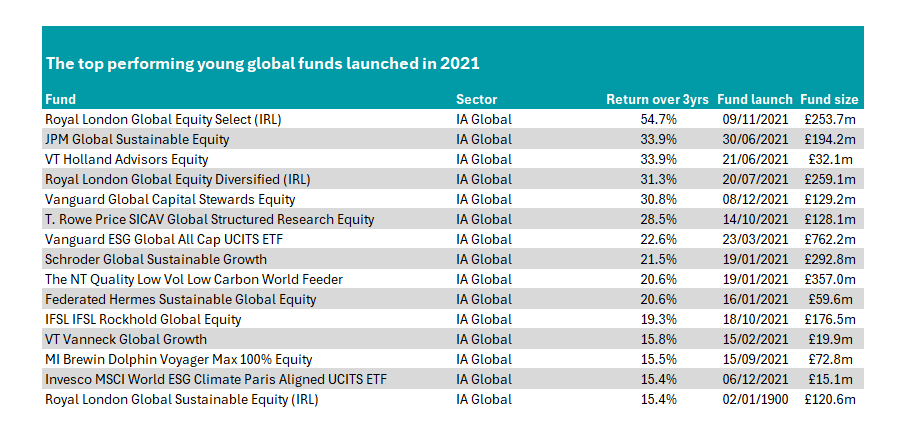

Global funds run by Royal London, JP Morgan Asset Management and Vanguard have shone in their first three years, while others from Invesco, Artemis and Premier Miton have struggled.

Some 31 funds were launched in the IA Global sector in 2021, all of which passed through their three-year milestones last year. Comparing their performance over the three years to the end of 2024, 15 were above average while 16 came up short of the peer group. All of the figures below are listed in sterling terms.

Of those shooting the lights out, Royal London Global Equity Select took the top spot with a 54.7% gain. With £253.7m in assets under management, the fund has been growing steadily since its launch in November 2021.

The fund has been closed to new investors since February 2024 and current managers Francois de Bruin and Paul Schofield only took over the fund in November 2024. It aims to beat the MSCI World by 2.5 percentage points over rolling three-year periods.

It was joined on the list by fellow Royal London funds Global Equity Diversified (IRL), managed by Schofield, Finn Provan and Matt Kirby, as well as the Global Sustainable Equity (IRL), headed by FE fundinfo Alpha Manager Mike Fox alongside George Crowdy and Sebastien Beguelin. Both also made above-average returns.

Source: FE Analytics

JPM Global Sustainable Equity and VT Holland Advisors Equity came in joint second, both up 33.9%. Sophie Wright and FE fundinfo Alpha Managers Timothy Woodhouse and Joanna Crompton run the former, which looks for companies improving their sustainability.

It has benefited from the rise of artificial intelligence (AI) and the Magnificent Seven, with Microsoft, Nvidia, Amazon and Apple its four largest holdings, making up more than a fifth of the total portfolio.

The latter, run by Andrew Hollingworth, is a quality-growth fund looking for companies that can compound over time. Top holdings here include US holding company Biglari Holdings, fintech firm Wise and housebuilder Green Brick Partners, as well as low-cost airline Ryanair and banking company Nu.

Among the top performers, the fund to take in the most money was Vanguard ESG Global All Cap UCITS ETF, with some £762.2m in assets under management.

The passive fund, which focuses on environmental, social and governance (ESG) principals, was able to make a 22.6% return, bucking the trend for passive ESG funds. It was the best-performing fund of those in the second quartile of the IA Global sector. All funds above this sat in the first quartile.

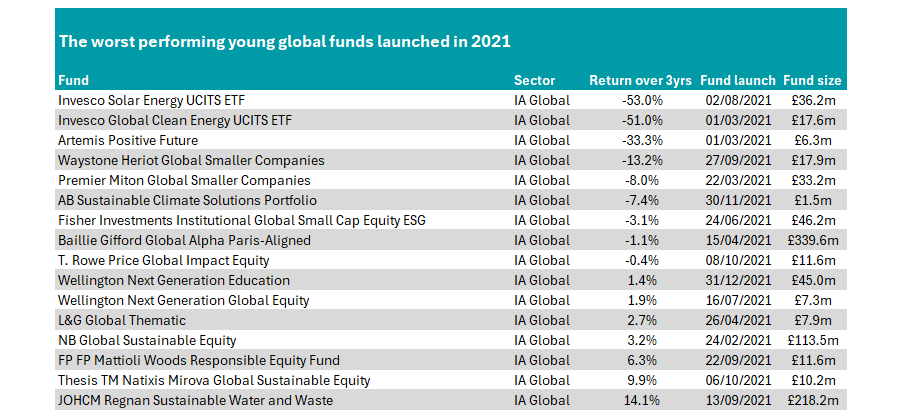

Turning to those that have failed to shine as brightly and ended in the third and fourth quartile of the sector, the worst performer was Invesco Solar Energy UCITS ETF.

The fund made a 53% loss in the three years to the end of 2024, and was followed by Invesco Global Clean Energy UCITS ETF, which recorded a 51% drop.

Clean energy had been a booming industry heading into 2021 but has dropped off since for a variety of factors, including the rise of climate-scepticism among some of the world’s leading politicians such as US president Donald Trump.

Additionally, higher interest rates have made it difficult to obtain financing for new projects, which has pushed back the sector.

The third-worst performer was Artemis Positive Future, run by Sacha El-Khoury. The £6.3m fund is another following ESG principals and looks for companies that are disrupting established industries while having a positive environmental or social impact.

Its largest exposure is to affordable and clean energy (22.8%), which is followed by good health and wellbeing (22.7%). Top stocks include mobile phone company Motorola Solutions (6.3%), medical imaging specialist Hologic (4.8%) and data analytics firm Verisk (3.9%).

Of the table below, only FP Mattioli Woods Responsible Equity, TM Natixis Mirova Global Sustainable Equity and JOHCM Regnan Sustainable Water and Waste are in the third quartile of the IA Global sector.

Source: FE Analytics

Alongside a plethora of ESG and sustainable names, Waystone Heriot Global Smaller Companies and Premier Miton Global Smaller Companies also stand out.

The market has been dominated over the past three years by the rise of AI and the largest US tech names, specifically Microsoft, Amazon, Apple, Nvidia, Meta, Tesla and Alphabet – the Magnificent Seven.

This has made it difficult for investors in other parts of the market to flourish, such as small-caps, as investors have not needed to take the risk of going down the market capitalisation spectrum for returns.

Waystone Heriot Global Smaller Companies is run by Gavin Harvie and Andrew Brown and has made a 13.2% loss over the three years to the end of 2024.

The fund is underweight the US while overweight European and UK stocks. The average market capitalisation of its holdings is between $2bn and $10bn and new stocks must be no larger than the largest company in the MSCI ACWI Small Cap index.

Premier Miton Global Smaller Companies meanwhile is headed by Alan Rowsell, who looks for undervalued smaller companies with positive prospects. The fund, which has lost 8% over the past three years, has a higher weighting (45.7%) to the US and is predominantly invested in industrials, consumer discretionary and financials.