Bond managers have been navigating through stormy waters in the past few years, as interest rates were hiked rapidly and yields rose to record levels, making it difficult to generate alpha.

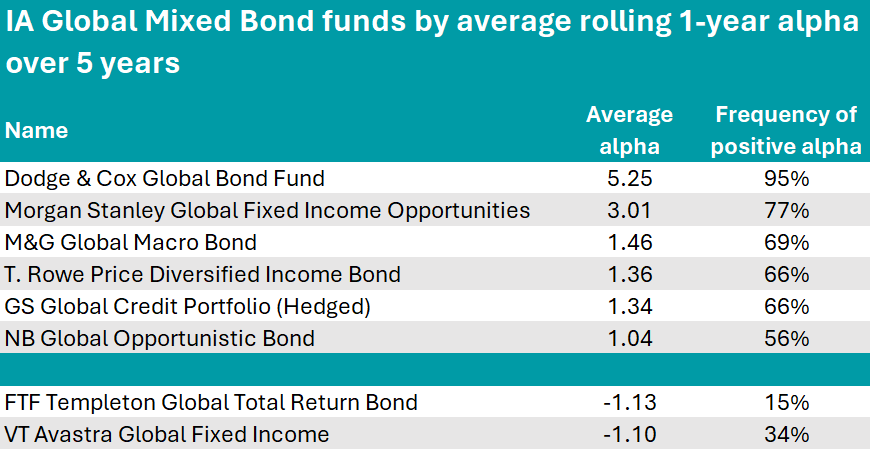

Among all global bond funds with at least a five-year track record, those in the IA Global Mixed Bond sector were most successful at beating their benchmarks. But even here, only 18 out of the 34 funds in consideration consistently outperformed their benchmarks and just six had an alpha greater than 1, meaning that the managers generated 1% of excess returns or more.

Alpha scores were even lower for global government bond funds and global high-yield funds, as the Trustnet study below shows.

For this research, we used data from FinXL and looked at average alpha scores across 61 year-long periods measured monthly since 2018.

We begin with the IA Global Mixed Bond sector, where managers can flexibly allocate resources across credit type and currency spectrums.

The first vehicle to stand out was Dodge & Cox Global Bond fund, which not only achieved an average alpha of 5.25, but also kept a positive alpha for most of the past five years (95% of the time) – meaning that it outperformed its benchmark in almost all market conditions.

The fund invests with a total-return mindset that is consistent with long-term capital preservation. Regarding the asset allocation, the investment committee currently has a preference for corporate bonds (41.5%) and government bonds (31.4%), while credit quality is mostly AA (27.9%) and BBB (27.8%).

Source: FinXL

At 3.01 of average alpha, Morgan Stanley Global Fixed Income Opportunities took the second place on the podium while also achieving the second-best frequency of average alpha, maintaining a positive score in 47 of the 61 year-long periods.

The $4bn fund is a five FE fundinfo Crown-rated strategy managed by Michael Kushma since 2011. He was joined by Utkarsh Sharma in 2020 and FE fundinfo Alpha Manager Leon Grenyer in 2022.

The team takes top-down macroeconomic views to determine the portfolio’s beta positioning, but also conducts bottom-up analysis for taking active decisions.

Assets are splits between credit (39.1%), securitized assets (35.9%) and government bonds (18.3%).

M&G Global Macro Bond was another fund to stand out with its average alpha of 1.46 and sizable portfolio of £1.1bn. FE Investments analysts highlighted manager Jim Leaviss’ success in calling macroeconomic movements.

“The fund offers attractive diversification characteristics and has proven effective at preserving capital during periods of market stress, such as March 2020,” they said.

“Leaviss benefits from working closely with other portfolio managers that hold niche expertise in emerging markets and currencies, while the credit research team is deep and experienced.”

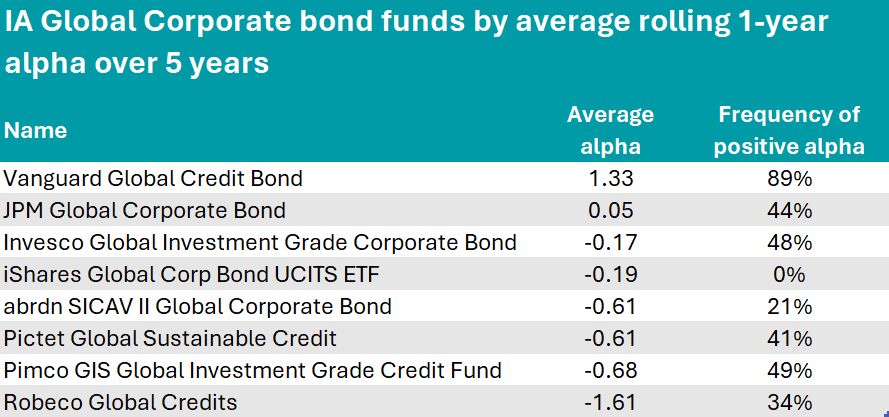

We continue with the IA Global Corporate Bond sector, where the only fund that consistently maintained an alpha above 1 was the $1bn Vanguard Global Credit Bond, averaging at 1.33.

