile.

Performance of trusts vs sector and benchmark over 10yrs

Source: FE Analytics

Emma Bird, head of research at Winterflood, and her team, wrote: “Caledonia invests across a range of quoted and unquoted equity, with the latter split across direct investments in mid-market UK companies and fund investments in US and Asian private equity funds. In our view, its wide discount [31.7% at the end of 2023] is representative of a continued theme of investor scepticism towards private market valuations.

“However, the fund successfully realised its largest asset (8.7% of NAV as at 30 September) at a 27% uplift to its 31 March carrying value during 2023, generating £255m of realisation proceeds, and holds 32% in publicly listed equity. We believe this should provide some comfort with respect to valuation accuracy and highlight that in any case this scepticism is inapplicable to a large proportion of the portfolio.”

Fixed income

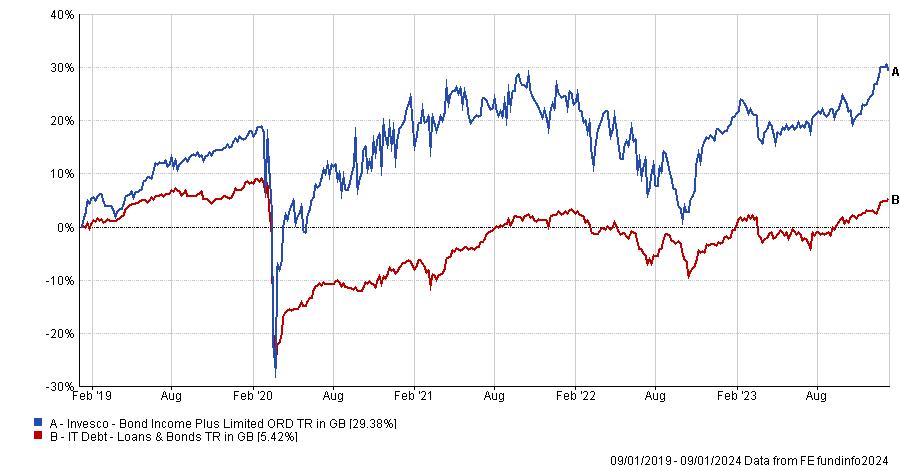

Turning to bonds, Invesco Bond Income Plus takes its place on the list while Blackstone Loan Financing left after it put forward proposals of a managed wind-down last year.

The Invesco trust has been the second best performer in the IT Debt – Loans & Bonds sector over five years and is third out of six names over the past decade, up 61.7%.

Performance of trust vs sector over 5yrs

Source: FE Analytics

Winterflood’s analysts said: “As 2023 unfolded, market expectations for a ‘hard landing’ gave way to rate cut optimism and the default cycle remained benign, leading to a strong year for the fund.

“With the managers having increased credit quality over this period (61% of portfolio rated BB or higher as at 30 November 2023 vs 50% as at 31 December 2022), we believe that the largely fixed rate portfolio is well positioned for the current environment.”

Shares trade on a small premium, which allowed it to raise £11m last year, while the managers will use gearing when the market is in their favour.

Biopharma Credit and CVC Income & Growth were retained on the list this year.

Private Equity

Winterflood analysts upped their number of private equity trust recommendations from two to four to reflect the “value available in the sector at present”.

Here, Oakley Capital came in. The analysts said: “We think Oakley Capital Investment’s underlying portfolio quality stands it in good stead to navigate difficult conditions, given average EBTIDA growth of 21% year-on-year for 2023, and the fact it has achieved an average uplift of 50% since inception (before IU Group realisation last year). Moreover, Oakley Capital and its directors own 11.7% of share capital, demonstrating considerable ‘skin in the game’.”

Elsewhere, Seraphim Space Investment Trust made the list as it offers “considerable value, supported by structural tailwinds” while Pantheon took the place of abrdn Private Equity Opportunities Trust as it is “offering value, supported by a significant share buyback programme”.

HgCapital Trust* remained on the list from last year.

Property

In the world of property, LXi Reit is out after a strong 2023 as the shares have “notable re-rated” since its takeover approach by LondonMetric last year. Tritax Eurobox was also removed by Bird and her team.

However, Urban Logistics REIT was added due in part to its 24% discount, which they said “offers attractive value”.

The fund continues to benefit from supportive sector fundamentals and has a good debt profile while its dividend is fully covered, the team said.

“The underlying occupational fundamentals of the last mile logistics sector remain strong and we think that there is scope for a re-rating in a more stable interest rate environment,” they noted.

Impact Healthcare also came in this year, with the trust offering investors “well-managed exposure to UK care homes and, in our opinion, offers an attractive prospective dividend yield of 7.6%”.

TR Property and Schroder Real Estate Investment Trust were retained from last year, keeping the allocation to the sector at four trusts.

Infrastructure and renewable energy

Lastly, in the infrastructure and renewable energy space, Sequoia Economic Infrastructure – added last year – was removed. The team believed the “considerable” floating rate exposure in its portfolio was well-placed to capture short-term rate rises but said this opportunity has now “largely played out”.

In its place, Downing Renewables & Infrastructure has been added to the list for 2024 on the back of an “attractive, diversified and fully operational” portfolio of hydro, solar, wind and grid services assets. They highlighted the net asset value (NAV) discount of 26% (versus the peer group average 17%) presented “an attractive entry point”.

The team retained the recommendations for Gresham House Energy Storage, JLEN Environmental Assets, BBGI Global Infrastructure and Cordiant Digital Infrastructure.

*FE fundinfo is a HgCapital portfolio company.