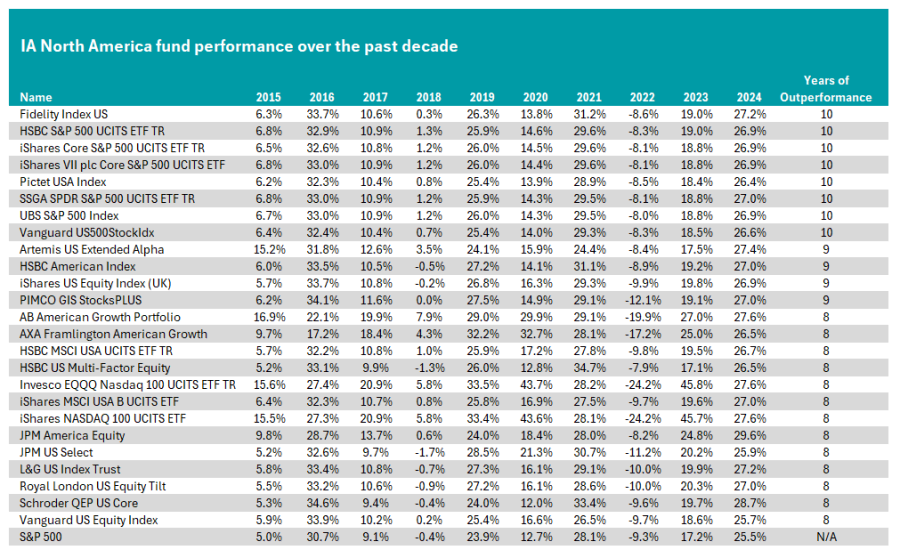

Eight passive funds have beaten the S&P 500 index in each of the 10 past calendar years out of 129 qualifying portfolios, according to a study by Trustnet. All track the index of the largest US companies, which is also the most-common benchmark in the IA North America sector.

In theory, passive funds should underperform the benchmark they are tracking as they charge investors fees. All data provided is after charges, suggesting these figures should be lower. However, there are reasons this is not the case.

Darius McDermott, managing director at FundCalibre, attributed this to stock-lending. He explained: “If I am running a tracker fund and I own lots of stocks, I can lend that stock to people who want a short sell, but they pay me for that, which improves performance.”

The eight funds to achieve this feat were: Fidelity Index US, HSBC S&P 500 UCITS ETF, iShares CORE S&P 500 UCITS, iShares VII plc Core S&P 500 UCITS, Pictet USA Index, SSGA SPDR S&P 500 UCITS, UBS S&P 500 Index, and the Vanguard US500Stockldx.

By contrast, no active funds consistently beat the market in the past decade. Indeed, recent data from AJ Bell found that just 23% of active managers outperformed in this period.

Source: FE Analytics

McDermott attributed this to the “style neutrality” of the S&P 500. He explained that the US market was so well balanced that it does not care what sector, or company goes up or down. He argued that it was challenging for active managers to achieve a similar balance.

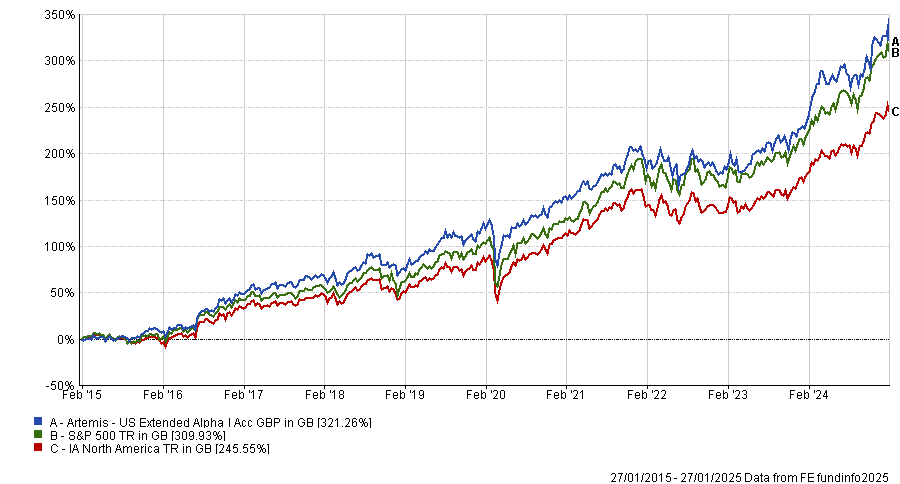

However, while no active strategy beat the market 100% of the time in the past decade, some got close. For example, the Artemis US Extended Alpha strategy beat the market in nine of the past 10 years.