Renowned for passive investing, Vanguard has also achieved success within its range of active funds, which includes this strategy.

Analysts at Rayner Spencer Mills Research (RSMR) described it as a core global credit fund, designed to provide “quality exposure” to global credit markets.

“It can draw on the research and expertise one of the largest fixed income teams around, aiming to add incremental value through stock selection rather than taking big bets,” they said.

“This is a high quality core offering, backed by one of the largest credit analyst teams in the world, providing a sustainable and diversified income stream.”

The price is a mere 0.35% and in the past five rolling years, it had a positive alpha in 54 of the 61 periods considered.

Just half a point above zero, JPM Global Corporate Bond was the only other fund with a positive average alpha. With $5.9bn of assets under management (AUM), this sizable strategy focuses on investment-grade bonds issued primarily in the US, which make up 59.1% of the portfolio.

The remaining funds in the sector didn’t hit positive territory, with the lowest alpha being that of the Robeco Global Credits fund, which stood at -1.61.

Source: FinXL

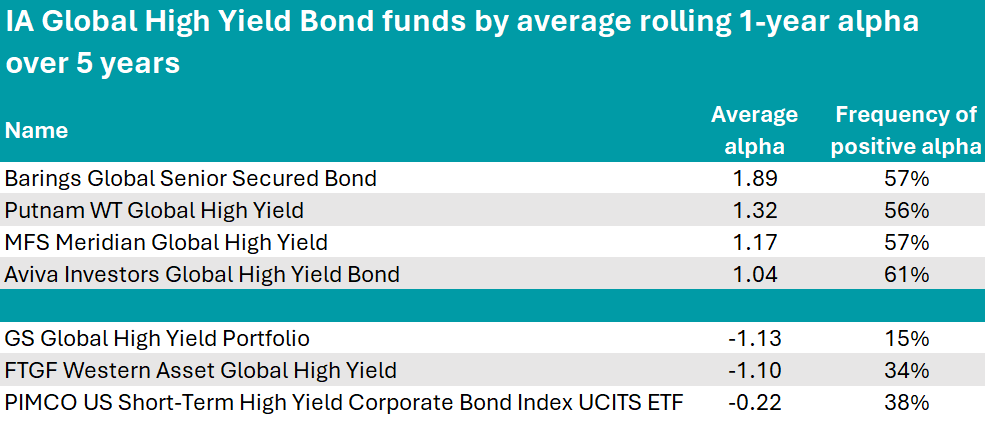

In the IA Global High Yield Bond sector, more funds managed an encouraging alpha track record.

The top vehicle was the $1.7bn Barings Global Senior Secured Bond fund, which combines a regional allocation strategy with fundamental selection of credits in the US (which make up 48.9% of the portfolio) and Europe (41.6%).

Its average alpha was 1.89.

Another sizable fund that proved its ability to outperform a benchmark was the $3.8bn Aviva Investors Global High Yield Bond fund, achieving an average alpha of 1.04.

It has a much higher allocation to the US (60%) compared to the Barings fund, which it outperformed between 2022 and 2023 only to fall behind again, as the chart below shows. The two vehicles are just 33% correlated.

Performance of fund against sector and index over 5yrs

Source: FE Analytics

The rest of the sector remained predominantly in positive territory, albeit with unimpressive numbers.

FE fundinfo Alpha Manager Konstantin Leidman, who has taken over the sole leadership of the Wellington Global High Yield Bond fund after his co-manager Christopher Jones retired in June 2023, has generated an average alpha for the fund of 0.34.

Three vehicles were in negative territory: PIMCO US Short-Term High Yield Corporate Bond Index UCITS ETF (-0.22), FTGF Western Asset Global High Yield (-1.10) and GS Global High Yield Portfolio (-1.13).

Source: FinXL

IA sectors previously in this series: UK Equity Income, UK All Companies, Global, Global Equity Income, Sterling bonds, smaller companies.