GLP-1 drugs such as Wegovy, Ozempic, Zepbound and Mounjaro have been the success of pharmaceutical companies Novo Nordisk and Eli Lilly since their approval as obesity treatment by the US Food and Drug Administration in 2021, but Ailsa Craig and Marek Poszepcyznski, managers of the International Biotechnology Trust, weren’t convinced they were a good investment until recently.

The two pharma companies above, together with United Health, make up the top-three names of the MSCI World Healthcare index, and have propped up its performance.

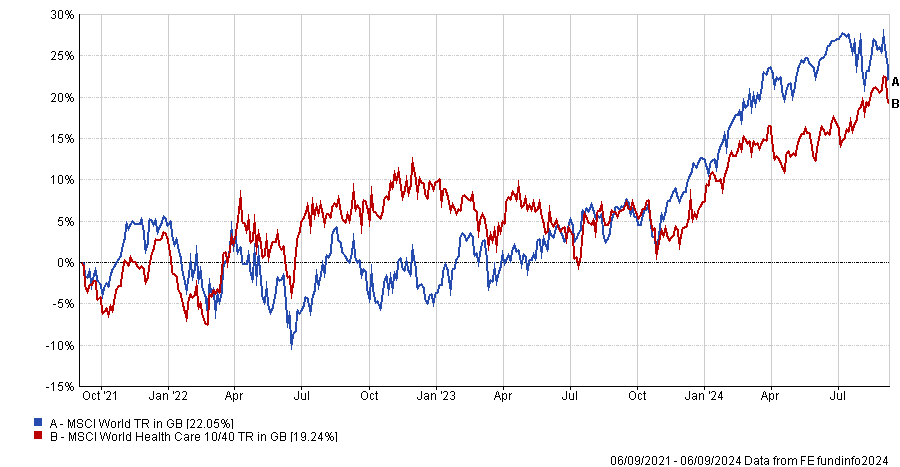

So much so, that its returns compete with the tech giants of the MSCI World index over the past three years, as the chart below shows.

Performance of fund indices over 3yrs

Source: FE Analytics

But the watershed moment for Craig and Poszepcyznski came after a study was released at the end of 2023 called Select, which triggered the managers to take the investment case in GLP-1 drugs more seriously.

“It was a major clinical trial showing that patients on GLP-1 drugs had a 20% reduction in cardiovascular events,” Craig said. “Before, the mindset was that obesity is not a disease, but a lifestyle issue. That trial changed all that. It was a real pivot for the whole space and it triggered us to take it seriously as well.”

It wasn’t only a change in perspective – the economic reason behind the investment was strong too. As the managers explained, what made the biggest difference is, once proven to extend or save lives, GLP-1 drugs be reimbursed by insurance companies.

This works even in places such as Europe, where a tender offer system is in place. As governments negotiate prices, proving that heart events such as strokes and heart attacks are reduced by the drugs allows the UK government to justify paying for these out of a small pot of public funds.

This change in conviction by the managers incidentally corresponded to a shift in backdrop that allowed them to allocate more money to the area.

Back in 2021, when Craig and Poszepcyznski had just taken over as lead fund managers, they took a defensive stance on the fund as they felt that things looked “quite bubbly and overvalued”.

“Now we think the inverse of that is true,” they said, and so, they are more ready to gear up (the current gross gearing of the fund is 8%) and tilt the fund out of the defensive names into the more exciting, earlier-stage names.

But the International Biotechnology Trust doesn’t own Novo Nordisk or Eli Lilly in its top-10 holdings. Its approach is to own a basket of names across a number of different technologies in developing stages, and GLP-1 drugs are no exception to that, as there are “lots of different ways people are trying to get a piece of that pie”.

Craig explained that many companies are at the early stages of developing improvements on different aspects of the medications available today, for example using tablets instead of injectable drugs or causing fewer side effects such as nausea or vomiting, all of which using different mechanisms.

“We are not putting all our eggs in one basket for the one next generation of product, we have four or five,” Craig said, “and then if a big pharma company acquires one, we're more likely to hit that, and the whole space will move up as well”.

Performance of fund against sector and index over 3yrs

Source: FE Analytics

Another widespread concern with Eli Lilly and Novo Nordisk are valuations, which for Craig are “very difficult” to judge.

“It is difficult to say if the valuations are justified at the moment, because we just don't know how much of the market Eli Lilly and Novo Nordisk are going to own. And it depends on all of these new companies succeeding.”

“But the sheer amount of potential competition around makes it quite unlikely that none will succeed.”

Her enthusiasm was also shared by Peel Hunt researchers Miles Dixon and Leolie Telford-Cooke. In a recent sector outlook they drew attention to an even more recent research paper, which found that, compared to a placebo, patients that received GLP-1s had lower rates of all-cause death, driven by a predictable reduction in cardiovascular death, but also – more surprisingly – non-cardiovascular death.

Some limitations to this study mean that it does not actually meet the statistical threshold for significance, but the evidence seems to be accumulating momentum and GLP-1 drugs seem to be “the gift that keeps on giving”.