Run by FE fundinfo Alpha Manager William Warren, Adrian Brass and James Dudgeon, it only faltered against the S&P 500 in 2021, a period when most growth stocks boomed following the pandemic. Towards the end of the year, value stocks shone versus their growth counterparts, meaning the index performed well while managers with strong style biases struggled to keep pace.

Over the past decade, the fund returned 321.3% to investors, with more recent performance attributable to its large weighting to the Magnificent Seven. Chipmaker Nvidia is its largest holding at 7.9%, while Microsoft, Amazon and Apple make up four of the fund’s top five holdings, with Meta in sixth place.

Performance of the fund vs the sector and benchmark over 10 years

Source: FE Analytics

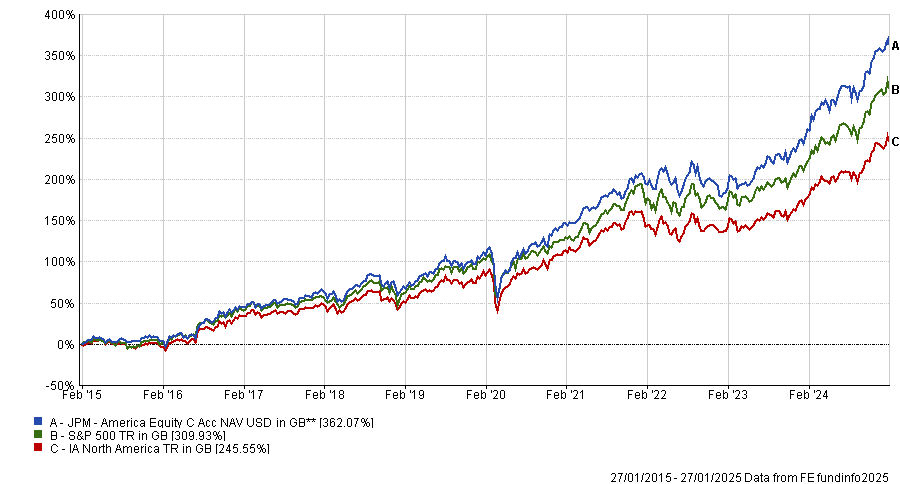

If we further broaden our scope to include funds that outperformed the S&P 500 in eight of the past 10 years, four more active funds qualify. The first was the £7.5bn JPM America Equity fund, managed by Jonathan Simon and his team, which surged 362.1% in the past decade. It only failed to beat the market in 2016 and 2022, the latter of which was a poor one for growth strategies, as rising interest rates and higher inflation caused value stocks to trounce their growth rivals.

In 2016, meanwhile, value also had a resurgence, with the MSCI USA Value index up 38.2% versus the MSCI USA Growth index’s gain of 26.5%.

Performance of the fund vs the sector and benchmark over 10 years

Source: FE Analytics

Notably, according to a recent study from Trustnet, this was one of the best-performing giant equity funds of 2024. Again, recent performance can be partially attributed to owning five of the highly popular Magnificent Seven tech stocks.

