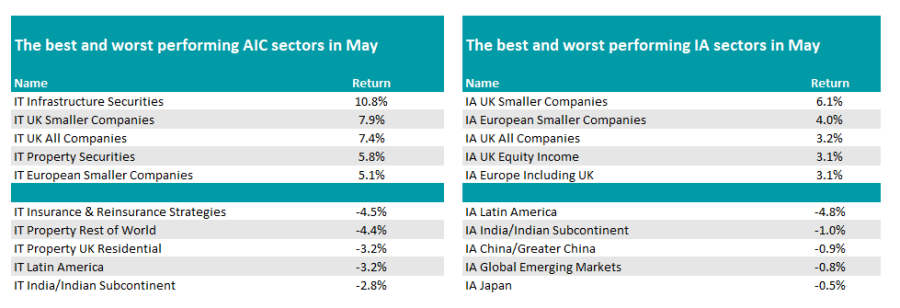

Domestic funds dominated the leaderboard in May, with all three major UK equity sectors in the Investment Association universe among the top five peer groups over the course of the month.

IA UK Smaller Companies topped the billing, with the average fund making a 6.1% total return. IA UK All Companies and IA UK Equity Income were in third and fourth place, making 3.2% and 3.1% respectively.

Splitting the UK sectors was IA European Smaller Companies (up 4%) while IA Europe Including UK rounded out the top five (3.1%).

It was a similar story in the investment trust sphere, where the average trust in the IT UK Smaller Companies sector marched 7.9% higher, while IT UK All Companies constituents made an average gain of 7.4%.

They were topped, however, by specialist strategies in the IT Infrastructure Securities sector (10.8%).

Source: FE Analytics

The month was a busy one for the UK, with prime minister Rishi Sunak shocking the nation with an early general election in July.

Ben Yearsley, director at Fairview Investing, said: “The polls look like it’s a one way bet, with Keir Starmer the next prime minister. However, the parties are yet to publish their manifestos which may contain some surprises. Unfortunately, most of the surprises will probably cost money although both parties are being very careful to rule out tax rises.”

Perhaps Sunak’s rationale centred around economic data, where official UK inflation was 2.3% in April, down from 3.2% the prior month.

Meanwhile, the UK has exited recession with growth of 0.6% in the first quarter beating forecasts of 0.4%. “Was it this that pushed Rishi into his election gamble or was it that household confidence is at its highest for three years?,” asked Yearsley.

Both the UK’s FTSE 100 and US’ S&P 500 indices hit new highs last month, yet it was the domestic funds that benefited the most.

“It is slightly odd when you consider all three main US indices hit new highs in May, however the US dollar was weak knocking returns to most UK investors,” said Yearsley.

At the foot of the table was Latin American funds, with the IA sector down 4.8%, while both China and India stocks also fell.

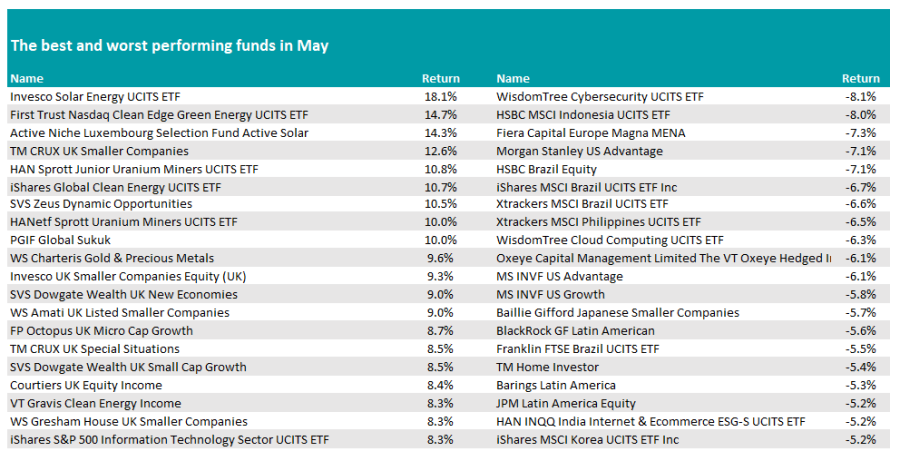

Turning to individual funds, there was a resurgence for renewable energy portfolios, with the top three - Invesco Solar Energy UCITS ETF, First Trust Nasdaq Clean Edge Green Energy UCITS ETF and Luxembourg Selection Fund Active Solar – all making 14% or more.

TM CRUX UK Smaller Companies, managed by Richard Penny, was the top domestic fund, with the £7.8m fund up 12.6%. It was joined in the top 20 by peers Invesco UK Smaller Companies Equity, WS Amati UK Listed Smaller Companies, FP Octopus UK Micro Cap Growth, SVS Dowgate Wealth UK Small Cap Growth and WS Gresham House UK Smaller Companies, while its larger stablemate TM CRUX UK Special Situations also made the top performers list.

Source: FE Analytics

Yearsley said: “Following on from April’s new FTSE high, May has continued the same trend. The UK market finally appears to be garnering attention. Takeovers and M&A are almost a daily occurrence now. Some are rebuffed like BHP’s attempt at Anglo and the PE approach for Hargreaves Lansdown, while others go through.

“It’s fascinating though that UK small-cap is also joining the party topping the performance charts in May – the rally is spreading. Despite this, the UK still looks cheap offering good yields and defensive characteristics - the only thing missing is proper growth stocks.”

In terms of losers, there were many individual emerging market ETFs under pressure last month, with Indonesia, Brazil, Korea India and the Philippines all represented in the bottom 20 funds. Worst of all however was WisdomTree Cybersecurity UCITS ETF, down 8.1% in May.

Among active funds, Fiera Capital Europe's Magna MENA was the bottom of the pile, down 7.3%, while Morgan Stanley US Advantage lost 7.1%.

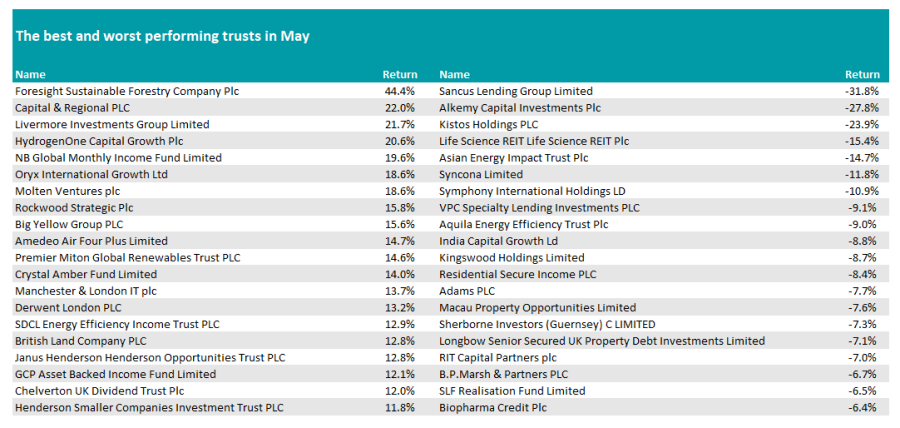

In the trust world, Foresight Sustainable Forestry topped the list after it received an offer from another Foresight managed product, making a return of 44.4% over the month. Yearsley asked: “Is it only time before all specialist trusts under say £200m in size get bought out?”

Source: FE Analytics

At the foot of the table, Sancus Lending lost 31.8% after the firm announced it would make a loss of around £10m for 2023 due to write-downs on legacy loans.