Columbia Threadneedle Investments has increased its allocation to investment trusts to gain exposure to specialist property, renewable energy and infrastructure-backed loans.

Adam Norris, an investment manager within Columbia Threadneedle’s multi-manager team, said when bond yields peaked in October 2023, many investment trusts looked extremely cheap.

Columbia Threadneedle took this opportunity to top up its exposure to GCP Infrastructure, which was delivering double digit yields, and to invest in LXi REIT (which it had previously owned and sold, and which just announced a merger with LondonMetric Property).

The multi-manager also invested for the first time in Greencoat UK Wind, the Renewables Infrastructure Group and Tritax Big Box REIT.

The Renewables Infrastructure Group provides inflation-linked cash flows and back in October, it was trading close to its IPO price 10 years ago.

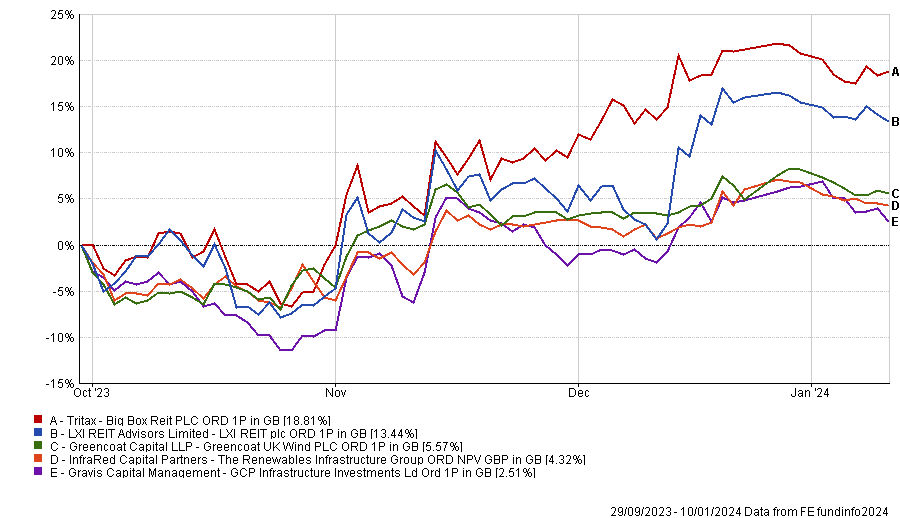

Tritax, meanwhile, was trading at its 2016 price in October 2023 and its shares have risen almost 25% since then, which shows the extent of the recent dislocation, Norris said.

Share price performance of trusts since October 2023

Source: FE Analytics

The past two years have been difficult for investment trusts. Rising bond yields meant that investors were looking for additional income, which they could find elsewhere, leading to selling pressure. The cost disclosure framework is an added complexity that deterred some wealth managers and asset allocators from closed-ended vehicles.

These circumstances led to some investment trusts becoming available at wide discounts to their net asset values. However, Norris warned that buying deeply discounted investment trusts has not proven to be a successful strategy. Columbia Threadneedle bought Greencoat UK Wind at a modest discount, for instance.

There are ample rewards for being “open-minded to closed-ended,” Norris continued. Columbia Threadneedle owned the Round Hill Music Royalties Fund, which was taken private in October 2023 at a 63% premium.

The CT Multi-Manager Navigator Distribution fund had a 17% exposure to investment trusts in 2021 which it reduced to 11% in 2022, then increased again to around 15% by the end of 2023. As a result, “we’ve got a more diversified group of assets than we’ve had for a long time,” Norris said.

Nonetheless, there are several reasons deterring Columbia Threadneedle from hiking its investment trust exposure further.

There are compelling opportunities elsewhere in the portfolio competing for capital, especially in bonds, where the funds Columbia Threadneedle invests in are tapping into diverse opportunities across asset-backed securities, floating rate notes and other areas. Columbia Threadneedle’s multi-manager team moved 15% of assets into bonds ahead of the recent rally.

Furthermore, the team usually uses open-ended funds for equities because they are often cheaper, the governance structure is less complex, and it is helpful to balance portfolios at the NAV price, but the team prefers investment trusts for illiquid assets.

Rob Burdett, head of multi-manager solutions, sounded a further note of caution; there is a risk that all the moving parts of investment trusts (such as the share price, the discount or premium to net asset value and gearing) can work against you at the wrong time, he said.

LXi REIT’s share price fell 45% in a single month at the start of the Covid pandemic, while the FTSE All Share was down 25%. “It affected our performance and volatility just when you want the moving parts to help you,” Burdett said.

Share price performance of LXi REIT vs FTSE All Share over 5yrs

Source: FE Analytics

Columbia Threadneedle tried to buy more shares in LXi REIT at the bottom of the market but was not able to do so, although Burdett and his colleagues held onto their existing shares which eventually outperformed open-ended property funds by 40-50%. They sold at premium in August 2022.