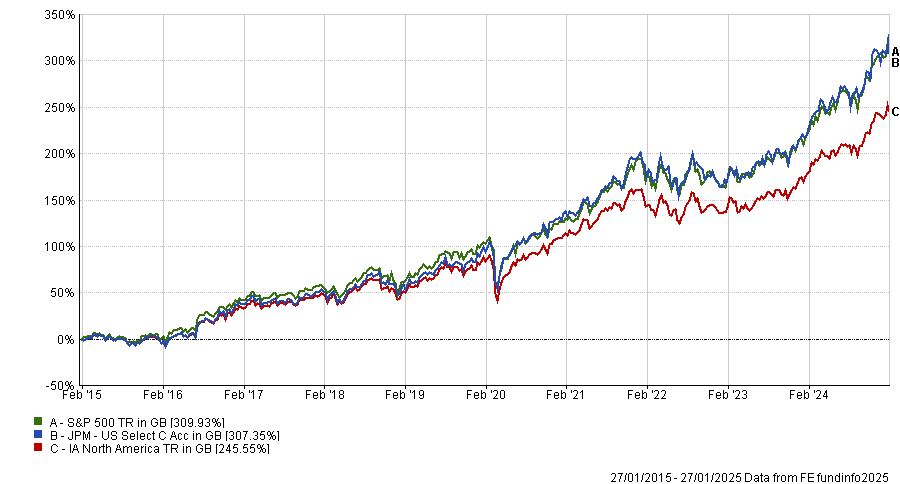

Its cousin strategy, the JPM US Select fund, also beat the S&P 500 in 80% of the past 10 years. However, weaker years compared to the S&P 500 in 2018 and 2022 have impacted its long-term results, with the strategy lagging the market over the past decade.

Performance of the fund vs the sector and benchmark over 10 years

Source: FE Analytics

The AB American Growth portfolio also stood out. This portfolio is one of a handful to maintain top-quartile results over the past one, three, five and 10-year periods. Its 10-year total return of 437.1% was the fifth best in the sector, beating the S&P 500 by almost 130 percentage points. Moreover, it was one of a handful of funds that beat the S&P 500 since the Global Financial Crisis.

As analysts at Invesco recently noted, the portfolio is a large-cap growth strategy with significant positions in technology and durable growth companies. Indeed, the portfolio prominently holds five of the Magnificent Seven, along with other mega-cap tech companies such as Broadcom.

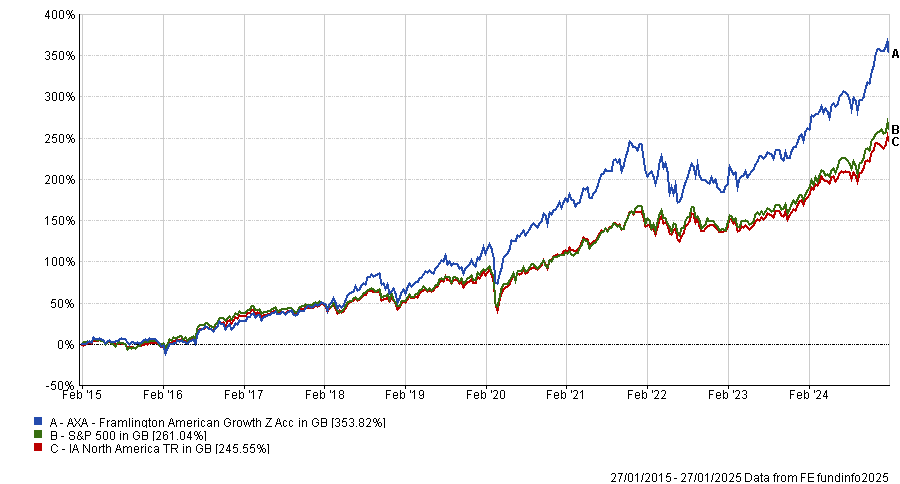

Finally, the AXA Framlington American Growth portfolio also outperformed the S&P 500 in eight of the past 10 years. Over 10 years, it was up by 353.8%.

While it also delivered a top-quartile result over five years, its recent results were slightly weaker, although still above average. It slid into the second quartile over the past three- and one-year periods.

Performance of the fund vs the sector and benchmark over 10 years

Source: FE Analytics

This was the result of significant underperformance in 2022 relative to the benchmark index. While this was a bear market for US funds, the AXA portfolio’s growth bias impacted returns. During the year the MSCI Value index rose 4.8%, while the MSCI USA Growth index fell 23.5%. The S&P 500 as a whole, meanwhile was down 8.3%.